Markets | E&P | NGI All News Access | NGI The Weekly Gas Market Report

OPEC Agrees to Reduce Oil Production by 1.2 Million b/d; Russia Signals Cut of 300,000 b/d

Crude oil prices surged Wednesday after the Organization of the Petroleum Exporting Countries (OPEC) formally agreed to its first global oil production reduction in eight years, cutting output by 1.2 million b/d effective Jan. 1.

On the news, U.S. crude futures surged almost 8% in early trading to about $48.56/bbl on the New York Mercantile Exchange. Brent prices jumped close to 8% as well to trade at about $51/bbl on the ICE Futures Exchange.

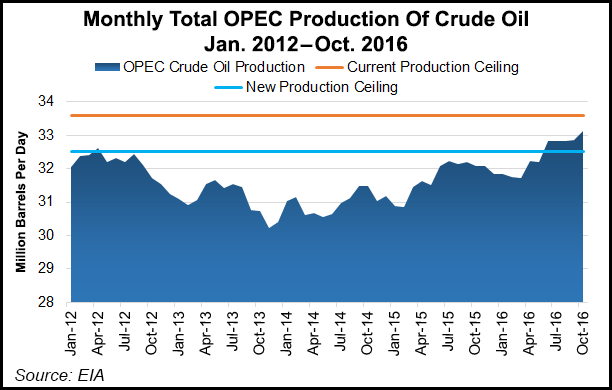

Members of the Saudi Arabia-led cartel reached the agreement in Vienna, which reduces output from its current ceiling of 33.6 million b/d to about 32.5 million b/d, representing a reduction of around 1% of global production. Saudi Arabia is to make the biggest reductions, estimated at around 486,000 b/d.

A tentative deal also has been reached for several key non-OPEC countries, including Russia, to reduce their combined production by another 600,000 b/d. Russia has proposed reducing its output by 300,000 b/d, according to OPEC President Mohammed Saleh Abdulla Al Sada, Qatar’s energy and industry minister. He held a press conference following the OPEC meeting.

Asked how the reductions by the cartel may impact U.S. shale producers, whose expertise in pumping unconventional oil has pressured prices, Al Sada said domestic operators would act with or without OPEC decisions.

OPEC, he said, had “taken measures to get the market rebalanced. We’re not saying the rebalancing is going to come…purely from OPEC…but producers outside OPEC, they will react to the price and they will see their position, etc.” and decide whether they want to increase production or not. “But we cannot see the threat of shale gas, shale oil, because again, there will be a look at how much it will cost them” if they decide to increase the oil surplus.

“They will do it anyway without us interfering,” Al Sada said of whether domestic operators choose to increase output as oil prices rise on OPEC’s cuts. “We are considering, to the best of our knowledge, a mechanism of rebalancing…We think this measure will help rebalancing….” He cautioned that U.S. operators would have to decide whether they wanted to take the risk, which could be “expensive…They will see whether they can afford” to increase production.”

The agreement came the same day the U.S. Energy Information Administration reported a draw in domestic crude oil inventories of 88,4000 bbl last week.

OPEC “surprised” the market by coming to a substantial agreement, said BMO Capital Markets analyst Randy Ollenberger.

“We believe that OPEC’s actions place a floor under crude oil prices and support a trading range of $45-$55/bbl,” he said, “with the low-end supported by OPEC actions and high-end established by U.S. shale production economics.”

The OPEC agreement “represents a shift in mindset…from market share to price maximization,” said Sanford C. Bernstein Ltd.’s team. “Two years ago OPEC surprised the market by not cutting production. OPEC’s objective was to slow investment and bring supply and demand back to balance. This has been largely achieved, although shale has proved far more resilient than imagined.”

Once the reductions are implemented, the oil markets should move into a 0.5 million b/d deficit in the first half of 2017, according to Bernstein. “By the second half of 2017, the deficit could be substantial with a supply deficit of over 1 million b/d. We expect significant cut in inventories going forward, which will put upward pressure on oil prices.

“Given the undersupply which will exist in the market from the start of 2017 onwards, there could be as much as 300 million bbl of inventory draws, which will come a long way to draining inventories back to normalized levels.”

A key risk to the agreement could be the response by U.S. unconventional producers, analysts said. Shale producers “will respond,” but they “cannot offset these cuts,” according to Bernstein.

ClearView Energy Partners LLC said “a sustained increase to oil prices is unlikely to occur until global petroleum inventories are reduced.” OPEC “needs to follow through on” the quota announcement, “or a second OPEC production cut may be needed” in the second half of 2017.

“We believe the group will need to consider actual first half 2017 oil supply data from Iran, Iraq, Libya, Nigeria, Russia and the United States before Saudi Arabia might be willing to backstop another supply reduction,” ClearView analysts said.

The agreement is to be reviewed in six months when OPEC members meet on May 25 and could be extended. Current OPEC member Indonesia, which rejoined last year following a seven-year absence, has requested and been suspended from the group as it now is a net oil importer and is unable to participate, Al Sada said.

OPEC has established a monitoring committee to check production levels of the members, which is comprised of representatives from Algeria, Kuwait and Venezuela.

“Historically, OPEC’s compliance to its production quotas has been poor; however, even with moderate levels of compliance, we believe that OPEC’s action should establish a floor price for oil,” BMO’s Ollenberger said.

Oil prices could jump to $55-60/bbl in the short-term, and while prices on Wednesday reacted positively, there could be more upside to come, according to Bernstein analysts.

“High beta names,” particularly international exploration and production companies, integrated producers and oilfield services companies “will gain the most from this announcement and a recovery in crude prices. Downstream refiners and petrochemical companies are likely to be negatively impacted as demand is crimped and feedstock prices rise.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |