NGI The Weekly Gas Market Report | M&A | Markets | NGI All News Access

Fertilizer Giants Agrium, PotashCorp Announce $36B Merger

Two Canadian giants in the agriculture business, Agrium Inc. and Potash Corp. of Saskatchewan Inc. (PotashCorp), on Monday announced plans to merge and become the world’s largest producer of fertilizer, in an all-stock deal valued at $36 billion.

If approved, the combined company would be the third-largest natural resource company in Canada, after oil and natural gas producers Suncor Energy Inc. and Canadian Natural Resources Ltd.

According to a presentation outlining the proposed merger, PotashCorp shareholders would receive a 52% stake in the new company, which has not yet been given a name, by receiving 0.4 shares in the new company for each share of PotashCorp. Meanwhile, Agrium shareholders would receive the remaining 48% stake, receiving 2.23 shares in the new company for each share of Agrium.

Upon consulting FERC Form 552 data, NGI found that PotashCorp. bought 73.6 TBtus, or 200 MMcf/d of natural gas in the United States during 2015, which ranks them as the 137th largest gas buyer. Agrium has no 552 data.

Todd Coakwell, Agrium’s director for investor relations, told NGI that Agrium purchased 118 Bcf of natural gas last year to produce fertilizer. Agrium spokesman Richard Downey added that about 85% of the natural gas was purchased from Canadian sources.

The proposed merger is contingent upon a favorable vote of two-thirds of each company’s shareholders. The merger is expected to be completed in mid-2017.

“This is a transformational merger that creates benefits and growth opportunities that neither company could achieve alone,” said Agrium CEO Chuck Magro. “Combining our complementary assets will enable us to serve our customers more efficiently, deliver significant operating synergies and improve our cash flows to provide capital returns and invest in growth.”

PotashCorp CEO Jochen Tilk added that the merger “reflects our shared commitment to creating value and unlocking growth potential for shareholders. The integrated platform established through our combination will greatly benefit customers and suppliers, and support even greater career development opportunities for employees.”

The proposed merger calls for equal representation of both companies on the new board of directors. Magro would serve as CEO, while Tilk would be executive chairman and hold responsibility for business strategy. PotashCorp CFO Wayne Brownlee would become CFO, with Agrium CFO Steve Douglas as the chief information officer. Corporate offices would be in Calgary and Saskatoon, SK.

Calgary-based Agrium and Saskatoon-based PotashCorp expect to save $500 million in annual cost synergies and create up to $5 billion in shareholder value during the first two years as a combined company. The merger would create the world’s largest publically traded fertilizer manufacturer, ahead of Mosaic Co. and CF Industries Holdings Inc., both of which are based in the United States.

Assuming the expected synergies are realized, the new company would also have an enterprise value of $41 billion, revenue of $20.6 billion and operating cash flow of $4.4 billion. It would also hold about $9.8 billion in net debt. The presentation indicated that the new company expects to maintain Agrium’s current dividend of 3.9%. By comparison, PotashCorp currently pays a 2.5% dividend.

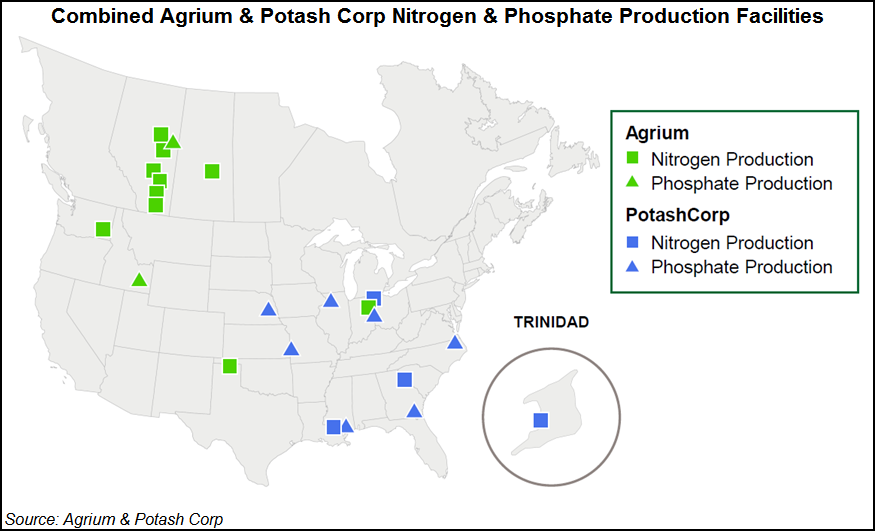

PotashCorp is currently the world’s largest producer of potash and the third-largest producer of nitrogen and phosphate, three of the main ingredients to produce fertilizer. The combined company is expected to have total potash nameplate capacity of 19.1 million tonnes, with 16.1 coming from PotashCorp and the remainder coming from Agrium.

A bounty of natural gas in North America, much of it the result of the shale revolution, has led to the construction of new or expanded fertilizer plants. In 2014, AM Agrigen Industries LLC and Indian Farmers Fertilizer Cooperative Ltd. announced plans for plants in Louisiana and Quebec, respectively (see Daily GPI, May 21, 2014; April 21, 2014). Agrium saw its earnings more than quadruple in 1Q2015, thanks in large part to low natural gas prices (see Daily GPI, May 6, 2015).

But last year, CHS Inc., an agricultural cooperative conglomerate based in St. Paul, MN, dropped plans to develop a major natural gas-based fertilizer plant in North Dakota (see Shale Daily, Aug. 17, 2015).

Last week, the Energy Information Administration said natural gas consumption in the industrial sector is expected to increase by 2.3% this year and by 1.0% next year, as new fertilizer and chemical projects come online (see Daily GPI, Sept. 7). But last February, analysts with Raymond James & Associates Inc. said U.S. industrial demand had failed to match expectations and lagged far behind supply growth, which in turn would keep natural gas prices low (see Daily GPI, Feb. 22).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |