Markets | NGI All News Access | NGI Data

Natural Gas Market Firms Following EIA Storage Report

Natural gas futures gained ground Thursday morning after the Energy Information Administration (EIA) reported a storage injection that was slightly less than what traders and analysts were anticipating.

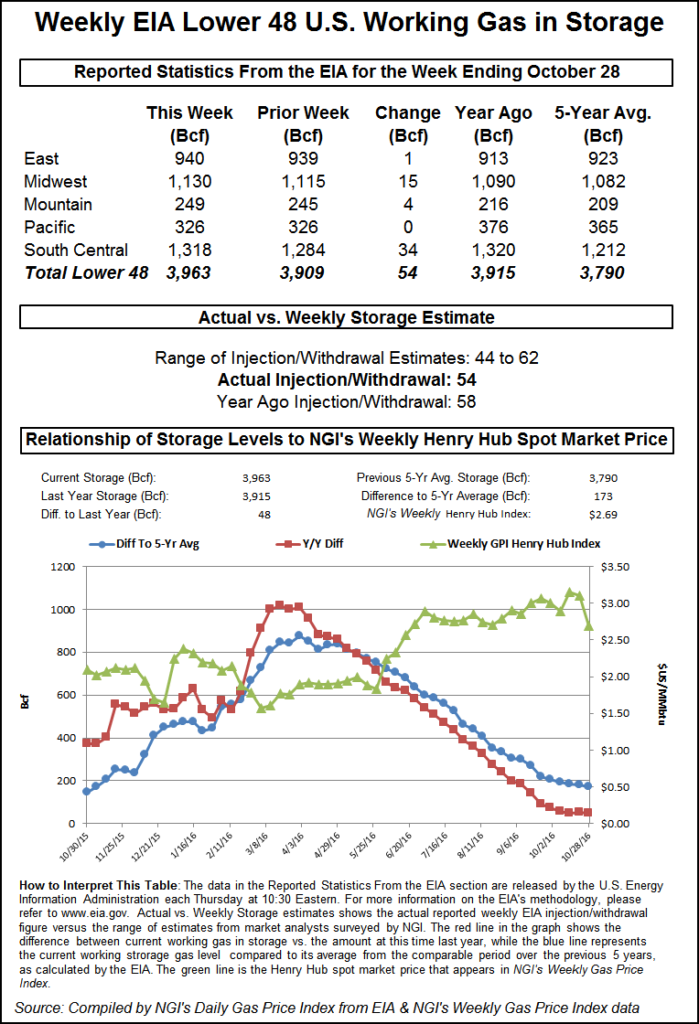

EIA reported a 54 Bcf storage injection in its 10:30 a.m. EDT release, about 2 Bcf less than what surveys and estimates by traders and analysts were expecting. December futures reached a low of $2.788 immediately after the figures were released and by 10:45 a.m. December was trading at $2.808, up 1.6 cents from Wednesday’s settlement.

“The market seems to be trying to find some base,” a New York floor trader told NGI. “I look for some sideways movement in here with some scale-in buying with caution. Now that we are down here, there is a little caution in finding support.”

“The 54 Bcf refill was slightly below the median expectation and less than the 62 Bcf five-year average, and so at least modestly supportive on a seasonally adjusted basis,” said Tim Evans of Citi Futures Perspective. “At the same time, we don’t think this will change the market’s recent bearish dynamic, with the forecast for warmer-than-normal temperatures still pointing to weak early season heating demand and further storage injections in the weeks ahead.”

Inventories now stand at 3,963 Bcf and are 48 Bcf greater than last year and 173 Bcf more than the five-year average. In the East Region 1 Bcf was injected and the Midwest Region saw inventories increase by 15 Bcf. Stocks in the Mountain Region rose 4 Bcf, and the Pacific Region was unchanged. The South Central Region added 34 Bcf.

Salt cavern storage was up 22 Bcf at 374 Bcf, while the non-salt cavern figure was up 13 Bcf at 944 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |