Texas Petro Index Down Again, But Some Indicators Rising

It has been nearly two years since the last peak in the Texas Petro Index (TPI), a barometer of oil/natural gas industry activity in the Lone Star State, and in August the TPI marked its 21st consecutive month of decline. But there are signs of an industry comeback.

In August, the TPI declined to 150.5, according to Karr Ingham, the economist who created and maintains the index. Since peaking in November 2014 at a record 313.5, the TPI through August lost 52% of its value. The decline, according to Ingham, is “an orderly and logical process that has surpassed some important milestones.”

Ingham noted that crude oil prices have stabilized in the $40-45/bbl range since posting a low of $27.08/bbl in February. In August, for the first time since the contraction commenced, the average monthly crude oil price in Texas ($41.49/bbl) exceeded the average price in the same month a year earlier ($39.67/bbl), he said.

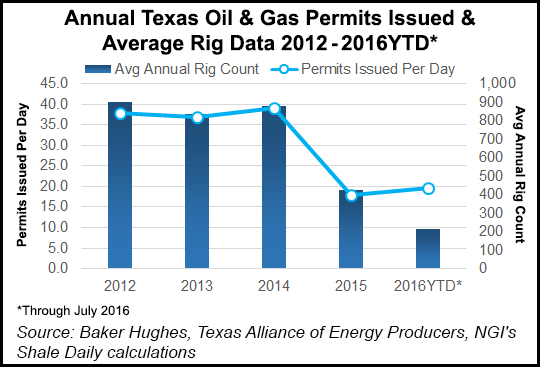

Drilling rig activity has been increasing since May in response to higher oil prices, although Ingham said he expects rig count growth to stall “in the near future absent another oil-price increase.”

Estimated total upstream oil and gas employment in Texas increased by 800 jobs in August compared to the updated July employment estimate, marking the first addition to upstream oil and gas employment in Texas since December 2014, according to Ingham. (Preliminary July employment data suggested a 100-job increase compared to June. However, that increase was wiped out when updated employment data were released, although upstream employment in both June and July was estimated at 203,325, he said.)

“These are important milestones,” Ingham said. “They certainly do not suggest a return to the activity levels the state was enjoying in advance of the downturn, but they do suggest the industry is no longer hemorrhaging in terms of price, the rig count and jobs. As long as the TPI continues to decline, the upstream oil and gas industry in Texas will not begin to transition to an expansionary mode.”

But increased oil prices have brought rigs back to the patch and have apparently stopped the decline in industry employment, Ingham said.

According to Ingham, August crude oil production in Texas totaled 96.3 million bbl, 9% less than in August 2015. With oil prices in August averaging $41.49/bbl, the value of Texas-produced crude oil totaled nearly $4.0 billion, 4.9% less than in August 2015.

Estimated Texas natural gas output surpassed an estimated 700.1 Bcf, a year-over-year monthly decline of about 6%. With natural gas prices in August averaging $2.69/Mcf, the value of Texas-produced gas declined 7.7% compared to a year ago to more than $1.88 billion.

The Baker Hughes count of active drilling rigs in Texas averaged averaged 231, 40% fewer units than in August 2015 when an average of 385 rigs were working. Drilling activity in Texas peaked in September 2008 at a monthly average of 946 rigs before falling to a trough of 329 in June 2009. In the most recent economic expansion, which began in December 2009, the statewide average monthly rig count peaked at 932 in May and June 2012.

The number of original drilling permits issued was 660, 23.6% fewer than the 864 permits issued in August 2015. The number of permits issued this year through August was 4,830, which is down 34.8% compared to the first eight months of 2015.

An estimated 204,125 Texans remained on upstream oil and gas industry payrolls, down about 19.3% from August 2015 and 33.3% fewer than the estimated high of about 306,020 in December 2014. According to TPI estimates, the trough of upstream oil and gas employment in Texas before the expansion ending December 2014 was 184,640 in October 2009. During the previous growth cycle, industry employment peaked at 225,965 in October 2008.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |