NGI Weekly Gas Price Index | Markets | NGI All News Access

Trading Places: Weekly NatGas Cash Up Nearly A Dime, But Futures Languish

The week’s natural gas trading was something of a role reversal from the week before with the physical market adding close to a dime, but spot futures eking out an advance of less than a penny. Last week natgas cash added a modest 2 cents to $2.63, but the futures raced higher by 15.1 cents to $2.948. For the week ending Sept. 23 the NGI Weekly Spot Gas Average rose 9 cents to $2.72, and October futures added a mere seven-tenths of a cent to $2.955 after briefly trading over $3.

The market point showing the week’s greatest gain was Tennessee Zone 5 200 L with a rise of 34 cents to average $2.64, and the biggest decline was made by Transco Zone 6 non New York South covering transactions from the Virginia Maryland border to York County, PA. That was a fall of 43 cents to $2.11.

Appalachia was the only region in the red with a loss of 10 cents to $1.25, and most regions scored gains well into double digits. The Northeast rose a penny to $2.16, but the Southeast added a nickel to $3.03 and South Louisiana added a dime to average $3.03.

East Texas was up by 12 cents to $3.03 and South Texas and the Midwest rose 13 cents to $3.04 and $3.02, respectively.

Both the Rocky Mountains and California rose 14 cents to $2.82 and $3.07, respectively and the Midcontinent topped the leader board with a 15-cent gain to average $2.90.

October futures improved seven-tenths of a cent to $2.955.

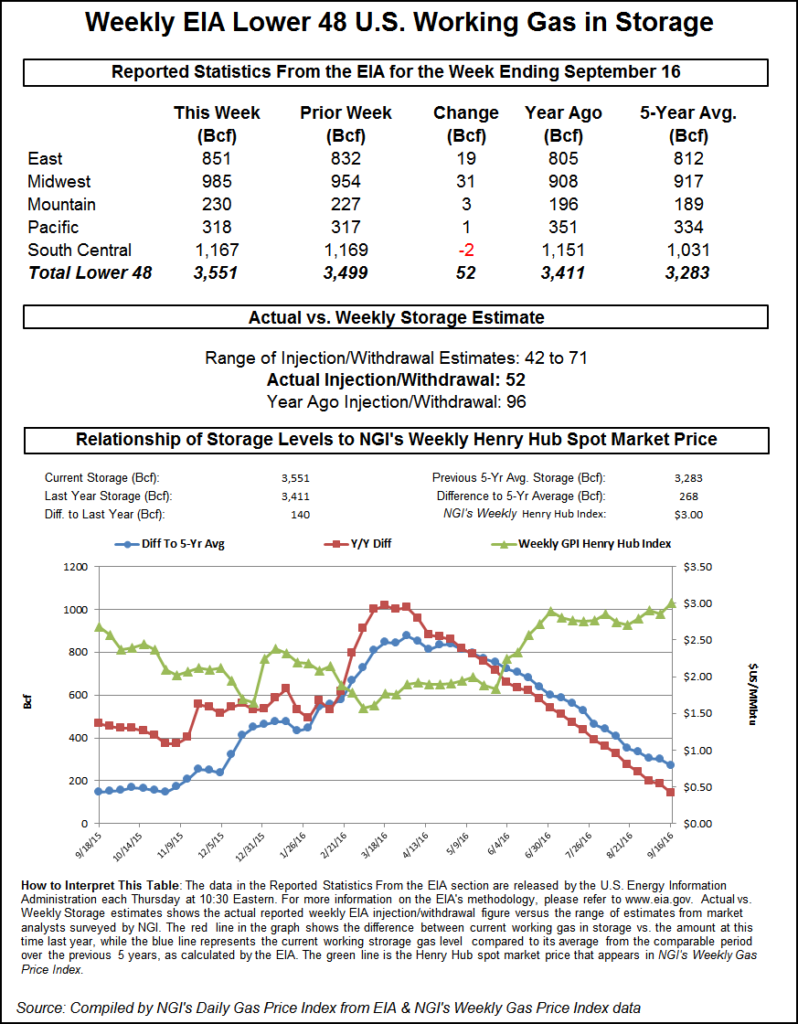

Thursday the market suffered a case of “What have you done for me lately” as the Energy Information Administration (EIA) reported an on-target storage figure of a 52 Bcf build for the week ending Sept. 16. It was not what the bulls were looking for and at the close on Thursday October had fallen 6.7 cents to $2.990 and November had dropped 7.1 cents to $3.061.

The day’s primary market driver was the EIA storage report and once the 52 Bcf figure hit trading desks October futures reached a low of $3.012 immediately after the figures were released and by 10:45 a.m. on Thursday October was trading at $3.026 down 3.1 cents from Wednesday’s settlement.

“We were hearing a 45 Bcf build,” said Alan Harry, director of trading at McNamara Options in New York before the figure was released.

“I think we are very overbought [and] $3.10-3.12 should be the next stop and then lower.”

“It surprised me because the number was pretty much on target. Not sure why the market took a free fall, said a New York floor trader.

“We are below the $3 level again, and now we are going to be looking at [support] $2.75 and $3 [resistance] although $3 is not such a big deal since we’ve been through it a couple of times. Maybe $3.10 would be better since we’ve been through $3 several times.”

Others were also uncertain why the market fell after the release of the data. “I wasn’t expecting that although every time we get above $3 it can’t seem to gather momentum to keep going,” said Steve Blair, vice president at Rafferty Commodities Group in New York.

“I don’t think it’s all attributable to coal-switching and even though we won’t have a glut of gas that will overflow storage capacity, we still have a lot of gas. I think the market has it in its head that we are coming to a close for the power generation sector of the market. I think the market fell under its own weight.”

Inventories now stand at 3,551 Bcf and are 140 Bcf greater than last year and 268 Bcf more than the five-year average. In the East Region 19 Bcf were injected and the Midwest Region saw inventories increase by 31 Bcf. Stocks in the Mountain Region rose 3 Bcf, and the Pacific Region was up by 1 Bcf. The South Central Region decreased 2 Bcf.

In Friday trading, three-day weekend physical natural gas deals were like a hot-potato that no one wanted to hold on to. A sharp turn to mild conditions by Monday sent prices plummeting with only a couple of points followed by NGI staying out of the loss column.

The NGI National Spot Gas Average tumbled 21 cents to $2.57 on Friday, and many points in the Marcellus and Northeast along Transco and Tetco set new all-time lows. Futures traders were preoccupied with the October contract and whether it could climb back above $3 after getting pummeled Thursday following on-target inventory data. October did trade above $3, but at the end of the day October had eased 3.5 cents to $2.955 and November had dropped 4.8 cents to $3.013.

By Monday temperatures across the nation’s midsection were forecast to be below normal. Forecaster Wunderground.com predicted that Chicago’s Friday high of 79 degrees would slide to 73 Saturday and drop further to 69 by Monday. The normal high in the Windy City is 73. Dallas’ Friday high of a sizzling 94 was predicted to fall to 92 Saturday but hit 78 on Monday, 7 degrees below normal.

Gas at the Chicago Citygates fell 11 cents to $2.95, and deliveries to the Henry Hub were quoted 10 cents lower as well to $3.04. Packages on El Paso Permian came in 7 cents lower at $2.83, and gas at the SoCal Citygate was flat at $3.05.

The real price carnage was reserved for Transco Zone 6 and Texas Eastern M-3, Delivery. Gas bound for New York City on Transco Zone 6 reached an all-time low of 77 cents, down 39 cents and well below the previous low of 88 cents reached March 11, 2016. Other Transco Zone 6 as well as Zone 5 points traded at historic lows as well, and Tetco M-3 Delivery took out its all-time low of 74 cents traded Dec. 22, 2015 when it reached 71 cents, down 45 cents from Thursday.

Marcellus points got hammered as well. Dominion South gas changed hands at 71 cents, down 43 cents, and gas on Tennessee Zn 4 Marcellus shed 40 cents to 67 cents. On Transco-Leidy Line weekend and Monday gas was quoted at 74 cents, down 41 cents.

A soft power environment didn’t help either. Intercontinental Exchange reported that Monday power at the PJM West delivery point fell $7.29 to $33.42/MWh and Monday peak power at the Indiana Hub dropped $5.73 to $38.85/MWh.

Futures trading was more sanguine on Friday. “The market closed well at $2.955,” said a New York floor trader. “At $2.955 the close is still good, and I think traders will pick it back up on Monday. On a pullback it should have traded down to $2.90 to $2.92, but even the low on the day is $2.933 so it set itself up to take another stab higher on Monday.”

Top traders see a rangebound market. “[Thursday’s] sizable 2.4% price decline in the face of a seemingly neutral EIA storage figure suggested some bearish adjustment to the short-term temperature views beyond next week,” said Jim Ritterbusch of Ritterbusch and Associates in closing comments.

“The supply hike of 52 Bcf was appreciably below our expectation but the counterintuitive price decline tended to reinforce our view that chasing this week’s price rally could prove hazardous. We were pushed to the sidelines earlier in the week at about current levels and, from here, we will expect some price consolidation largely within parameters of about $2.82-3.10.”

Enhancing the case for continued ample supplies, Friday Baker Hughes Inc. (BHI) reported continued additions to the rig fleet. Rigs continued to return to duty during the week ending Sept. 23, according to BHI data. Given drilling and completion efficiency gains, it will take fewer rigs than before to make for peak volume growth, an analyst cautioned.

Six U.S. land rigs returned to action for the week ending Sept. 23, according to BHI. The week saw only modest changes across plays and states, with no standouts.

With the departure of one U.S. rig from the inland waters, the overall U.S. count added five units to end at 511. Of these, 488 were land rigs. Two oil rigs came back, joined by three natural gas units. Eight horizontal units returned along with one directional, offset by the departure of four vertical units. Oklahoma and Texas led the state gainers with each adding two rigs.

Market technicians still see the uptrend intact as long as prices don’t fall about another 15 cents. “While the bears were able to generate a reversal from the critical $3.039-3.085-3.147 zone they were not able to take out any meaningful support levels,” said Brian LaRose, market technician at United ICAP in closing comments Thursday.

“To suggest a top is forming $2.882-2.830 will need to be broken. Only if the bears can make that happen will we have a case for a top being in place. And if the bears can not get the job done? Then the trend will remain up.”

Gas buyers tasked with procuring supplies for power generation over the weekend across the

PJM footprint may have to be on their toes as weather conditions are expected to change and provide little in the way of wind generation to offset power purchases. “Fair, unseasonably warm and moderately humid conditions are expected across the majority of the power pool [Friday],” said forecaster WSI Corp. in a Friday morning report to clients.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |