Infrastructure | NGI All News Access | NGI The Weekly Gas Market Report

U.S. Natural Gas Exports to Mexico Continue to Grow, EIA Says

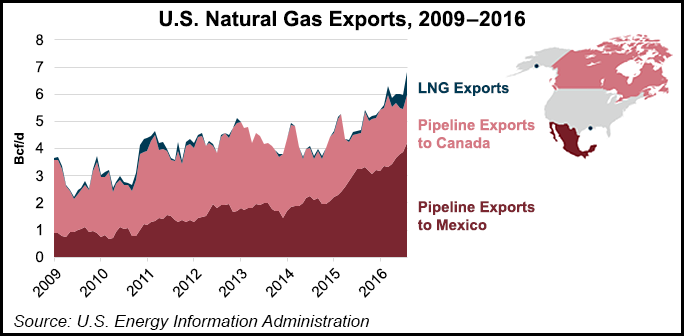

U.S. pipeline exports of natural gas have doubled since 2009 and are expected to continue to grow in 2016, with almost all of the growth attributed to increasing exports to Mexico, according to the U.S. Energy Information Administration (EIA).

In a “Today in Energy” brief issued Tuesday, the EIA said Mexico has accounted for more than half of all U.S. natural gas exports since April 2015. The agency said the United States exported 4.2 Bcf/d of natural gas via pipelines to Mexico in August, adding that through that month U.S. daily pipeline exports to Mexico are at a yearly average of 3.6 Bcf/d, a 25% increase above 2015 and 85% higher than the five-year average from 2011 through 2015.

Mexico is expanding its natural gas pipeline network to accommodate higher imports from the United States, in large part for power generation purposes.

Following sweeping energy reforms submitted by President Enrique Pena Nieto and enacted by Mexico’s Congress in 2014, the country’s Secretaria de Energia (SENER) launched a five-year plan to expand its natural gas transportation and storage systems in 2015. SENER modified the plan in July by changing some projects and dropping others.

Under the revised plan, SENER established the Centro Nacional de Control del Gas Natural (Cenagas) as an independent operator of Mexico’s natural gas pipeline system. Last October, Cenagas signed an agreement with Mexico’s national oil company, Petroleos Mexicanos (Pemex), to take over day-to-day operations of Pemex’s natural gas pipeline network over the next year or so.

“These [natural gas] imports would help meet increasing power demand, offset declining domestic natural gas production, reduce reliance on LNG [liquefied natural gas] imports, and create new markets for natural gas in currently supply-constrained regions,” the EIA said, later adding that “growth in Mexico’s domestic electricity market has largely driven the country’s increasing natural gas usage.

“Because of the availability and affordability of U.S. pipeline natural gas, Mexico is meeting its growing electricity demand with generation from new natural gas-fired plants.”

SENER’s five-year plan includes 12 pipeline and one compressor station projects. Mexico’s public power utility, the Comision Federal de Electricidad (CFE), assigned seven strategic pipelines to private contractors between December 2014 and June 2015. Last June, the CFE awarded the Sur de Texas-Tuxpan pipeline, the largest and most expensive pipeline project, to Infraestructura Marina del Golfo, a joint venture between TransCanada Corp. and Sempra Energy Mexico unit IEnova.

“U.S. natural gas exports to Mexico are expected to continue to grow in the short term, and SENER forecasts a widening gap between domestic production and demand through the end of the decade,” the EIA said. “Mexican imports of natural gas continue to outpace most projections. The 4.1 Bcf/d exported in August 2016 matched the level originally forecasted in 2013 to be reached in 2018.

“However, uncertainty in Mexican demand growth, particularly from the power generation sector as natural gas-fired capacity competes with renewables and nuclear generation, may slow the increase in Mexico’s natural gas imports, leading to lower pipeline capacity utilization. Domestic natural gas production may also rebound and reduce the need for pipeline imports from the United States.”

Mexico’s evolving natural gas market was the topic of discussion during a webinar — Mexico Natural Gas Infrastructure — Drill Down Into the Market of Tomorrow With the Leaders Who Will Shape It — hosted by NGI earlier this month.

NGI has also recently released a special report, “Inside Cenagas,” detailing the growth of Mexico’s natural gas infrastructure.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |