NGI The Weekly Gas Market Report | E&P

NatGas, Oil Rigs Return, Continuing Climb Back From Drilling Nadir

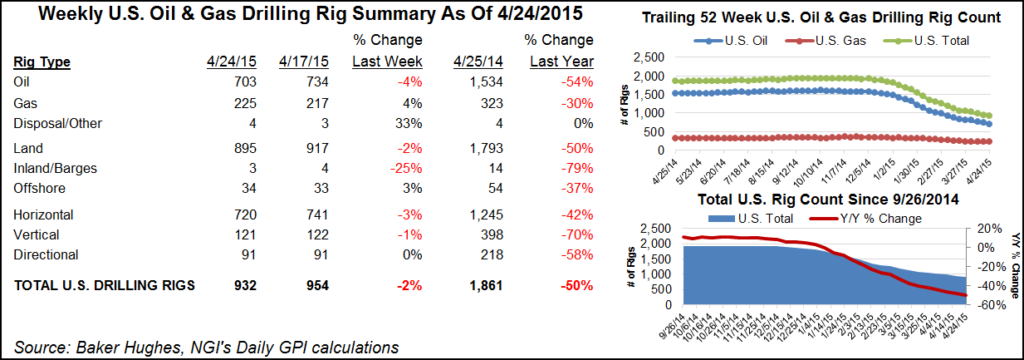

Rigs continued to return to duty during the week ending Sept. 23, according to Baker Hughes Inc. (BHI) data. Given drilling and completion efficiency gains, it will take fewer rigs than before to make for peak volume growth, an analyst cautioned.

Six U.S. land rigs returned to action for the week ending Sept. 23, according to BHI. The week saw only modest changes across plays and states, with no standouts.

With the departure of one U.S. rig from the inland waters, the overall U.S. count added five units to end at 511. Of these, 488 were land rigs. Two oil rigs came back, joined by three natural gas units. Eight horizontal units returned along with one directional, offset by the departure of four vertical units. Oklahoma and Texas led the state gainers with each adding two rigs.

Canada added six rigs to end at 138 running. Five natural gas rigs came back, along with two oil rigs, offset by the departure of one miscellaneous rig. North America’s net gain for the week was 11 rigs, bringing the total to 649.

In a note dated Sept. 16, Societe Generale’s Breanne Dougherty wrote that except for the Utica Shale (no change from the previous week with 15 rigs), every key shale play has seen its rig tallies fall below where they were in January 2010. The counts reached their nadir in May, though, she said.

“The count in key shales has increased every month since May, with over 70% of the rig count increase between May and August attributed to the Permian,” Dougherty wrote. “Marcellus is the only key shale play that has continued to drop rigs.” The Marcellus added one rig last week to end with 30 running, down from 49 a year ago.

Recent weeks of rig additions should not be seen as a “material shift” back to growth, she said. “There is a difference between adding a few rigs to maintain a production plateau/tilt, and adding a volume of rigs capable of shifting the supply base back onto a stable growth trajectory. It does though support the assumption that the producers feel the worst is behind them.

“It is important to keep in mind that a return to previous peak rig counts and drilling activity will not be required to deliver peak volume growth. The efficiency gains in shale oil production, in particular, since peak activity in 2014 have been impactful, and we believe at least a portion of them structural/sustainable. Producers are getting greater volume with fewer rigs.”

During the week the Railroad Commission of Texas (RRC) released preliminary production figures for July.

Preliminary production for July was 75.50 million bbl of crude oil and 611.03 Bcf of total gas from oil and gas wells. These early figures are based on production volumes reported by operators and will be updated as late and corrected production reports are received.

Production reported to the RRC for the same time period last year was: 76.15 million bbl of crude oil preliminarily, updated to a current figure of 91.06 million bbl; and 656.85 Bcf of total gas preliminarily, updated to a current figure of 750.08 Bcf.

In the last 12 months, total Texas reported production was 1.011 billion bbl of crude oil and 8.4 Tcf of total gas. Crude oil production reported by the RRC is limited to oil produced from oil leases and does not include condensate, which is reported separately.

Texas production in July 2016 came from 183,260 oil wells and 92,238 gas wells.

At week’s end, the Texas rig count stood at 246, down 117 units from a year ago.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 1532-1266 |