NGI Weekly Gas Price Index | Markets | NGI All News Access | NGI Data

Weekly NatGas Gains Come To An End With Northeast Leading The Way Lower

A string of weekly advances came to a screeching halt with the four-day trading week ended September 29. Only two of the points followed by NGI reached the positive side of the trading ledger and the NGI Weekly Spot Gas Average skidded 14 cents to $2.58. Most points outside Appalachia and the East were down about a dime, but outsized double-digit declines ruled most of New England, the Mid-Atlantic, and the Southeast.

The point showing the week’s greatest gain was far removed from the free-falling prices of the East. In Canada, Westcoast Station 2 rose $C0.54 to $C2.62/Gj and the point with the greatest loss was gas delivered to the Algonquin Citygate with a fall of 86 cents to $2.05.

Regionally the Northeast fell the most losing 54 cents to $1.62, and California proved to be the most resilient losing just 6 cents to $3.01.

Appalachia and the Southeast were pounded for 28 cent and 27-cent losses to 97 cents and $2.76, respectively.

South Texas and the Midwest each dropped 11 cents to $2.93 and $2.91, respectively, and the Midcontinent and Rocky Mountains lost a dime to $2.80 and $2.72, respectively.

East Texas and South Louisiana both fell 8 cents to $2.95.

For the 4 days November futures gave up 5.4 cents to $2.959.

Trading lore has it that any market that doesn’t respond positively to good news or conversely negatively to unfavorable news is ripe for a correction. That looks to have been the case Thursday when the Energy Information Administration (EIA) released storage data that showed inventories growing at a rate less than trader expectations. The EIA reported a build of 49 Bcf, about 6 Bcf less than what the market was looking for, and prices initially rose, but by the end of the day the screen was solidly in the red. The November contract shed 4.3 cents to $2.959 and December was off 3.8 cents to $3.161.

As soon as the storage report rumbled across trading desks, November futures reached a high of $3.032 immediately after the figures were released but by 10:45 a.m. November was trading at $2.993 down nine-tenths of a cent from Wednesday’s settlement.

“We were trading $2.99 when the number came out, and it’s ‘now you see it, now you don’t’,” said a New York floor trader describing the market’s momentary move after the release of EIA storage figures.

“$3 is the pivot point which we need to stay above for a few days to generate any upward momentum. I’m not getting much in the way of a bullish vibe.”

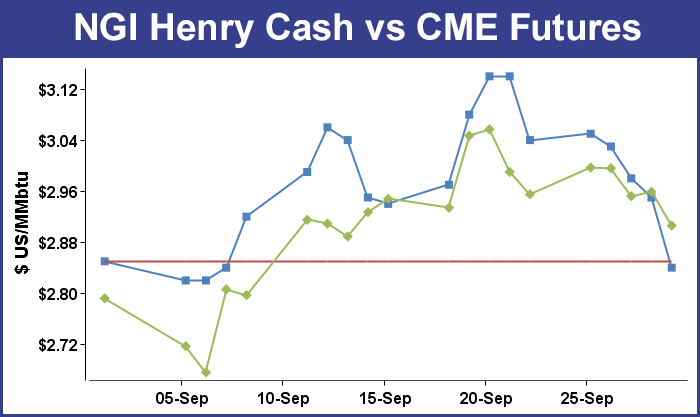

“We were looking for a build of 55 Bcf and it came in a little less but the market still came off,” a trader told NGI. “That’s a failure and that’s not good. There’s a little support at $2.88 to $2.89 but not much. Look to the downside. It could get down to the $2.60s.”

“The number indicates slight tightening on a week-over-week basis and has helped support prices, but expectations of a larger injection next week may limit upside above $3 through the day today,” said Harrison, NY-based Bespoke Weather Services.

Inventories now stand at 3,600 Bcf and are 90 Bcf greater than last year and 220 Bcf more than the five-year average. In the East Region 23 Bcf were injected and the Midwest Region saw inventories increase by 29 Bcf. Stocks in the Mountain Region rose 3 Bcf, and the Pacific Region was unchanged. The South Central Region decreased 6 Bcf.

In Friday’s trading the natural gas market, like all Gaul, ended up being divided into three parts: physical gas outside Appalachia and the Southeast, physical gas within Appalachia and the Southeast, and futures.

In typical shoulder season fashion, with mild weather expected, no one wanted to commit to three-day deals, and the NGI National Spot Gas Average fell 21 cents to $2.29. Points outside sections of the transportation-starved Northeast experienced double-digit declines. However, along Transco Zones 5 and 6, Tennessee Zones 4, 5 and 6, and Texas Eastern market zones 2 and 3, declines of 30 cents close to $1 were common, with new all-time lows the norm at several points. Some points traded as low as a dime.

Futures got off easy, with November sliding a relatively modest 5.3 cents to $2.906 and December giving up 2.9 cents to $3.132. November crude oil rose 41 cents to $48.24/bbl.

It wasn’t difficult to determine why buyers were on the sidelines. Weekend and Monday temperatures across major energy markets were expected to be right at moderate seasonal norms with load-killing rain thrown in as well. Boston, New York and Chicago were all expected to see ongoing rain along with seasonal temperatures. Boston’s Friday high of 59 degrees was expected to fall to 57 Saturday before making it back up to 65 on Monday, 2 degrees below the seasonal norm. New York City’s high on Friday of 61 was seen rising to 65 Saturday and making it to 72 by Monday, 2 degrees above normal. Chicago’s relatively toasty high Friday of 65 was expected to reach 67 on Saturday and 68 by Monday, 1 degree below normal.

In New England several points experienced declines approaching $1. Gas on Algonquin Citygate dropped 82 cents to $1.43, and deliveries to Iroquois Waddington shed 79 cents to $1.52. Gas on Tennessee Zone 6 200 L fell 70 cents to $1.34.

“Persistent downpours will raise the flood risk in part of the Mid-Atlantic into Friday night, while rain will spread over the rest of the northeastern United States into the weekend,” said AccuWeather.com’s Alex Sosnowski.

“While the cool and rainy weather into this weekend will have people reaching for jackets and sweaters, some may need to keep an eye on streets and basements for flooding. Highs will mainly range from the lower 60s F to the middle 70s into this weekend. However, the combination of wind, rain and other conditions will cause [wind chill] temperatures to be in the 40s and 50s at times.”

Numerous points set all-time low spot prices. Dominion South traded at 29 cents, down 37 cents and 30 cents below its all time low. Tennessee Zone 4 Marcellus changed hands at 32 cents, down 30 cents and 4 cents less than its all-time low. Gas on Tetco M-3 Delivery was seen at 37 cents, down 28 cents and 28 cents under its all-time low. Gas bound for New York City on Transco Zone 6 was quoted at 41 cents, down 28 cents and 28 cents below its all-time low.

Major market centers didn’t endure quite the devastation of Appalachia and the Northeast. Gas at the Chicago Citygate fell 19 cents to $2.67, and deliveries to the Henry Hub were seen 11 cents lower at $2.84. Gas on Panhandle Eastern changed hands at $2.60, down 8 cents, and Transwestern San Juan was seen at $2.57, down 11 cents. Deliveries to the SoCal Citygate shed 18 cents to $2.74.

In spite of the day’s broad retreat in physical and futures, analysts see limited downside. “With last year’s supply peak now appearing out of reach, the bearish impact of a large supply has been muted and we see significantly more upside risk than downside from current levels,” said Jim Ritterbusch of Ritterbusch and Associates in a Friday morning report to clients.

“And while physical pricing has declined seasonally this week, we believe that downside follow through will prove limited as non-weather related factors dampen additional spot price weakness. We continue to cite recent strength in the spread curve and although the November-December differential is showing some topping tendencies, we feel that the next major storm event into the GOM will strengthen gas structure in facilitating another upward price advance.”

Gas buyers across the MISO footprint having to purchase incremental supplies for power generation over the weekend aren’t expected to have a lot of wind generation to offset gas purchases. WSI Corp. in a Friday morning forecast said, “Surface low pressure associated with a broad upper-level low over the Ohio Valley will lead to variable cloud cover, widely scattered showers, breezy and cool conditions across eastern areas during the next couple of days. Otherwise, weak high pressure will promote fair weather.

“Temperatures will vary in the 60s, 70s and 80s, warmest across Entergy. High pressure will nose in behind this system during Sunday into early next week. This should result in partly sunny and a warming trend. High temps may rebound into the 70s and 80s. Relatively light wind generation is expected today into the weekend. Output is forecast to drop down to 2-5 GW. A developing southerly wind will cause wind gen to ramp up late Sunday into early next week. Output is forecast to top out 8-9+ GW late Tuesday.

In its 5 p.m. EDT Friday report the National Hurricane Center (NHC) said Hurricane Matthew was 465 miles southeast of Kingston, Jamaica and was heading to the west-southwest at 9 mph. Winds had increased to 140 mph, and NHC predicted that it would make a sharp turn northward toward the eastern end of Cuba when it reaches the western Caribbean.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |