Markets | NGI All News Access | NGI Data

NatGas Cash Gains Outpace Plodding Futures; January Adds 4 Cents

Natural gas for Thursday delivery bounded higher in Wednesday’s trading as the pricing landscape got a firm boost from a strong screen, expectations for storage withdrawals below seasonal averages, soaring petroleum quotes and a firm power price environment.

One point followed by NGI fell into the loss column, one point was unchanged, and all others scored solid double-digit gains. The NGI National Spot Gas Average jumped 20 cents to $3.13. Futures did their part to lift physical quotes. January settled at $3.352, up 3.7 cents and February added 1.8 cents to $3.359. January crude oil soared $4.21 to $49.44/bbl.

The day’s marquee event was the announcement of an agreement by the Organization of the Petroleum Exporting Countries (OPEC) to its first global oil production reduction in eight years, cutting output by 1.2 million b/d effective Jan. 1. On the news, U.S. crude futures surged almost 8% in early trading to about $48.56/bbl on the New York Mercantile Exchange. Brent prices jumped close to 8% as well to trade at about $51/bbl on the ICE Futures Exchange.

Members of the Saudi Arabia-led cartel said the agreement would reduce output from the current ceiling of 33.6 million b/d to about 32.5 million b/d, representing a reduction of around 1% of global production. Saudi Arabia is to make the biggest reductions, estimated at around 486,000 b/d.

Market observers saw the agreement as a production stimulus.

“To the extent that it supports price and incentivizes American producers we may see more natural gas come out as well,” said Al Levine, principal at Powerhouse LLC, a Washington DC-based energy risk management and trading firm.

A long term price ceiling could be on the horizon. “As a result it may put something of a top on the gas price,” he said.

Overnight weather models turned slightly cooler, but agreement between the various models used is lacking.

The U.S. weather model “is back on the colder side, sort of,” said Commodity Weather Group President Matt Rogers in a Wednesday morning report. “After a few weird days when the American weather model guidance ran warmer than the European versions for the 11-15 day outlook, the roles have reversed back to their usual roles with the American ensemble now the coldest-looking 11-15 day.

“The ‘sort of’ part is that now the European ensemble is colder/faster than the American version in the six-10 day range as it sends cold to Texas faster and sweeps the cold front eastward across the U.S. faster next week. We edged our timing slightly faster for the Midwest and East, but were a bit more aggressive for Texas given concerns of faster southward progress of the colder air along the flat Plains.”

Weather uncertainty along with a myriad of factors ranging from full storage, slowing production, and a mild start to the winter have producers layering in a greater number of hedges.

BTU Analytics analyst Corey Boettiger said it had been “a rocky road for natural gas producers.” In a review of 3Q2016 natural gas hedging by U.S. producers, Boettiger said 2017 hedges “were up across the board…Based on the new numbers of roughly 25 select independent producers, gas hedges for 2017 are up by nearly 3.5 Bcf/d compared to where they were in the second quarter.”

Notable additions included nearly 1 Bcf/d by Chesapeake Energy Corp. and 850 MMcf/d by Southwestern Energy Co. Range Resources Corp. added hedges through its acquisition of Memorial Resource Development Corp., while Rice Energy added hedges through its acquisition of Vantage Energy, Boettiger noted.

“Among the chosen producers, nearly 50% of 2017 gas production is hedged, up from 35% of 2017 production in the second quarter of this year.”

In physical market activity, spot gas prices benefited from a firm power market. Intercontinental Exchange reported that next-day on peak power at the ISO New England’s Massachusetts Hub rose $1.37 to $31.14/MWh, and Thursday power at the PJM West terminal added $1.38 to $31.07/MWh. On the West Coast, next-day power at SP-15 rose $2.53 to $38.25/MWh.

Gas at the Algonquin Citygate jumped 42 cents to $2.94, and deliveries to Iroquois, Waddington gained 15 cents to $3.55. Gas on Tennessee Zone 6 200 L jumped 18 cents to $3.25.

Major market centers were solidly in the black.

Gas at the Chicago Citygate added 15 cents to $3.29, and deliveries to the Henry Hub rose 26 cents to $3.29. Gas at Opal tacked on 22 cents to $3.20, and gas priced at the SoCal Border Avg. rose 17 cents to $3.31.

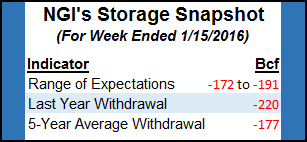

Thursday’s Energy Information Administration gas storage report is expected to show the first meaningful inventory drawdown of the nascent heating season. Last year 35 Bcf was withdrawn and the five-year pace stands at a 44 Bcf decline.

PIRA Energy calculated a pull of 50 Bcf, and First Enercast is expecting a withdrawal of 62 Bcf. A Reuters survey of 25 traders and analysts showed an average 53 Bcf decline with a range of -26 Bcf to -65 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |