Markets | NGI All News Access | NGI The Weekly Gas Market Report

Mild Weather, Record Storage Depress Natural Gas Forwards Markets

This week’s presidential election wasn’t the only thing sending shockwaves through the natural gas industry. Persistently mild weather and expectations of bearish storage news once again took a toll on natural gas forwards markets, which swung wildly between Nov. 4 and 9 and ultimately slid about 8 cents on average, according to NGI’s Forward Look.

The action in the forwards markets was indicative of the volatility in the Nymex futures strip, where December prices traded as low as $2.55 and as high as $2.875 during the four-day period. December ultimately lost 8 cents during that time to settle at $2.69.

The Energy Information Administration (EIA) on Thursday reported a 54 Bcf build into storage for the week ending Nov. 4, generally in line with market expectations, but that was not the focus. Bears are licking their chops as stocks are at an all-time record of 4,017 Bcf, 32 Bcf above prior-year storage levels and 146 Bcf over the five-year average.

The new record level of gas in the ground eclipses the previous record of 4,009 Bcf that was recorded for the week ending Nov. 20, 2015. It is also important to note that EIA’s demonstrated maximum capacity for storage is 4,343 Bcf.

While an overall 8-cent decline for the week may not accurately reflect “volatility” in a market in the thick of shoulder season, Tuesday’s action alone saw the prompt month plunge 18 cents, and Wednesday’s session was a microcosm of the pricing dynamics present over the past two months at the front of the natural gas curve, analysts with Mobius Risk Group said.

“December futures hit an intraday low of $2.555 shortly after 9 a.m. CST, and by 11:45 a.m. CST,they had subsequently risen to $2.743. Eventually, the December contract settled $0.057 higher on the day at $2.69,” Houston-based Mobius said.

Wednesday trading also saw huge swings in the calendar-year strips. The Nymex calendar 2017 strip traded in a 15-cent range. Morning trades were weak, with 2017 touching a seven-month low at $2.81 before closing 2.6 cents higher on the day at $2.922. Calendars 2018-2020 were all flat on the day and closed at $2.905, $2.882 and $2.903, respectively.

At the forefront of this week’s decline are weather forecasts that continue to show only brief periods of cold for the next couple of weeks, which tend to show up only in some parts of the U.S. for a few days while the rest of the country enjoys unseasonably mild temperatures.

In their latest outlook, forecasters with NatGasWeather said that while cooler weather is expected to reach the eastern U.S. beginning Thursday and continue through the weekend, the cold snap will be followed by a return to above-average temperatures and thus, below-average natural gas demand.

Data and analytics company Genscape shows heating degree days getting above seasonal norms in the New England, Northeast and Southeast/Mid-Atlantic markets on Saturday and Sunday, but then quickly returning to significantly warmer-than-normal conditions starting Monday and progressively warming through the rest of next week.

“With these temps, we have New England demand topping out Saturday at 2.75 Bcf/d, then averaging 2.56 Bcf/d through next week. Appalachia demand peaks at 12.43 Bcf/d on Saturday, then averaged 11.45 Bcf/d for the week. SEMA demand peaks Saturday at 14.77 Bcf/d. The fall-off in SEMA for next week is not as extreme as markets north; demand is forecast to average just above 14 Bcf/d for the week,” Genscape said.

Medium-term weather outlooks are not showing much promise either.

Genscape meteorologists noted that the failure for ridging to develop over the Gulf of Alaska means the warm-weather trend that has dominated so far this month will persist well into Thanksgiving. And an averaging of the last 40 CFS weather model runs projects warmth pushing into December.

The dismal demand outlook could be why winter forward prices in the premium-priced Northeast plunged more than 40 cents. Transco zone 6-New York December forward prices were down 45 cents between Nov. 4 and 9 to reach $3.295, and the balance of winter (January-March) was down 42 cents to $6.50, Forward Look data shows.

At New England’s Algonquin Gas Transmission citygates, December forwards tumbled 57 cents between Nov. 4 and 9 to reach $3.69, while the balance of winter dropped 49 cents to $5.97. Aiding the bearish weather sentiment is the partial in-service of Algonquin’s AIM pipeline project, which will ultimately bring online some 342,000 Mcf/d of capacity. Currently, 245,000 Mcf/d is online.

NatGasWeather said it still anticipates additional weather systems will follow late next week and beyond, beginning over the west-central U.S. first. But there remains considerable uncertainty in the amount of colder air out of Canada that will be tapped, and then which regions it would spread across.

“It was important the weather data showed at least modest amounts of subfreezing temperatures arriving late next week and beyond if there was to be any hope in satisfying what’s proven to be a very impatient market,” NatGasWeather said. “The weather data does show that there’s likely to be at least some surge back to stronger nat gas demand around Nov. 19-24, it’s just a bit unknown how much cooling will ultimately arrive and will need refining in the days ahead.”

Forecasters at Bespoke Weather Services said the latest Global Forecast System (GFS) ensemble guidance for day seven did back a bit off the strength of ridging and thus showed a bit less warmth, though the bias was still very clearly to far warmer temperatures. Day 10 did show some cooler risk across the South, though that is not a key heating demand region this time of year, it said.

Beyond that, GFS ensemble guidance continued to decrease ridging across the center of the country by day 12, with temperatures decently above average now. Come day 14, a cooler bias has begun to arise across the Southeast despite weak ridging still shown across much of the West. The CPC analog favors temperatures generally near averages, though it appears to be lagging behind the most bullish GFS ensemble run, Bespoke said.

“Long-term forecasts remain quite noisy with conï¬dence below average, so further volatility can be expected in the coming days,” the weather forecaster said.

Indeed, book-squaring before Thursday’s U.S. EIA storage report and additional end-user buying interest appeared to be behind Wednesday’s recovery in prompt-month futures. But alas, the flip into the black was short-lived as the Nymex December contract once again moved into negative territory following the release of the storage report.

The South Central region continues to drive the majority of the surplus build, accounting for nearly half of this week’s storage injection (+25 Bcf versus +15 Bcf in 2015), while the East and Midwest regions also posted storage figures that were well above their respective five-year averages.

“Natural gas storage is now at the highest level on record, and with continued warm weather expected across much of the Northeast, we could see storage build even further,” analysts with Wells Fargo said.

Mobius analysts agreed, noting that heating degree day forecasts for the weeks ending Nov. 11 and Nov. 18 are likely low enough to yield two more injections, or at the very least, an overall net injection over the 14-day period. This additional bearish risk is likely behind Thursday’s retreat. As of midday, the Nymex December contract had fallen nearly 10 cents.

But while most natural gas markets in the country weakened this week, Marcellus/Utica points saw some strengthening amid returning production and increased takeaway capacity in the region.

At Dominion South, December forward prices rose 13.5 cents from Nov. 4 to 9 to reach $1.91, just 78 cents below the Nymex, according to Forward Look. January forward prices were up 5 cents during that time to $2.10, while the balance of winter (January-March) rose 10 cents to $2.10.

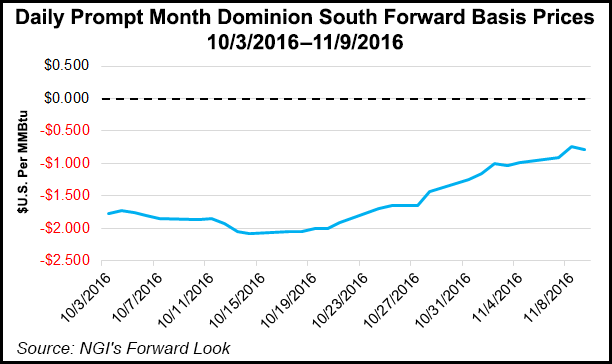

In fact, Dominion South has been on an upward trajectory since the latter part of October in both the forwards and cash markets. NGI historical forward price data shows December basis prices climbing from around minus $1.67 on Oct. 21 to minus 78 cents on Nov. 9.

On Wednesday, Dominion South spot prices hit $1.79, exceeding their 30-day high of $1.77.

At Transco Leidy, December forward prices rose 23 cents from Nov. 4 to 9 to reach $1.82, while January climbed 8 cents to $1.89. The balance of winter was up 12 cents to $1.92. Like Dominion, strength has been ongoing the last few weeks as Transco Leidy December basis has risen from minus $1.81 to minus 87 cents, Forward Lookdata shows.

On Wednesday, Transco Leidy spot gas changed hands at $1.77, well above its 30-day high of $1.71 (see Daily GPI, Nov. 9).

The week’s gains come as production in the Northeast has grown to levels not seen since the summer. Production reached close to 23 Bcf/d over the weekend, just shy of the summer high seen at the start of August, and has risen more than 900,000 Mcf/d since the start of the month.

Meanwhile, Dominion’s Lebanon West II project began transporting approximately 130 million MMBtu of Rex Energy natural gas volumes on Nov. 1 from its Butler-operated area to both the Gulf Coast and Midwest premium markets.

In its third quarter conference call, Rex said it will now transport approximately 50% of its natural gas volumes to the Gulf Coast and Midwest, where it expects to receive pricing that averages approximately 10 cents off of Henry Hub.

“We will continue to sell the remaining 50% of our natural gas volumes at Dominion Southpoint, where we have an estimated 60% of that basis hedged as a company at approximately $0.80 off of Henry Hub for calendar 2017 and 2018,” Rex CEO Thomas Stably said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |