Shale Daily | Haynesville Shale | Infrastructure | NGI All News Access | NGI The Weekly Gas Market Report

New Midstreamer Palmilla Begins Prospecting in Louisiana, East Texas

More players appear ready to take bets on U.S. onshore growth, as private equity-backed Palmilla Energy LLC becomes the latest to launch a venture that initially will prospect for midstream opportunity across the Haynesville Shale.

The newly formed Houston-based midstreamer, funded by Oaktree Capital Management LP, is led by Rich DiMichele, who was president of Halcon Resources Corp.’s midstream unit, Halcon Field Services LLC. He previously was president of the former Petrohawk Energy midstream unit, Hawk Field Services LLC, which became part of BHP Billiton Ltd. in 2011. At Hawk, DiMichele developed and operated scalable midstream systems in the Fayetteville, Haynesville and Eagle Ford shales.

“I’m excited about the prospects we’re seeing in our industry right now,” DiMichele said. “Alongside Oaktree’s expertise, we’ve put together a team at Palmilla that can capitalize on the opportunities the energy cycle currently presents. The key is to execute win-win deals for us and our customers. One of the things that differentiates us is that we’ve proven we can create tremendous value for stakeholders on both sides of the table.”

Initially, Palmilla is to manage the Wildcat Caddo system in northwestern Louisiana, which is owned by Highstar IV, a fund managed by Oaktree. The private equity’s infrastructure portfolio company Wildcat Midstream Holdings LLC, based in Dallas, owns a natural gas gathering, compression, processing and natural gas liquids transportation system in northwest Louisiana that serves the Haynesville Shale and the Cotton Valley formation.

Wildcat owns and operates 65 miles of gas gathering pipeline and a 40-mile NGL pipeline in Louisiana that runs from its Caddo natural gas processing facility in DeSoto Parish to the Black Lake Pipeline in Bienville Parish.

“Producers in northwest Louisiana seem to be increasing their activity, and we think that a recently constructed cryogenic processing plant and gathering system, in the core of the Cotton Valley, can add tremendous value to those producers,” said Palmilla Executive Vice President (EVP) Travis Boeker, who runs commercial and business development. “Having an unlevered asset with a strong financial partner in Oaktree creates the flexibility to enter into successful deals that work both right now and when gas and NGL prices recover.”

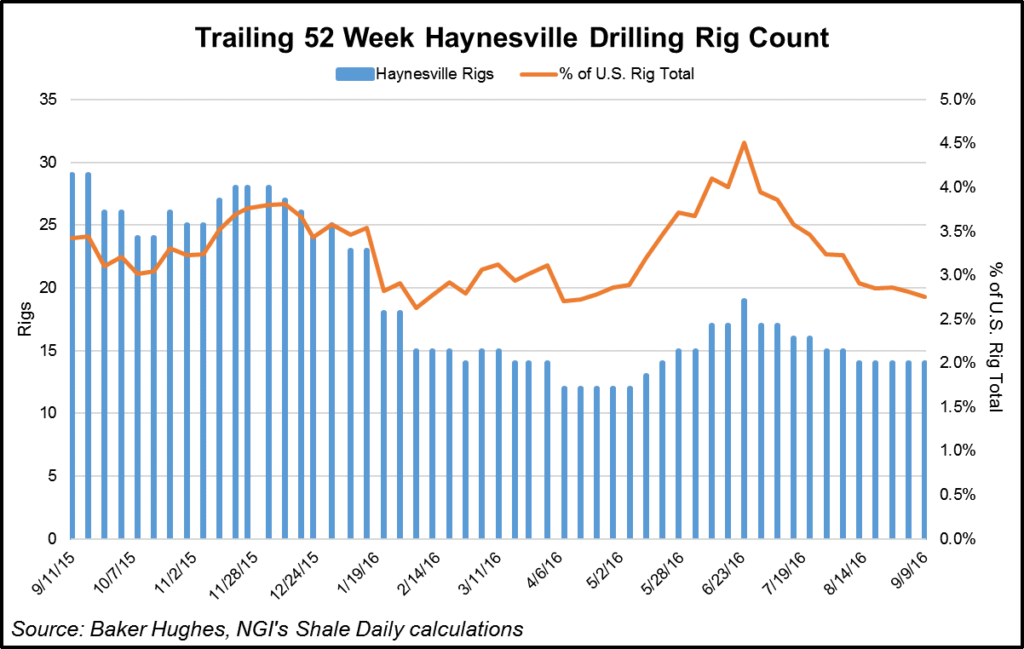

Chesapeake Energy Corp. of late has touted its natural gas drilling success in the Haynesville because of better completion technology. Last month, CEO Doug Lawler has referred to the higher proppant rates, which have resulted in impressive output, as “proppant-geddon” (see Shale Daily, Aug. 5). Louisiana had 43 active rigs working as of last Friday, with eight rigs added during the week, according to Baker Hughes Inc. (see Shale Daily, Sept. 9).

Other Palmilla executives include EVP Scott Grahmann, chief of accounting, finance and administration, and EVP David Wright, operations and construction. The combined management team has been involved in various developments, acquisitions, operations, turnarounds and divestitures.

The Palmilla team has a “strong history of experience and execution across a number of different opportunities in the midstream sector,” said Oaktree Managing Director Bret Budenbender. “We value their operational expertise and their customer-focused approach as a foundation to develop best-in-class midstream businesses throughout the U.S., with a particularly strong focus in Louisiana and East Texas.”

Oaktree’s energy investments also stretch deep and wide across the U.S. onshore.

Last week, Charger Shale Oil Co. LLC, formed only a few months ago, said it had secured up to $900 million from Oaktree to expand its Permian Basin footprint in West Texas (see Shale Daily, Sept. 8). The Midland, TX-based limited liability exploration company, whose focus is the Delaware sub-basin, received an initial commitment of $600 million from Oaktree with a $300 million runway commitment.

Oaktree’s infrastructure investments also include NorthStar Terminals, which was formed to develop, build and operate midstream energy assets in North America, with a particular focus on emerging opportunities in the transportation sector for shifting vehicles, trains and marine vessels from diesel fuel to liquefied natural gas.

Another investment, NorthStar Transloading LLC, is a rail transloading terminal in the heart of the Bakken Shale in McKenzie County, ND. Oaktree also is backing Linden Cogen Holdings, a 942 MW natural gas-fired cogeneration plant in Linden, NJ, as well as the 674 MW New Salem Harbor Station, another gas-fired power plant, near Boston.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |