ExxonMobil’s Lack of Writedowns Reportedly Triggers Another Probe by New York AG

ExxonMobil Corp. has not written down the value of its natural gas and oil assets over the past year despite the dramatic plunge in commodity prices, leading New York Attorney General (AG) Eric Schneiderman to launch another investigation, according to reports.

Schneiderman already is embroiled in a wide-ranging probe into ExxonMobil’s potential misstatements to shareholders regarding how its operations may impact climate change (see Daily GPI, Nov. 6, 2015). New York’s Martin Act, passed in 1921, gives the AG extraordinary powers and discretion to investigate financial fraud, exceeding those given any regulator in any other U.S. state. ExxonMobil has been subpoenaed for financial records, emails and other documents dating back to the 1970s, and other state AGs have joined in the fray, along with politicians and conservation groups (see Daily GPI, Sept. 14).

The latest investigation, first reported by The Wall Street Journal on Friday, reportedly has New York’s top cop investigating why the No. 1 supermajor hasn’t written down the value of its assets because of low commodity prices while its peers, including Chevron Corp., have recorded billions in losses related to reserves impairments (see Daily GPI, July 29).

Schneiderman’s office had no comment about the investigation, which the Journal said relied on sources. ExxonMobil said the value of its assets follows U.S. Securities and Exchange Commission (SEC) protocol, and it it did not have to take any material charges.

ExxonMobil has reported a decline in profits for its U.S. upstream arm for six straight quarters. During the second quarter, the Irving, TX-based supermajor earned a total of $1.7 billion (41 cents/share), versus profits in the year-ago period of $4.18 billion ($1.00). However, it did not appear to report any asset impairments.

By contrast, No. 2 U.S. integrated producer Chevron recorded a $1.5 billion loss (minus 78 cents/share) in 2Q2015, with impairments and one-time charges totaling $2.8 billion. According to a study by Ernst & Young LLP, 44 of the 50 largest U.S. producers in 2015 recorded property impairments, including ceiling test charges, totaling $141.8 billion (see Shale Daily, June 14).

The SEC requires U.S. exploration and production companies to use the 12-month average trailing price for oil and natural gas to book the value of their reserves. The commission also mandates that proved undeveloped reserves, or PUDs, be developed within five years or be deleted from the reserves numbers.

ExxonMobil in 2015 added 1 billion boe to its proved reserves, about 67% of production, with natural gas reserves falling by 834 million boe to reflect lower prices (see Daily GPI, Feb. 19). Over the past 10 years, ExxonMobil has on average replaced about 115% of its reserves, including the impact of asset sales.

In its annual SEC Form 10-K filing for 2015 that was issued in February, ExxonMobil acknowledged that commodity prices were weak, but said management is assuming they will improve.

“In general, the corporation does not view temporarily low prices or margins as a trigger event for conducting impairment test,” ExxonMobil stated. Because of continued weakness in the upstream industry in late 2015, the corporation “undertook an effort to assess its major long-lived assets most at risk for potential impairment. The results of this assessment confirm the absence of a trigger event and indicate that the future undiscounted cash flows associated with these assets substantially exceed the carrying value of the assets.”

The assessment reflected crude and natural gas prices “that are generally consistent with the long-term price forecasts published by third-party industry experts,” it said. “Critical to the long-term recoverability of certain assets is the assumption that either by supply and demand changes, or due to general inflation, prices will rise in the future.”

If increases in long-term prices don’t materialize, some of the assets “will be at risk for impairment.” However, because of the inherent difficulty in predicting future commodity prices, and the relationship between industry prices and costs, “it is not practicable to reasonably estimate a range of potential future impairments related to the corporation’s long-lived assets.”

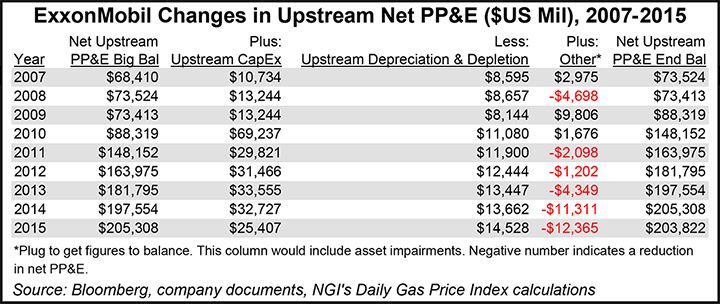

Based on a “back of the envelope analysis” of net property, plant and equipment (PP&E), ExxonMobil likely is writing down the value of some of its properties, according to NGI‘s Patrick Rau, director of strategy and research. If it isn’t writing down the value of its proved properties, “at the very least, weaker commodity prices likely have negatively impacted its upstream asset values.”

PP&E, tangible fixed assets that include land, buildings and vehicles, are expected to generate economic benefits for a business for longer than one year.

To reconcile year/year changes over several years, Rau used ExxonMobil’s reported net upstream PP&E from the beginning of a particular year, which includes proved reserves and equipment, then added to that figure the company’s upstream segment capital expenditures. He then subtracted the stated upstream depreciation and depletion. From there, Rau backed into “other” changes that would be required to bring year-end net upstream PP&E in-line with its beginning year figure.

“Three of the biggest negative ‘other’ changes for ExxonMobil came in 2008, 2014 and 2015 — the three years when crude oil prices saw major declines,” Rau said. “I seriously doubt that is a coincidence, and very likely represents that lower asset prices have indeed negatively impacted their upstream asset values, whether from direct asset impairments (and any such writeoffs may be to assets other than reserves) or something more indirect.”

ExxonMobil stated in its latest 10-K that an asset group would be impaired “if its undiscounted cash flows were less than the asset’s carrying value. Impairments are measured by the amount by which the carrying value exceeds fair value. Cash flow estimates for impairment testing exclude the effects of derivative instruments.”

In general, ExxonMobil doesn’t view “temporarily low prices or margins as a trigger event for conducting impairment tests. The markets for crude oil, natural gas and petroleum products have a history of significant price volatility…The relative growth/decline in supply versus demand will determine industry prices over the long term, and these cannot be accurately predicted.”

Some energy analysts have questioned why ExxonMobil hasn’t written down the value of its reserves. Jefferies LLC estimated that since the start of 2014, integrated oil companies have written down about $103 billion worth of assets. Wolfe Research senior analyst Paul Sankey said it was “impossible to believe that no assets have been impaired.”

However, Societe Generale’s John Herrlin said in a note about 75% of ExxonMobil’s reserves are from areas with producing wells, which means impairments would be less likely than in undeveloped basins. Oppenheimer & Co. analyst Fadel Gheit, who covers ExxonMobil, called the latest investigation a publicity stunt and said if anything, SEC’s guidelines should be reviewed.

“This issue is not new and happens when prices fall sharply, forcing companies to write-down reserves that are uneconomic at the low prevailing prices,” Gheit said in a note. “The SEC guidelines are not strict enough and have not been enforced. The SEC should issue clear reserve accounting guidelines and not leave it up to the companies to decide. Fault the SEC, not ExxonMobil.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |