Utica Shale | E&P | Marcellus | NGI All News Access | NGI The Weekly Gas Market Report

Rice Energy Plans to ‘Immediately’ Develop Vantage’s Marcellus Assets

Vantage Energy’s Barnett Shale assets are an afterthought for Rice Energy Inc., which said Tuesday it would acquire the company in a $2.7 billion deal. Rice’s top executive said the real “prize of the Vantage acquisition is its large block of core, contiguous Marcellus acres adjacent to our existing Greene County” assets in Pennsylvania.

CEO Daniel J. Rice noted the striking similarities between Rice Energy at the time it went public in 2014 to where Vantage’s business stands as Rice prepares to acquire it in a deal expected to close in the fourth quarter. The company sees growth for years to come, Rice said, strengthening its commitment to the Appalachian Basin’s dry gas core.

“Our two acreage positions fit well together…combining our two positions significantly increases the size and scale of our Appalachian leasehold by 65% and nearly doubles our location of Marcellus drilling locations,” Rice told analysts during a conference call on Tuesday to discuss the acquisition. “We plan to immediately begin developing these assets at a rate of 45 net wells per year.”

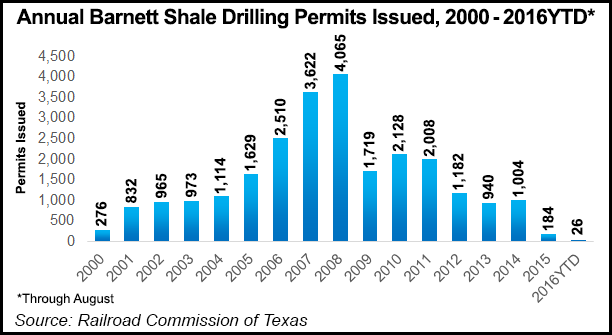

The assets being acquired from Vantage Energy LLC and Vantage Energy II LLC include 85,000 net Marcellus acres in Greene County, which also include 52,000 net acres that are prospective for the Utica (see Shale Daily, Sept. 26). Rice also agreed to take 37,000 net acres in the Barnett Shale located in Tarrant, Denton and Wise counties, TX. The properties produced 399 MMcfe/d in the second quarter. Rice said it would sell its master limited partnership, Rice Midstream Partners LP (RMP), Vantage’s 30 miles of natural gas gathering and compression assets in Pennsylvania for $600 million.

The Appalachian Basin accounted for 268 MMcfe/d of Vantage’s 2Q2016 production, while the Barnett produced 131 MMcfe/d, according to a prospectus the company filed earlier this month to go public before Rice announced it would buy it (see Shale Daily, Sept. 15).

“It’s certainly not a core focus for us,” Rice said of the Barnett on Tuesday. “It came with the fantastic asset base that we picked up in Appalachia. But Appalachia is really where we’re going to focus 99% of our time and energy to unlock the value there. The Barnett is a long-life production property — 97% held-by-production. So, we have plenty of time to figure out what we’re going to do with it.”

The deal would boost Rice’s position in the Appalachian Basin to 231,000 net acres and 1,164 drilling locations. It would be the largest leaseholder in Greene County, a mainstay of the Marcellus boom in years past and more recently a place where some operators have successfully tested the deeper Utica Shale.

Vantage’s midstream assets, which had 313 MMcfe/d of throughput in the first half of the year, would also increase RMP’s acreage dedication by 67% to 199,000 acres in Pennsylvania, which “opens the doors for potential new third party opportunities,” Rice said. The company has been actively leasing and developing the Marcellus in Greene County for eight years now. With the Vantage acquisition, its position has grown from about 92,000 net acres in Belmont County, OH, and Washington and Greene counties, PA, at the time it went public (see Shale Daily, Jan. 31, 2014).

Rice told analysts that the Vantage deal would make it easier to secure an additional 20,000-40,000 infill acres in Greene County. There are no options or tag along rights included in the purchase agreement. Vantage’s Marcellus properties are 100% operated.

“When we talk about the 20,000 to 40,000 acres, we’re talking about just infill organic acreage opportunities,” Rice said. “When you have 120,000 to 130,000 acres across Greene County like we do, there’s going to be a ton of these holes that really only make sense for us to pick up because we’re the only ones that can really drill it.”

Analysts said the Barnett portion of the deal simply added value for Rice. But they also said while there is upside in the Marcellus infill leasing opportunities, Rice is now more exposed to Northeast basis differentials, which have widened as storage reaches its peak ahead of the winter heating season that remains months away. Vantage, they said, also has limited takeaway capacity for its 72 producing Marcellus wells.

Rice management said it expects in-basin prices to firm in the long-run, pointing to the forward market and saying that as more infrastructure is built to get gas out of the region, local hubs will see a boost.

“This certainly doesn’t change the way we view what we do with our growing interruptible volumes going to the Appalachian markets,” Rice said. “For us, with firm transportation, it’s still the same economically. It has to be more competitive than producing locally into the Appalachian hubs, and if you just look at the forward curve, that strip for Dominion is improving pretty quickly over the next couple years as all these expansion projects come on.”

Proforma for the acquisition, Rice said 80% of its 2017 volumes are hedged locally. CFO Grayson Lisenby said the company would update its average gas price realizations later this year.

Englewood, CO-based Vantage had 63 employees at the end of last year, according to its prospectus. It’s unclear how the acquisition would affect the company’s personnel. Vantage, which is backed by three private equity firms, would get a seat on Rice Energy’s board when the deal is completed, Lisenby said.

“If you look at the further cost synergies between us, we haven’t fully quantified them yet, but I think it’s very reasonable to expect that we’re not going to need two heads of Appalachia, another set of completion engineers, drilling engineers and land folks to manage the same asset that we’ve been managing for the last few years,” Rice said. “I think you’ll see a step-change down in our [general and administrative] costs and our operating structure in the back half of 2017 and then you’re really going to see it come down in 2018 and beyond.”

Rice expects the new assets to increase its 2017 year-over-year production by 70% to 1.355 Bcfe/d at the high end. Its budget would also increase next year to $950 million to $1.125 billion from $735 million this year. The company, which is currently running three rigs, would add two rigs in 2017, including one on the newly acquired Marcellus acreage and another in the Ohio Utica.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |