Markets | NGI All News Access | NGI The Weekly Gas Market Report

EIA Boosts 2017 Henry Hub Spot Price Forecast to $3.12/MMBtu

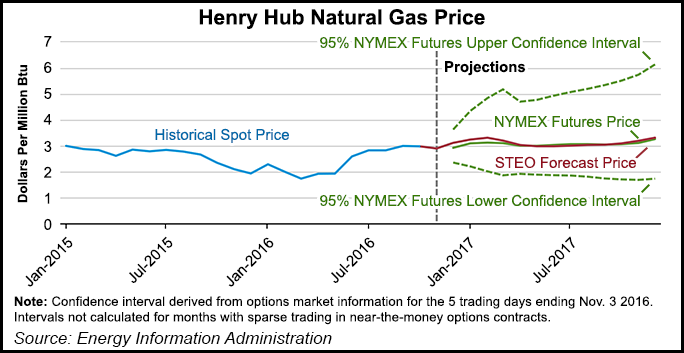

Henry Hub natural gas spot prices will average $3.12/MMBtu in 2017, up from an estimated $2.50/MMBtu in 2016 and higher than previously forecast, according to the Energy Information Administration (EIA).

Growing domestic consumption and increasing exports, both via pipelines to Mexico and liquefied natural gas to other markets, will help to boost prices next year, EIA said in its latest Short-Term Energy Outlook (STEO).

EIA’s projected prices have steadily increased. In October, the agency said it expected 2017 Henry Hub natural gas spot prices to average $3.07/MMBtu (see Daily GPI, Oct. 13). EIA’s 2017 natural gas price forecast stood at $2.87/MMBtu in September (see Daily GPI, Sept. 7).

The front-month natural gas contract for delivery at Henry Hub moved lower in the second half of October, settling at $2.77/MMBtu on Nov. 3. NYMEX contract values for February 2017 delivery traded during the five-day period ending Nov. 3 suggest a price range from $2.01/MMBtu to $4.84/MMBtu encompasses the market expectation of Henry Hub natural gas prices in February 2017 at the 95% confidence level, EIA said.

“The price volatility toward the end of October was mostly the result of warmer-than-normal weather and a change in the delivery month from November to December, reflecting seasonality in natural gas prices. The average Henry Hub natural gas spot price in October decreased by 2 cents/MMBtu from the September average.

“Warmer-than-normal temperatures in the United States during October led to lower-than-expected heating degree days (HDD), putting downward pressure on natural gas demand and prices. HDDs were 38% below the previous 10-year average in October. With total U.S. working natural gas inventories already at elevated levels, the reduced demand did not translate into additional storage builds. The pace of storage injections in October was slower compared with previous years, which could reflect a decline in natural gas production during October [see Daily GPI, Nov. 3],” EIA said.

EIA is forecasting about 21% of U.S. natural gas consumption in December, January, and February to be drawn from inventories, slightly higher than the five-year average. “Rather than signaling the need for inventory builds to meet winter heating needs, the higher November-to-January futures price spread this year likely reflects the difference between current warmer-than-normal temperatures and the expectation for colder temperatures this winter compared with last winter,” the agency said.

Temperatures this winter are expected to average 3% warmer than the 10-year average, but 15% colder than last winter, which was exceptionally warm, EIA Administrator Adam Sieminski said last month. Those colder temperatures will lead to higher demand for space-heating fuels, compared to winter 2015-2016, but fuel demand will still be 2-3% lower than average, and while prices for all fuels are forecast to be higher than last winter, heating oil and propane prices are forecast to be “significantly below the average of the previous five winters,” he said.

Natural gas marketed production is expected to average 77.3 Bcf/d in 2016, a 1.4 Bcf/d decline from the 2015 level, which would be the first annual decline since 2005, according to the STEO. EIA expects production to start rising this month as a result of increases in drilling activity and infrastructure build-out that connects gas production to demand centers. In 2017, forecast natural gas production increases by an average of 2.9 Bcf/d from the 2016 level.

EIA expects the share of U.S. total utility-scale electricity generation from natural gas will average 34% this year, compared with 33% in 2015, and the share from coal will average 30%, down from 33% last year. With natural gas prices forecast to increase in 2017, EIA expects natural gas to generate about 33% and coal 31% of electricity next year.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |