NatGas Market ‘Must Take Care of Itself,’ Analyst Says; Rigs Come Back

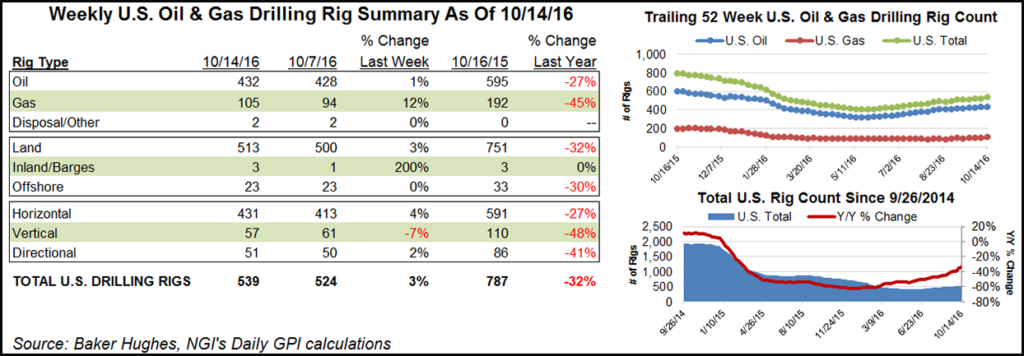

Stronger natural gas prices have apparently enticed drillers as 11 gas rigs came back into U.S. play, accompanied by an additional four oil rigs, making for an overall gain of 15 for the week ending Friday (Oct. 14), according to Baker Hughes Inc. (BHI).

That could turn out be a good thing as at least one analyst figures that the natural gas market will have to take care of itself in the months ahead given a decline in associated gas production.

“…[T]here is lots of production on tap, for instance in Eagle Ford and Haynesville, but how quickly and easily that growth [can] be delivered since most non-Northeast gas regions have been in decline quite a while now is very uncertain,” wrote Societe Generale’s Breanne Dougherty in an Oct. 7 note. “The lack of additional support from associated gas is ultimately forcing the gas market to take care of itself as it returns to growth.”

Thirteen land-based rigs came back in the United States. Louisiana led the states in gains, adding six, while Texas saw the departure of three rigs. Two rigs came back to the inland waters. Eighteen U.S. horizontal rigs came back, accompanied by one directional unit and offset by the departure of four vertical rigs.

At week’s end there were 539 U.S. actives, 513 of which were running on land.

The Permian Basin lost two rigs, and the Eagle Ford Shale gave up four. Two rigs came back to the Haynesville, lending credence to the emerging dry gas theme there.

The big gainer among plays was the Cana Woodford, which added four units. Oklahoma posted a gain of three rigs.

For a closer look at who’s doing what and where in the many targets in Oklahoma, check out NGI’s latest special report: THE SOONER BOOMER: How SCOOP, STACK and the OK Liquid Plays are changing the game in the Midcontinent.

Cowen and Company tallies 401 U.S. horizontal land rigs running, according to a note out Thursday. That compares with BHI’s U.S. horizontal count of 431 for the week. Referencing their firm’s tally, Cowen analysts wrote that 126 horizontals have been added since the trough in drilling activity. These have been split between public and private exploration and production (E&P) companies. “Of the 126 additions, 76, or 60%, have been in the Permian, reflecting the same split between public and private E&Ps,” Cowen said.

Canada stood pat with the previous week at 165 rigs running but swapped three natural gas rigs for the return of three oil rigs.

The Railroad Commission of Texas (RRC) has gotten a little busier with drilling-related administrative duties, but it’s still slower than it was a year ago.

RRC issued 746 original drilling permits in September compared to 906 in September 2015. The September total included 610 permits to drill new oil or gas wells, seven to re-enter plugged wellbores and 129 for recompletions of existing well bores. These included 217 oil, 39 gas, 448 oil or gas, 34 injection, one service and seven other permits.

In September RRC staff processed 430 oil, 155 gas, 38 injection and seven other completions compared to 1,153 oil, 284 gas, 41 injection and six other completions in September 2015. Total well completions for 2016 year to date are 8,737, down from 16,149 recorded during the same period in 2015.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 |