U.S. Land Rigs Hit Big 500; Ears Will Be on Permian This Earnings Season

The U.S. land-based rig count compiled by Baker Hughes Inc. (BHI) came to rest at an even 500 units on Friday following a week that saw only modest changes in drilling activity week to week.

Three U.S. land rigs were added while two were taken from the inland waters category and one rejoined the hunt in the offshore, making for a net gain of two units overall and a U.S. rig tally of 524 at week’s end. Three oil rigs were added; two natural gas rigs departed and one “miscellaneous” rig came back. The addition of six horizontal rigs was tempered by the withdrawal of one directional unit and three verticals.

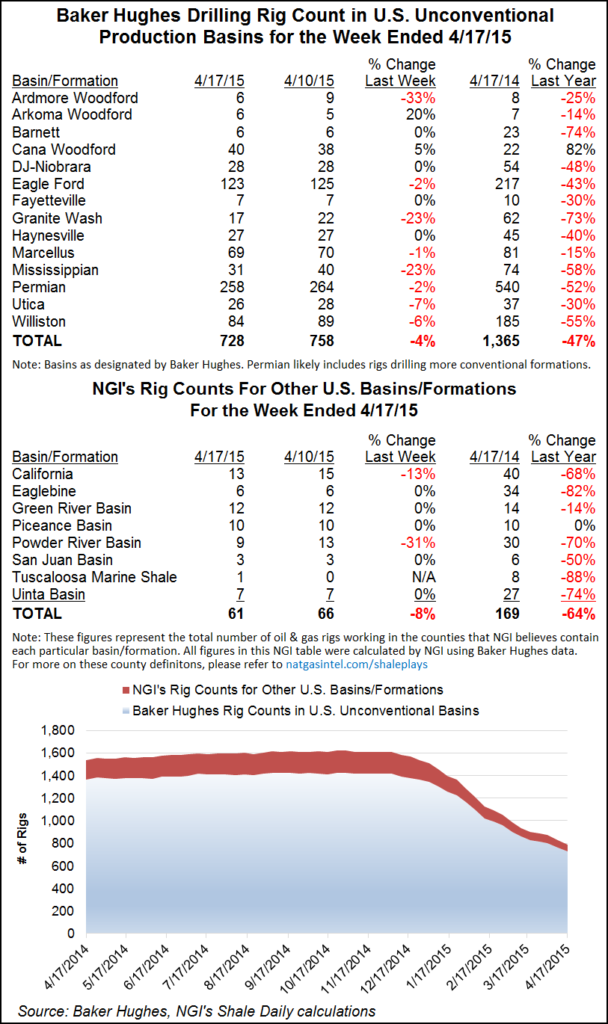

Across states, rig departures were no greater than one per state and additions were no greater than two (Texas). Among plays, the Barnett Shale was the big gainer for the week, adding two rigs. The Haynesville Shale saw the return of one rig. And the Denver-Julesburg/Niobrara, Eagle Ford Shale and Permian Basin saw the departure of one rig each.

Canada saw the return of three rigs to end the week at 165 actives (87 oil and 78 gas). The three rigs that came back were of the oily sort; gas rigs stood pat with the previous week.

Overall, North America added five rigs to end the week at 689 running.

“While the U.S. [oil] rig count has risen to 425 [as of Oct. 30], it is still far away from the 1,609 level reached in 2014,” analysts at Bank of America Merrill Lynch said in a note published Friday before the latest BHI numbers. “Still, the oil rig count is not the only item to factor in to estimate production. Rig efficiency and well productivity improvements have faded somewhat versus year-ago levels across all basins. As for well productivity, initial production rates (IPs) and cumulative production have stopped increasing in almost all basins but the Permian, where IPs are up 28% year on year. An Average Permian well now produces more oil than in any other play.

“Put differently, West Texas is once again set to lead a recovery in U.S. crude production as prices rise.” Hints of industry recovery are beginning to emerge in the Lone Star State (see related story).

In a note published Thursday, analysts at BMO Capital Markets also gave a nod to the Permian, saying it has accounted for nearly 60% of the increase in rig count since the late-May nadir. Meanwhile, the Bakken and Eagle Ford shales as well as the STACK (Sooner Trend of the Anadarko Basin, mostly Canadian and Kingfisher counties) have contributed 5-7% each to rig gains.

“Permian production has been flat for most of 2016, but now growth is resuming with the increase in rigs, a message we expect to hear from most Permian producers this earnings season,” BMO said. “The Permian, as well as the Utica (wet to dry gas), has achieved the greatest improvements in lateral-adjusted recoveries, while unadjusted improvements have been significantly greater as laterals have been extended.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |