Shale Daily | E&P | NGI All News Access | NGI The Weekly Gas Market Report | Regulatory

NatGas, Oil Renaissance Bounty Ignored by Anti-Energy Groups, U.S. Chamber Says

The U.S. economy would be “much weaker” if the energy renaissance had not occurred, the U.S. Chamber of Commerce said in a report outlining the jobs and financial gains resulting from unconventional drilling. Researchers also highlighted some of the biggest benefactors: Ohio, Pennsylvania, Texas and Wisconsin.

The report, “What if America’s Energy Renaissance Had Not Actually Happened?” is the second in a series by the Chamber’s Institute for 21st Century Energy. Researchers compiled data from 2009 through 2015 to imagine the U.S. economy minus the plethora of oil and natural gas reserves uncovered in shale, sand and other formations now being tapped by hydraulic fracturing and horizontal drilling.

“The ‘Keep It in the Ground’ movement completely ignores the vast benefits to our nation’s economy that the energy renaissance has brought to us,” Institute CEO Karen Harbert said. “For instance, lower electricity and fuel prices spurred a comeback in manufacturing that alone is responsible for nearly 400,000 jobs. It costs consumers less to drive a car and heat their homes today. And all the while, our nation has been decreasing its energy imports and lowering emissions.”

Because of the energy renaissance, U.S. natural gas import levels have declined by 73%, while oil imports have fallen by 62%, the researchers said.

“As recently as a decade ago, 60% of the oil consumed in the United States came from foreign sources. Today, the country only imports 24% of its overall consumption. Natural gas import levels have also dropped from 16% to 3% during that same period.” Meanwhile, carbon dioxide (CO2) emissions have fallen by 19%.

“Natural gas has gradually replaced coal as the primary fuel choice for U.S. power generation. This shift has contributed to a net decrease of power-sector CO2 emissions of 19% over the past decade.”

Gas “has not only benefited residential consumers, it has also stimulated manufacturing activity,” the researchers said. “For example, the U.S. plastics industry has benefited from lower natural gas prices, since natural gas is used as both a fuel and natural gas liquids are the primary feedstock for plastics manufacturing…

“The recent plunge in natural gas commodity prices has shifted the competitive advantage back in favor of the United States. The industry has responded in kind with substantial investments to increase plastics production in this country. According to the American Chemistry Council, over the past five years the chemicals industry has announced plans for more than $130 billion in investment in new manufacturing capacity. In the next 10 years, these investments are expected to generate roughly 462,000 new jobs for American workers.”

Without the gains from the oil and gas industry, the United States would have lost an estimated 4.3 million jobs and $548 billion in annual gross domestic product (GDP), according to the report. Were it not for the growth and development of oil and natural gas, “today’s electricity prices would be 31% higher, and motor fuels would cost 43% more,” the researchers said.

Few jobs and “very little growth” also would have been realized in sectors beyond the energy industry, researchers argued in the 64-page report. Publicly available information on jobs and production levels were reviewed using the Impact Analysis for Planning, or IMPLAN, a macroeconomic model that estimates the economic and fiscal impacts of investments.

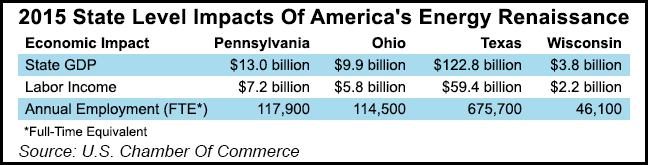

Expanded energy development has led to huge benefits for Ohio, Pennsylvania, Texas and Wisconsin, the Chamber said.

“Pennsylvania is now the second largest natural gas producing state in the country,” while “manufacturing remains the backbone” of Pennsylvania and Ohio economies, the report said.

“Texas was selected because it leads the nation in both oil and gas production. It also has a large manufacturing sector, including robust petrochemical and fuels manufacturing segments.” Wisconsin is not considered an oil and gas producer, but “its sand mines serve as an important supplier to service companies and operators that deploy hydraulic fracturing technology, and it has a large manufacturing base that has directly benefited from the lower energy and feedstock prices that have resulted from the energy revolution.”

Without the onshore energy gains, Pennsylvania over the period studied would have lost an estimated $13 billion in GDP while Ohio would have lost $10 billion in GDP. Texas would have lost more than 675,000 jobs, while Wisconsin’s job losses would have amounted to around 46,000.

“From Pennsylvania’s paper industry, to iron and steel in Ohio, to petrochemicals in Texas, to cheese manufacturing in Wisconsin, the energy renaissance has been responsible for the preservation and growth of industries across America,” Harbert said.

“This is not just about the oil and gas industry. This is about the investment that has taken place and would continue to take place in virtually every sector of the economy if we are able to take of advantage of our abundant, inexpensive energy supplies.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |