Utica Shale | E&P | Infrastructure | Marcellus | NGI All News Access | NGI The Weekly Gas Market Report

DTE Energy to Purchase Two Appalachian Midstream Systems For $1.3B

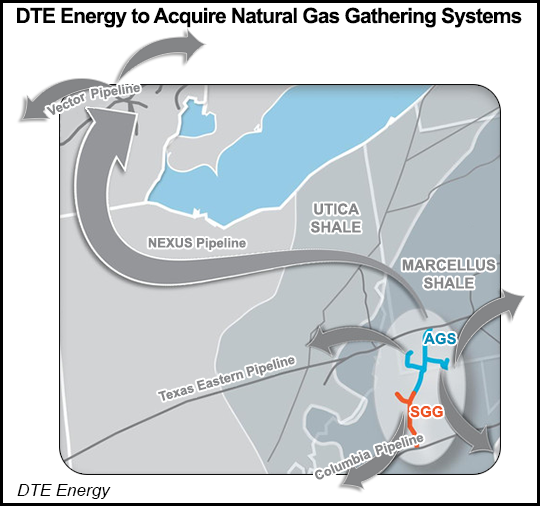

DTE Energy Co. said it has agreed to purchase two natural gas gathering systems in Pennsylvania and West Virginia for a combined $1.3 billion, adding to its midstream portfolio and expanding its presence into the southwest Marcellus and Utica shales.

In a statement Monday, the Detroit-based company said it will purchase 100% of the Appalachian Gathering System (AGS) and a 40% stake in the Stonewall Gas Gathering System (SGG) from M3 Appalachia Holdings LLC. DTE will purchase an additional 15% stake in SGG from Vega Energy Partners Ltd.

According to a slide presentation DTE filed Monday with the U.S. Securities and Exchange Commission (SEC), AGS is a 110-mile natural gas gathering system with a capacity of 0.7 Bcf/d. The system entered service in 2012 and 2013, and has pipe ranging from 16 to 24 inches in diameter. Information from M3 shows AGS gathers gas produced in West Virginia’s Harrison, Marion and Monongalia counties, and in Pennsylvania’s Greene and Washington counties.

Meanwhile, DTE’s slides show the 67-mile SGG, which is an expansion of AGS, has a capacity of up to 1.5 Bcf/d and is a 36-inch diameter system. Additional information from WGL Midstream, a unit of WGL Holdings Inc., shows SGG entered service in November 2015 and gathers natural gas produced in West Virginia — including Doddridge, Harrison and Lewis counties — and connects with the Columbia Gas Transmission (CGT) system. It delivers Marcellus Shale gas to mid-Atlantic markets.

DTE said the gathering systems will become part of its non-utility gas storage and pipeline business, which currently owns and manages a network of natural gas gathering, transmission and storage facilities serving the Midwest, Ontario and Northeast markets.

“These transactions will significantly increase our midstream presence in the Appalachian Basin,” said DTE CEO Gerry Anderson. “The acquired assets are in a productive area of the Southwest Marcellus/Utica region and have expansion potential. These acquisitions align with DTE’s existing strengths in managing natural gas midstream assets.”

COO Jerry Norcia added that the assets are “consistent with DTE’s growth plans. These two systems are complementary to our current asset portfolio and will provide synergies over time.”

Last February, WGL made an $89 million equity investment in SGG and acquired a 35% stake in the gathering system from Antero Resources Corp. (see Shale Daily, March 1). WGL’s purchase stemmed from a supply agreement with Antero. WGL added that its ownership of SGG would drop to 30% during fiscal year 2016 if other participants join the project as expected.

DTE’s slides list Antero and WGL as partners in SGG. Aside from the 55% stake DTE will hold after the deal closes, it was unclear how much would be held by Antero and WGL. Representatives from Antero and WGL could not be reached for comment Tuesday. Houston-based Vega declined to comment.

In an 8-K filing with the SEC, DTE said the acquisition is expected to be completed in October and will be subject to various customary closing conditions. The company said Wells Fargo Securities LLC served as its exclusive financial adviser, and that Wells Fargo Bank NA committed financing for the transaction.

DTE said the assets being acquired will provide access to multiple markets, including the Great Lakes, through interconnections with CGT, Texas Eastern Transmission and the 255-mile Nexus Pipeline, a project DTE is currently developing with Spectra Energy Corp.

The Nexus pipeline would move 1.5 Bcf/d of Marcellus and Utica shale gas from eastern Ohio into Michigan, connecting Appalachian gas to markets in the Midwest and Canada. It received a favorable draft environmental impact statement from the Federal Energy Regulatory Commission in July (see Shale Daily, July 11).

“Demand for natural gas in the Great Lakes region is expected to increase significantly, driven by coal-to-gas conversions for electricity generation and economic growth,” DTE said. “The low-cost natural gas supply from the Marcellus/Utica region is expected to serve this growth and displace higher-cost alternatives.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |