Late-Week Rally Could Be Sign of More Volatility to Come This Winter

November natural gas forward prices averaged 11 cents higher between Oct. 7 and 13, setting the stage for hefty double-digit increases across the front half of the curve and reminding the market that weather isn’t always necessary to spook prices.

The strength was resounding as gains mounted through the winter. December forward prices averaged 12 cents higher over the week, while the balance of winter (December-March) averaged 13 cents higher, according to NGI’s Forward Look.

And even packages as far out as winter 2017-2018 rose an average 10 cents from Oct. 7 to 13. Single-digit increases were seen beyond that. The national price trend is reflective of Nymex futures, which strengthened the better part of the week despite a lack of supporting fundamentals.

In fact, the Nymex slid into the red on only two days since Oct. 7 but bounced back with a vengeance Thursday following a one-two punch from the Energy Information Administration (EIA) via a smallish storage build report for the week ending Oct. 7 and separate news that the government agency is boosting price average expectations through 2017 (see Daily GPI, Oct. 13a; Oct. 13b).

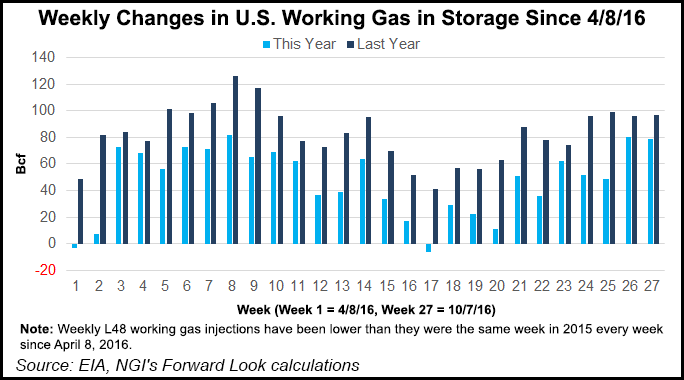

EIA reported a 79 Bcf injection into storage for the week ending Oct. 7, far below market consensus of an 88 Bcf build and below the year-ago injection of 97 Bcf.

EIA also said it now expects Henry Hub natural gas spot prices to average $3.04/MMBtu in 4Q2016 and $3.07/MMBtu next year, substantially higher than the agency’s previous 2017 price forecast. That had leap-frogged from its September prediction when EIA said it expected 2017 Henry Hub natural gas spot prices to average $2.87/MMBtu (see Daily GPI, Sept. 7). The September forecast was a retreat after back-to-back monthly increases had put the August forecast at $2.41/MMBtu for 2016, and the 2017 price forecast at $2.95/MMBtu (see Daily GPI, Aug. 9).

The Nymex November futures contract surged 13.1 cents on the news, settling Thursday at $3.341, notching a new 22-month high for a front-month contract settlement. November futures were up about 15 cents between Oct. 7 and 13 and are up 38 cents since Sept. 29.

“The November natural gas contract rallied over 4% today, with the rest of the strip rallying to a similar degree off a very bullish miss in EIA data today,” analysts at Bespoke Weather Services said Thursday.

Indeed, the Nymex December futures contract jumped 12 cents Thursday to settle at $3.53, while balance of winter (December-March) shot up 11 cents to $3.61. For the period between Oct. 7 and 13, Nymex futures were up 14 cents for both December and the balance of winter, reaching $3.53 and $3.61, respectively.

After such a spike, the market is now in overbought territory, and a pullback is expected into the weekend, Bespoke said. Indeed, the Nymex November futures contract was trading about 5 cents lower midday Friday as traders sold off positions.

Weather was also doing its part to drive prices lower Friday.

“A majority of the U.S. will be tranquil this coming weekend into next week besides the West Coast, where powerful Pacific storms will bring strong winds and heavy rains, with localized power outages expected,” forecasters with NatGasWeather said.

Cooler air will finally push into the eastern United States with stronger natural gas demand beginning late next week and lasting through around Oct. 25 as weather systems tracking out of the West marginally tap into the cold pool over southern Canada, the forecaster said.

Until then, the southern and eastern United States remains under the influence of strong upper-level high pressure with comfortable temperatures of upper 60s to lower 80s. With such mild temperatures on tap, analysts at Mobius Risk Group said storage inventories could still reach record levels before the start of winter.

“Based on weather forecasts, and current supply-demand dynamics, the 4 Tcf mark is certainly still within reach,” Mobius said. An average injection of 60 Bcf over the next four weeks would put inventory just below the 4 Tcf mark, and for reference, the current week is shaping up to generate an injection closer to 70 Bcf, the Houston-based company said.

“This estimation includes rolling today’s implied tightness into the next EIA storage report, which of course may not be warranted,” Mobius added.

The EIA on Thursday said it expects end-of-October inventories to reach 3,966 Bcf, which would be near the record high going into the heating season.

Regardless of weather patterns, supplies continue to tighten, NatGasWeather said. “This was proven with yesterday’s EIA report showing a build of only +79 Bcf, which occurred while comfortable conditions were observed across a majority of the U.S.,” the weather group said.

The tighter supply-demand picture comes as production remained near year-to-date lows this week, hovering in the upper 60s Bcf/d to low 70s Bcf/d.

“This highlights an environment that’s much different compared to last year where the onus was on cold weather proving it to justify higher prices,” NatGasWeather said. “Going into this winter, as long as production remains lower year over year, we expect supplies are going to continue to tighten with the onus on milder weather patterns overcoming what we view as a bullish background state.”

As the recent strength in the futures curve has done little to drive reinvestment in dry gas production, maintaining a year-over-year deficit appears likely. In fact, rig count data released Oct. 7 by Baker Hughes showed natural gas rigs falling by two from the previous week to 94 rigs, which is nearly half of what the rig count was at this time last year.

But the Natural Gas Supply Association said the lower rig count is not indicative of production this winter. In fact, the organization said it projects only a .5 Bcf/d decline in production this winter compared to last.

“The shale revolution has ushered in a remarkable era, as evidenced by dramatic growth in production over the last nine years. Despite the low rig count, this winter’s supply is expected to remain robust because of drilling efficiencies and new infrastructure coming online to move natural gas to customers,” the NGSA said earlier this month.

EIA, meanwhile, expects marketed natural gas production to average 77.5 Bcf/d in 2016, a decrease of 1.6% from the 2015 level, which would be the first annual decline since 2005. Forecast production would increase by 3.7 Bcf/d in 2017, it said.

Regardless of robust storage inventory levels and only small projected decreases on the production front, there is growing consensus in the market that prices this winter will be higher than last year and even brief periods of cold could lead to price spikes.

“Storage is still above year-ago levels, but the storage surplus has shifted to the consuming Northeast, while ”producing’ area storage is now below year-ago levels,” investment bank Jefferies said. “Given a bloated Northeast pipeline network, short-term cold snaps could lead to a greater ”call’ on Gulf Coast supply and create price spikes.”

Price volatility during the winter is nothing new to natural gas markets, but last year’s unusually warm winter, the second warmest on record, left prices averaging just $1.98 at the Henry Hub.

That’s likely to change this year as growing exports to Mexico and LNG exports combine with weakening oversupply to drive up natural gas prices, analysts have said.

Just this week, ConocoPhillips’ Jim Duncan, director of commodity market research, said that assuming traditional winter weather shows up, even a “half-polar vortex winter,” developments driven by the electric generation sector are likely to shake up gas prices (see Daily GPI, Oct. 12).

Mexico’s imports of U.S. gas for power generation are projected to grow from a current total of 3.7 Bcf/d to 8.2 Bcf/d over the next few years, he said.

Meanwhile, the U.S. renewables market has climbed substantially, with wind hitting 9.8 GWh and solar 4.3 GWh last year. That “means natural gas demand is going to grow,” Duncan said.

The National Oceanic and Atmospheric Administration is forecasting a 12% colder winter compared to last year, while EIA said it expects this winter to be 15% colder than last.

Furthermore, the upcoming winter could be an extended one from the northern Plains to the natural gas-hungry population centers of the eastern United States, with cold and snowy conditions stretching into the spring, AccuWeather forecasters have said.

Given recent “climate patterns and signs that the fundamental supply and demand dynamics of the [natural gas market] are tightening, combined with a decisive, bullish shift in the technicals in the last two months, natural gas is a buy right now,” Tyler Richey, analyst and co-editor of The 7:00 Report, said.

“This may be the beginning of a multi-year bull market in natural gas,” Richey added, noting that his next “upside target” remains $3.50, with a longer-term move back toward $6 a possibility.

So far, Nymex futures are far from reflecting a move back toward $6, but $3+ gas appears to be likely for the next couple of years. After Thursday’s rally, the Nymex calendar 2017 strip moved to its highest close since May of 2015, which at $3.401 is 94 cents higher than its year-to-date low.

The calendar 2018 strip also closed Thursday at a year-to-date high of $3.078. Respective closing prices for calendar 2019 and 2020 are still well below their year-to-date highs, and for that matter struggling to climb back to $3, Mobius said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9915 | ISSN © 2577-9877 |