NatGas Futures Settle at 22-Month High Following Bullish Storage Data

Physical natural gas trading for Friday delivery took a backseat to more exuberant futures activity on Thursday. Moderate temperatures kept a lid on physical prices, but futures raced higher, led by a series of government reports indicating not only improved pricing but a thinner addition to storage inventories than the market expected.

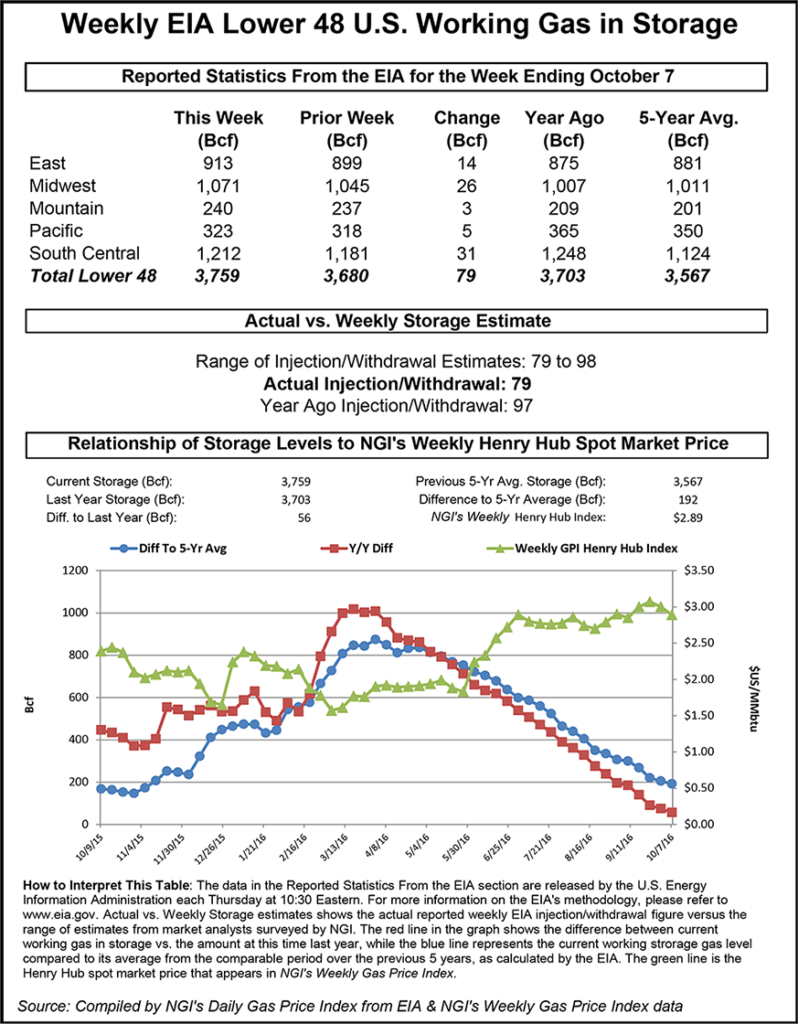

The Energy Information Administration (EIA) reported an inventory build of 79 Bcf, about 8 Bcf less than industry estimates, and prices wasted no time in marching higher. At the close, November had added a stout 13.1 cents to $3.341, the highest close in 22 months, and December was up by 12.2 cents to $3.532. November crude oil gained 26 cents to $50.44/bbl. NGI’s National Spot Gas Average slide 3 cents to $2.70.

As soon as the EIA report rattled across trading desks November futures reached a high of $3.320 and by 10:45 a.m. EDT, November was trading at $3.308, up 9.8 cents from Wednesday’s settlement.

“We were looking for an 87 Bcf number, so the market got a little boost. Right off the bat we made $3.32 and it’s staying there,” a New York floor trader told NGI.

“We have volume already of 100,000 [November] contracts, which is double the normal volume we have at this time. Usually we have 60,000 contracts traded at this time; $3.50 is the next level higher, but you will get pops along the way. December got up to $3.517. At expiration we could already be at $3.50.”

Others see reporting issues in play. “The data for last week was a clear bullish surprise, a 79 Bcf build instead of the 87-88 Bcf consensus forecast,” said Tim Evans of Citi Futures Perspective. “Coming after a larger-than-expected 80 Bcf refill in the prior week suggests there may have been some issues at the margin between the two periods rather than an overall shift in supply versus demand.”

Inventories now stand at 3,759 Bcf and are 56 Bcf greater than last year and 192 Bcf more than the five-year average. In the East Region 14 Bcf was injected and the Midwest Region saw inventories increase by 26 Bcf. Stocks in the Mountain Region rose 3 Bcf, and the Pacific Region was higher by 5 Bcf. The South Central Region added 31 Bcf.

Followers of Elliott Wave see the market moving higher. “We are in the fifth and final wave of a five-wave advance from the lows of March,” said David Thompson, vice president at Powerhouse LLC, a Washington DC-based trading and risk management firm.

“It’s a pretty standard five-wave pattern and doesn’t look too tortured. In Elliott methodology there is the potential for an extended fifth wave and Elliott has the fifth wave extending up to $3.50. It’s not looking like we are at the point where we are done on this.”

“It looks like a healthy advance, and October into November is typically the strongest seasonal times for natural gas. Not so much the last three years but if you go look at the last 15 years the period ahead of winter is the strongest traditionally for natural gas prices.”

Aiding the day’s advance was a further announcement by EIA that it had raised its 2016 forecast on spot natural-gas prices to $2.51/MMBtu, up 3.7% from the September forecast. For next year, it raised its forecast by 7.1% from last month to $3.07 (see related story).

Weather forecasters are throwing out the idea that expected stormy weather in the Pacific Northwest this week might be an indication of longer-term things to come. “At least three potent storms will blast the northwestern United States from the latter part of this week to the early part of next week,” said AccuWeather.com meteorologist Alex Sosnowski.

“The storms could be an early sign of a La Nina-like pattern for the winter ahead. La Nina is a pattern noted by a zone of cooler-than-average water temperatures in the tropical Pacific Ocean. Depending on the strength and extent of this cool puddle, weather patterns across much of the globe can be affected.

“The series of storms will bring heavy rain, high country snow and high winds to portions of Washington, Oregon, Idaho, northern California and western Montana, as well as neighboring British Columbia into next week,” AccuWeather.com meteorologists said.

In physical market trading Midwest market points were some of the hardest hit as temperatures were forecast to be mild and unassuming. AccuWeather.com forecast that Thurday’s high in Chicago of 56 was expected to reach a pleasant 65 Friday and 71 on Saturday, 7 degrees above normal. Detroit’s 56 high Thursday was seen reaching 61 Friday and 70 on Saturday, 9 degrees above normal.

Gas at the Chicago Citygate skidded 15 cents to $3.00, and packages on Consumers were seen 8 cents lower at $3.03. Deliveries to Michcon were quoted 15 cents lower at $2.94, and gas at Joliet shed 13 cents to $2.97.

Price moves at other market centers were not so extreme. Deliveries to Dominion South rose a nickel to 96 cents, but parcels at the Henry Hub shed a penny to $3.16. Gas on El Paso Permian fell 6 cents to $2.70 and gas priced at the SoCal Citygate was quoted 6 cents lower at $2.97.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |