Markets | NGI All News Access | NGI Data

Natural Gas Bulls Get Early Stuffing As Weekly Quotes Soar

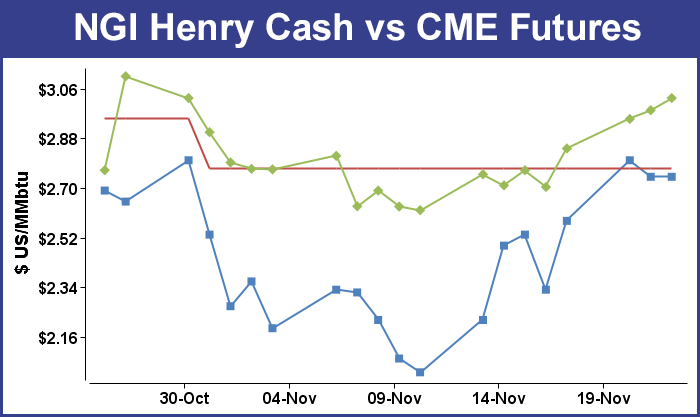

It may have been a short three-day trading week, but you would never have known it from the size of the weekly gains. All but one point followed by NGI romped higher by double-digits, and the NGI Weekly Spot Gas Average jumped 41 cents to $2.70.

The week’s outlier, and only loss was seen at Westcoast Station No. 2 which fell $C0.29 to $C1.96/Gj. The week’s star performer was Tennessee Zone 6 200 L, posting a rise of $1.36 to $3.84.

All regions sported hefty gains, with the Northeast leading the pack with a 69-cent rise to $2.98 and South Louisiana, East Texas, and South Texas bringing up the rear with gains of 33 cents to $2.76, $2.69, and $2.68, respectively.

The Southeast improved by 34 cents to $2.76, Appalachia was up 35 cents to $2.36, and the Rocky Mountains added 37 cents to $2.57.

California and the Midcontinent rose 39 cents to $2.85 and $2.64, respectively, and the Midwest gained 43 cents to $2.79.

If futures serve their rose as a leading indicator, next week’s physical prices may be in for a rise as well. December futures added 18.3 cents to $3.026.

At the close of the shortened week Wednesday natural gas for the extended holiday weekend worked lower at nearly all market points as weather forecasts called for temperatures at or above seasonal norms.

A few points were unchanged, and a few locations added a few pennies, but the NGI National Spot Gas Average fell 8 cents to $2.63.

Eastern points took the greatest hits, with at least one location falling by double-digits. Futures got a boost from an inventory report showing the season’s first storage draw, a 2 Bcf pull that caught traders expecting a modest build off guard.

At the close, December had added 4.4 cents to $3.026, and January was up by 4.7 cents to $3.147.

Natural gas futures surged past $3 Wednesday morning after the Energy Information Administration (EIA) reported a storage withdrawal that was not what the market was expecting. EIA reported a 2-Bcf storage withdrawal in its noon EST release, while traders had been expecting a build of about 5 Bcf. December futures reached a high of $3.057 immediately after the figures were released and by 12:15 p.m. December was trading at $3.028, up 4.6 cents from Tuesday’s settlement.

Floor traders were fed bad information.

“We looked at the way the number popped and said that has got to be a draw, but we looked at the screen and it was showing a 2-Bcf build,” a New York floor trader told NGI. “Crazy stuff. If that had happened in the old days, it would have been chaos.

“I’m thinking $3 is light support, and below that you have $2.90. $3.10 would be resistance, and maybe $3.25 from there. The bulls will be eating the turkeys.”

Wells Fargo Securities analyst David Tameron said the 2-Bcf withdrawal “was well below consensus and 11 Bcf below last year’s mark, while the five-year average withdrawal of 45 Bcf was heavily influenced by the 162-Bcf withdrawal figure in 2014. Natural gas storage likely peaked last week and our model currently forecasts a draw of 49 Bcf next week.”

Traders are optimistic prices can hold if not advance short term.

“The latest weather forecast is calling for cold. There is a pattern coming out of Alaska and making its way to the Northeast,” a trader with McNamara Options told NGI. “It could potentially bring some cold Canadian air, but they can quickly change. The risk is to the upside.

“We are coming into a long weekend, and even though you can trade on Friday, no one wants to hold a short position over the long weekend.”

Inventories now stand at 4,045 Bcf and are 39 Bcf higher than last year and 241 Bcf more than the five-year average.

In the East Region, 9 Bcf was withdrawn, and the Midwest Region saw inventories decrease by 2 Bcf. Stocks in the Mountain Region rose 2 Bcf, and the Pacific Region was unchanged. The South Central Region added 7 Bcf.

Weather forecasters continue to wrestle with models unable to show a clear consensus. “Confidence continues to be lower than usual during this period as models struggle with the evolution of the MJO [Madden-Julian Oscillation] and show disagreements in how the U.S. pattern responds to that signal,” said MDA Weather Services in its Wednesday morning 11-15 day forecast.

“This forecast gives consideration to a MJO response out of phases 3-4, but a small colder adjustment is noted in parts of the Eastern Third due to storm-based variability. Overall, the period remains warmer than normal,” per national gas-weighted heating degree days, “with a coverage of aboves spanning from the Midwest to the East.

“Colder threats are found in the West and supported by a Pacific regime featuring +WPO [Western Pacific Oscillation] and -PNA [Pacific North American] signals. Still warmer risks exist in the Eastern Half, focused ahead of low pressure on day 6 in the Midwest and at mid-period in the East. The West could be colder with more widespread below normal coverage there.

“Risks continue to lie in the colder direction of forecast, with the greatest risk for colder versus forecast being in the West. The colder risk is seen in the East as well, but models are split there.”

In physical trading, temperatures were seen at or above seasonal norms, thus taking some of the luster off the strong screen. AccuWeather.com forecast that New York City’s Wednesday high of 47 degrees would rise to 53 by Saturday before easing to 50 by Monday, 1 degree below normal. Chicago’s high of 46 Wednesday was seen rising to 48 on Saturday and reaching 50 on Monday, five degrees above normal. Dallas’ Wednesday maximum of 66 was expected to ease to 65 by Saturday before climbing to 69 by Monday, also five degrees above normal.

Eastern points were hit the hardest. Gas at the Algonquin Citygate dropped $1.16 to $2.96, and deliveries to New York City on Transco Zone 6 shed 25 cents to $2.36. Gas on Texas Eastern M-3, Delivery was quoted 14 cents lower at $2.33.

Other major market centers also felt the selling. Gas at the Chicago Citygate fell 7 cents to $2.70, and deliveries to the Henry Hub were flat at $2.74. Gas on El Paso Permian changed hands 10 cents lower at $2.48, and packages priced at the PG&E Citygate came in 6 cents lower at $3.19.

In Tuesday’s trading some pockets of strength were noted in New England as power prices firmed, but theNGI National Spot Gas Average fell 4 cents to $2.71. Futures prices advanced for a third consecutive session and at the close December was higher by 3.2 cents to $2.982, and January had risen 2.3 cents to $3.100.

Firm power prices in the New England market helped lift quotes, but for the most part temperatures were expected to hover around seasonal norms. Intercontinental Exchange reported on peak power for Wednesday delivery to the ISO New England’s Massachusetts Hub added $2.34 to $36.83/MWh.

Gas at the Algonquin Citygate rose 22 cents to $4.12, and deliveries to Iroquois, Waddington added 7 cents to $3.38. Gas on Tenn Zone 6 200L gained a stout 46 cents to $4.18.

Near-term temperatures at major market centers were seen within a tight range. Forecaster Wunderground.com predicted Boston’s Tuesday high of 45 would ease to 42 Wednesday and 41 by Thursday, 8 degrees below normal. Chicago’s Tuesday high of 40 was expected to climb to 45 by Wednesday but ease to 42 Thursday, 3 degrees below normal.

Trading centers saw prices slide. Gas at the Chicago Citygate fell a nickel to $2.77, and deliveries to the Henry Hub dropped 6 cents to $2.74. Gas at Opal fell 5 cents to $2.62, and parcels at the SoCal Citygate eased a penny to $2.97.

The National Weather Service (NWS) forecast the week’s heating load slightly less than normal. For the week ending Saturday (Nov. 26), NWS is forecasting New England will see 182 heating degree days (HDD), or five less than normal. The Mid-Atlantic was expected to endure 168 HDD, also five below normal, and the greater Midwest from Ohio to Wisconsin was anticipated to see 180 HDD, or 17 under its seasonal tally.

Analysts saw conflicted fundamentals and technicals.

Most of the price advance Monday “appeared driven by some colder adjustments within the short-term temperature views during the past weekend,” said Jim Ritterbusch of Ritterbusch and Associates. “Furthermore, nearby futures hitched a ride on the tails of a stronger physical market that is developing off of a current Midcontinent cold spell.”

However, despite Monday’s “upside breakout to three-week highs, tacking on additional gains could prove arduous in the absence of some below-normal temperature expectations across the upper Midwest.

“Given this supply cushion amidst some shifts in longer-term forecasts away from a cold winter, additional price gains could prove limited,” he added. “Nonetheless, our technical indicators suggest upside possibilities to as high as $3.20 basis January futures where we may look to approach the short side for a trading turn depending upon weather updates.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |