Markets | NGI All News Access | NGI The Weekly Gas Market Report

Coal May Overtake NatGas For Power Gen This Winter, EIA Says

Coal could beat natural gas on prices and reclaim its spot this winter as the most-used fuel for U.S. electric generation, according to a brief published Friday by the Energy Information Administration (EIA).

Coal had long dominated domestic power generation before giving way to natural gas last year, a transition spurred by low gas prices and regulatory headwinds favoring lower carbon fuel sources.

According to EIA, natural gas-fueled power generation hit record-high levels over the summer. “During the first six months of 2016, natural gas supplied 36% of total U.S. electricity generation compared with 31% for coal.”

But the economic factors that have incentivized coal-to-gas switching could shift back in coal’s favor as natural gas spot prices trend upward, especially under a return to normal temperatures after the unusually warm 2015-2016 winter, according to EIA.

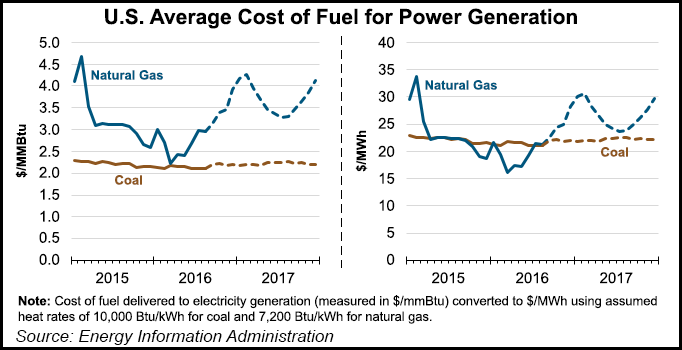

“The prices for natural gas and coal were relatively competitive for much of 2015,” EIA said. “At the beginning of 2016, the national average price of natural gas was consistently below the cost of coal delivered to power plants, reaching a low point of about $16/MWh in March, while coal has averaged between $21/MWh and $23/MWh for the past two years. Natural gas prices were low earlier this year because of ample fuel supplies and mild winter weather, which also reduced overall electricity demand.”

Any increase in natural gas prices this winter will increase costs for power generators and, depending on regional factors, could lead to more coal-fired generation, EIA noted.

EIA’s November Short-Term Energy Outlook projects average natural gas-fired generation costs to go as high as $31/MWh in February, or 40% higher than the projected national average for coal costs for the month.

“The higher costs of natural gas relative to coal are likely to encourage the industry to use more coal to fuel electricity generation than in the recent past. Forecast cooler winter temperatures, especially in areas where coal is dominant, also contribute to higher projected coal use in power generation. If winter temperatures end up warmer than forecast, natural gas prices would likely stay low, which would reduce the incentive to use more coal-fired generation.”

Moving forward, growth in renewable capacity is expected to continue to cut into the generation shares for both coal and natural gas, EIA said. “In July 2017, projected generating capacity from utility-scale solar and wind plants is 57% and 10% higher, respectively, than in July 2016.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |