Shale Daily | E&P | NGI The Weekly Gas Market Report

NatGas Rigs Return Among Shale Play Production Declines

This is likely to be the first year since the dawn of the shale era that doesn’t show year-over-year natural gas production growth, Societe Generale analyst Breanne Dougherty said in note late last month.

She cited monthly U.S. Energy Information Administration (EIA) Drilling Productivity Report data (see Shale Daily, Aug. 15) and said, “Even accounting for the slight uptick that has been seen over the last few weeks, which we expect will be attributed to the Marcellus region in future EIA reports, 2016 is very likely to be the first year since the rise of shale to not show year-on-year production growth.”

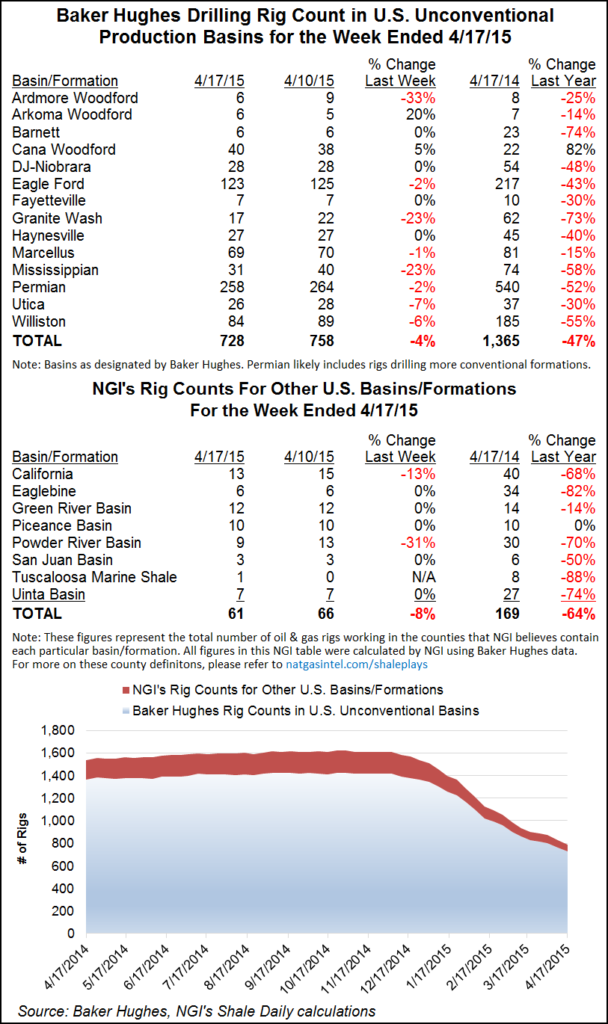

However, the latest rig count data from Baker Hughes Inc. (BHI) shows natural gas rigs making a comeback. In a flip from previous weeks, it was natural gas-directed rigs that returned to action in the United States. Seven gas rigs came back, joined by just one oil-directed unit. At week’s end, there were 407 oil rigs running along with 88 natural gas units.

Fourteen U.S. land-based rigs returned to play during the week ending Sept. 2, according to BHI. Gains were tempered, though, by the departure of seven offshore rigs, offset by one returning to the inland waters.

That’s a turnabout from the previous week when two rigs left land operations (see Shale Daily, Aug 26).

The United States ended the week with 497 rigs running, with 482 of these on land, representing a net gain of eight overall. The Gulf of Mexico dropped to only 10 rigs running after seven were lost. That’s less than one-third of the year-ago tally of 31.

Horizontals were in high demand, adding 16 to their ranks of operating units. That was offset by the departure of six directional units and two verticals. The majority of rigs running are horizontals with 395 units represented.

Canada saw a decline of nine rigs (seven oil and two gas).

In a Tuesday note, Cowen And Company analysts said they see the BHI land rig count on track for a 14% increase during the third quarter, assuming flat from the Aug. 30 level. There is a risk, though, that rig count gains flatten or even reverse in the weeks and months ahead as 75% of rig additions have come from private company operations, “which can be highly seasonal.” However, that note was published before the latest count showing the gain of 14 land units.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1266 | ISSN © 2158-8023 |