Markets | NGI All News Access | NGI Data

NatGas Futures Inch Higher Following On-Target Storage Build

Natural gas futures rose modestly Thursday morning after the Energy Information Administration (EIA) reported a storage injection that was right in line with trader expectations.

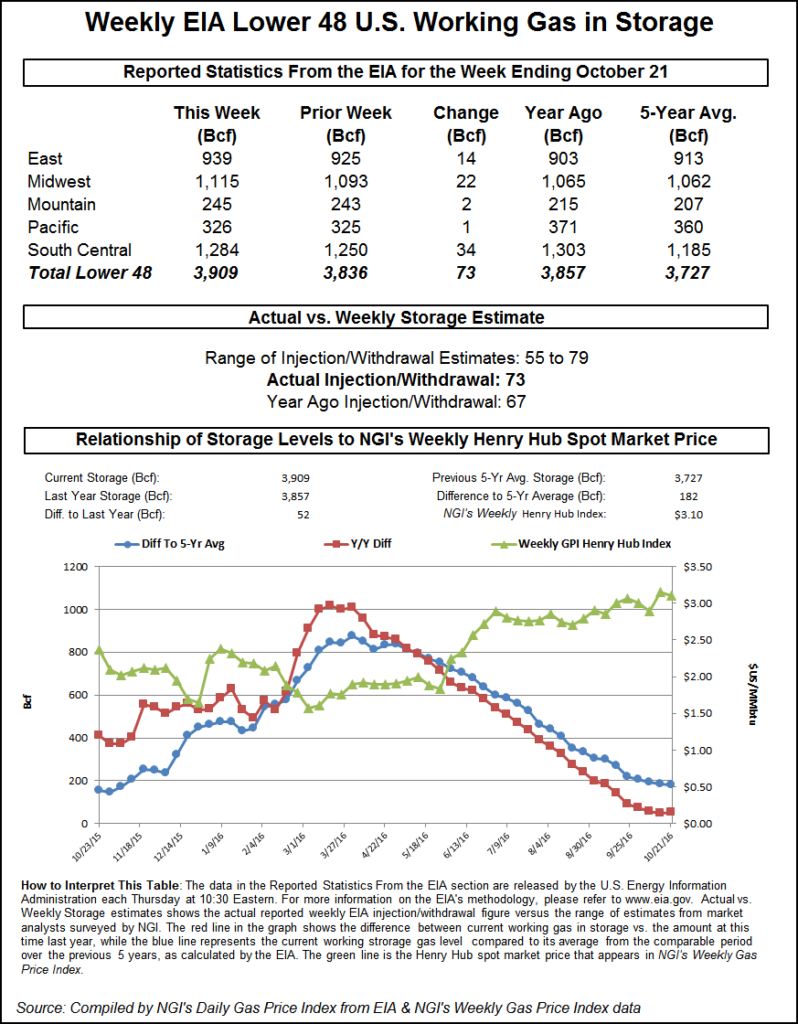

EIA reported a 73 Bcf storage injection in its 10:30 a.m. EDT release, just what surveys and estimates by traders and analysts were expecting. The expiring November futures contract reached a low of $2.725 immediately after the figures were released, but by 10:45 a.m. EDT November was trading at $2.740, up nine-tenths of a cent from Wednesday’s settlement.

Traders noted that natural gas from the December contract onward is still a $3 market despite the price implosion of the last six days. “You have got $3 all the way back to March 2018, so you are in good shape in regards to $3,” said a New York floor trader.

“The 73 Bcf in net injections for last week matched the major newswire surveys and was more than the 68 Bcf date-adjusted build from a year ago,” said Tim Evans of Citi Futures Perspective. “It was still just below the 77 Bcf five-year average, although close enough to be considered neutral rather than bullish. Overall, we don’t see today’s data changing anyone’s view.”

Inventories now stand at 3,909 Bcf and are 52 Bcf greater than last year and 182 Bcf more than the five-year average. In the East Region, 14 Bcf was injected, and the Midwest Region saw inventories increase by 22 Bcf. Stocks in the Mountain Region rose 2 Bcf, and the Pacific Region was up 1 Bcf. The South Central Region added 34 Bcf.

Salt cavern storage was up 22 Bcf at 352 Bcf, while the non-salt cavern figure increased 11 Bcf at 931 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |