Regulatory | NGI All News Access

Alberta’s Flexible Royalty Regime Attracts Drilling Investment, Review Finds

Alberta has gained a profit advantage in attracting drilling and will keep the edge when oil and natural gas prices rise, according to a review of royalty revisions that take effect in 2017.

Only Pennsylvania tops Canada’s chief fossil fuel supplier province as an investment target, said a research paper released Monday by the University of Calgary School of Public Policy.

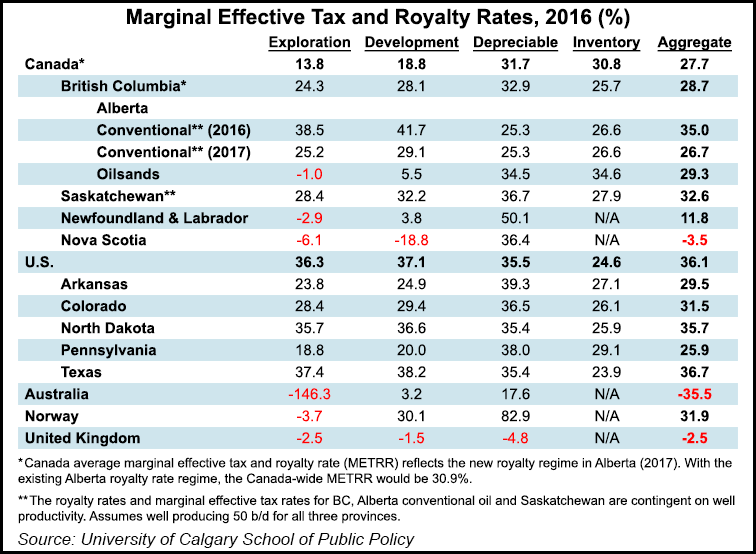

Economists Daria Crisan and Jack Mintz award Alberta the rank of second-best among active producer jurisdictions on a scale of combined royalty and tax loads called METRR, short for marginal effective tax and royalty rate.

The paper defuses industry fear — and right-wing political claims — that development would be stifled by reforms that the left-leaning New Democratic Party government enacted this year after lengthy study by an independent review panel.

Mintz’s name on the paper highlights its forgiving message. He stands out as a prominent pillar of Calgary economic analysts who has served on corporate boards of directors and done studies accepted by the Canadian Association of Petroleum Producers.

“After Alberta’s NDP government commissioned a review of the royalty regime to ensure the province was receiving its ”fair share’…the few changes that were made have had a substantial impact on incentives for new investment” said Crisan and Mintz. “Those changes have, in fact, only made it more lucrative for investors in Alberta’s conventional oil and gas [flowing from wells outside the oilsands].”

The revisions chopped Alberta’s METRR, or government take, to 26.7% at current commodity prices from 35%, the economists calculated. “Most notably, Alberta is more competitive now than its immediate neighbors, British Columbia and Saskatchewan.” Critics of the NDP regime predicted its royalty review would make Canadian drilling rigs scurry away to investment targets in the other provinces.

In North America only Pennsylvania — with a score of 25.9% — offers lower tax and royalty burdens for oil and gas drilling investment, according to the paper. Texas scores a METRR of 36.7%. North Dakota rates as slightly more attractive at 35.7%.

Elsewhere in Canada, Newfoundland and Nova Scotia set lower royalty and tax loads than Alberta but render their attractions meaningless by outlawing horizontal drilling and hydraulic fracturing in response to popular fears of the practices.

Overseas, complex fiscal structures in Australia and the United Kingdom impose lower METRRs than the North American oil and gas producer jurisdictions for companies big enough to tackle their mostly offshore industries, the Calgary economists said.

The main change in the Alberta regime is introduction, as of January 2017, of a regime for drilled, flowing wells that mimics incentives that have encouraged high oilsands investments since the late 1990s.

The new rules cut royalties on new Alberta wells to a nominal 5% until costs are recovered. Expenses are deemed by a formula called the “drilling and completion cost allowance.”

The system adds an investment sweetener by making the allowance an industry average, rather than the actual costs of each well. As a result, companies that outperform overall efficiency standards will gain by keeping the five-per-cent royalty rate longer than they need to pay for their wells.

The new Alberta rules also effectively cut royalty rates for the producing life of wells after costs are recovered, the economists said. The reductions are made by adjusting sliding scales of commodity prices and well output volumes that set the rates.

The Calgary economists calculated Alberta’s METRR will only rise to 29.9% if oil rebounds to US$70/bbl — higher than their forecast of 25.3% for Pennsylvania, but still competitive against 35.3% for Texas and 34.3% for North Dakota.

“Under the new regime, Alberta’s tax burden on conventional oil projects is reduced for a wide range of oil prices,” the research paper said. “Whether the Province will attract investment for conventional oil once the market conditions improve will depend as well on other policies being adopted but at least the new royalty regime will help boost interest in the province.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |