NatGas Cash, Futures Part Company as October Slides to Sub-$2.70

Natural gas for delivery Thursday bounded higher led by Herculean gains in New England and the Mid-Atlantic, but most other market points traded only a penny or two higher, while the NGI National Spot Gas Average gained 5 cents to to $2.63.

Forecasts of warmer temperatures and a supportive power market were all that was necessary to bring Northeast buyers to attention, but major market centers struggled to keep their heads above water.

Futures could have used some help on Wednesday as well, and at the close, October had dropped 4.1 cents to $2.676 and November was down 3.1 cents to $2.811. October crude oil added 67 cents to $45.50/bbl.

Natural gas traders might do well to follow crude oil going forward.

“Natural gas has been following the rest of the petroleum complex around like a lost puppy since the infamous OPEC meeting of 2014,” said United ICAP technical analyst Brian LaRose. “There will be some delay, but overall I think natural gas trends in the same direction.”

Overlaying line charts of crude oil and natural gas futures over the last year shows a significant correlation, and “this looks more like a displaced moving average, and I think natural gas will continue to track WTI to some extent, unless that correlation can be jarred loose.

“Until we see a catalyst that is related just to natural gas to jar the markets apart, I am hesitant to come up with a trend for natural gas that is counter to the rest of the petroleum complex,” said LaRose.

Hurricane Hermine turned into a “nonevent, although we have some hot days coming in, weather is starting to calm down,” said a New York floor trader. “All those factors are starting to put some weight on the market and longs are starting to get out. You still have room down to the low to mid $2.50s, and there is a good chance the run to the upside is done.”

Those hot days to come are still registering in the physical market. From Boston to New York forecasts of warm temperatures had buyers working the phones.

Forecaster Wunderground.com predicted Wednesday’s high in New York City of 84 would reach 90 by Thursday and 93 on Friday, 15 degrees above normal. Boston’s high of 76 on Wednesday was seen rising to 78 Thursday and to 90 by Friday, also 15 degrees above normal.

Gas at the Algonquin Citygate lost no time climbing higher. Thursday deliveries were quoted 72 cents higher at $3.66, and packages at Iroquois, Waddington gained 13 cents to $3.07. Gas on Tenn Zone 6 200L rose 65 cents to $3.56.

Mid-Atlantic pricing gained as well as next-day power quotes scored double-digit gains. Intercontinental Exchange reported that on-peak power Thursday at the ISO New England’s Massachusetts Hub surged $10.29 to $48.15/MWh, and deliveries of on-peak power at the New York ISO’s Zone A delivery point (western New York) rose a stout $10.40 to $59.40/MWh. On-peak Thursday power at the PJM West terminal added $3.77 to $52.08/MWh.

Gas on Transco Zone 6 NY rose 67 cents to $2.83, and packages on Transco Zone 6 non-NY North to Trenton, southeasternmost Pennsylvania, and southern New Jersey jumped 64 cents to $2.85.

Other market centers struggled to break even. Gas at the Chicago Citygate was unchanged at $2.81, and deliveries to the Henry Hub were also flat at $2.82. Kern Receipts fell 4 cents to $2.56, and gas priced at the SoCal Citygate fell 12 cents to $2.78.

Forecasters aren’t letting up in their expectations for continued above-normal warmth in major markets.

“We continue to track some impressive late-season heat for the Eastern Seaboard over the coming days,” to the mid-90s in the Middle Atlantic and threats of upper 90s from Washington, DC, to Richmond, VA on Thursday and Saturday, said Commodity Weather Group President Matt Rogers in a Wednesday morning note to clients.

“Humidity levels are unusually strong for post-Labor Day weather, too, with dew points around 70 during much of the peak heat. This fades away next week, but we still get some quick swipes at the lower 90s in the Middle Atlantic toward middle of next week.”

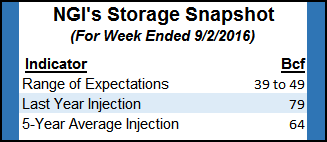

Checking in on the natural gas storage situation, Tim Evans of Citi Futures Perspective is expecting a 48 Bcf storage build in Thursday’s Energy Information Administration (EIA) inventory report for the week ending Sept. 2, well below last year’s robust build of 79 Bcf and five-year mean of a 64 Bcf build.

“From what we’ve seen so far, our estimate of 48 Bcf in net injections for the week ended Sept. 2 is on the upper end of early range of forecasts, with the consensus running closer to 40-45 Bcf, Evans said. Production shut in because of Hermine “may account for some of the difference as we are not making any explicit adjustment to our figures given that even the peak outage of 360 MMcf/d for Aug. 31 was inside where the normal margin for error for the U.S. supply-demand balance, in our view.

“In the current market, for example, we see potential for a seasonal decline as the rate of storage injections picks up again and storage approaches its peak for the year,” Evans said. “We also see the market’s current valuation at a premium over the 2015 price as difficult to sustain at a time when last week’s storage total was still 238 Bcf (7.5%) higher than a year ago.”

Stephen Smith Energy Associates is calculating a 47 Bcf build, and IAF Advisors is looking for a 41 Bcf injection.

Evans said he entered the market on the short side Tuesday with a stop at $2.74 in the October contract. “We recommend working a protective buy stop at $2.94 to limit the initial risk. Our profit objective is $2.44.”

For the week ending Friday (Sept. 10) the National Weather Service (NWS) is calling for well above normal cooling degree days (CDD) in major energy markets. New England is expected to endure 44 CDD, 35 above normal, and the Mid-Atlantic is forecast to swelter under 58 CDD, or 37 above normal. The greater Midwest from Ohio to Wisconsin is seen baking under 66 CDD, or 45 more than its normal seasonal tally.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |