E&P | Markets | NGI All News Access | NGI The Weekly Gas Market Report

Extraction, First E&P Launch in Two Years, Soars Early in Nasdaq Debut

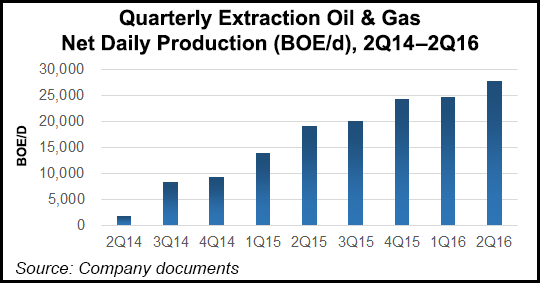

Denver-based Extraction Oil & Gas LLC, the first U.S. exploration and production company to go public in two years, climbed 15% in its debut on Nasdaq Wednesday after pricing above expectations.

The operator raised $594.1 million net late Tuesday after offering 33.3 million shares priced at $19/share, which was above its initial public offering (IPO) forecast of $15-18 (see Shale Daily, Sept. 30). The company, backed by private equity Yorktown Partners LLC, is listed under “XOG.” At the close on Wednesday, Extraction rose by 15%, or $2.85, to end the day at $21.85. More than 19 million shares traded hands.

Extraction, founded in 2012, from June 2015 to June 2016 booked $215 million in sales. In the Greater Wattenberg field, the company is developing a leasehold east of Greeley, CO, in Weld County (see Shale Daily, July 1). The plan is to drill 24 wells, install 18 oil tanks, two water tanks 24 separators, two meter houses, four vapor recovery units, eight emission control devices and two vapor recovery towers.

Also set to IPO this week is Mammoth Energy Services Inc., whose top customer is Gulfport Energy Corp. (see Shale Daily, Sept. 8). Mammoth has said it expects to raise $128 million, with an offer for 7.75 million shares priced at $15-18 when it debuts Friday on Nasdaq under “TUSK.”

Permian Basin producer Centennial Resource Production LLC had filed in July for a $100 million offering, but Silver Run Acquisition Corp. intervened and scooped up a majority stake (see Shale Daily, Oct. 11). Silver Run, which was launched as a publicly held blank check company earlier this year, is helmed by former EOG Resources Inc. chief Mark Papa.

Last month Noble Energy Inc. also rolled out Noble Midstream Partners LP, which raised above initial market expectations at $281 million on its first trading day on the New York Stock Exchange (see Shale Daily, Sept. 15).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |