Bearish Storage News, Holiday Drag Down NatGas Forwards

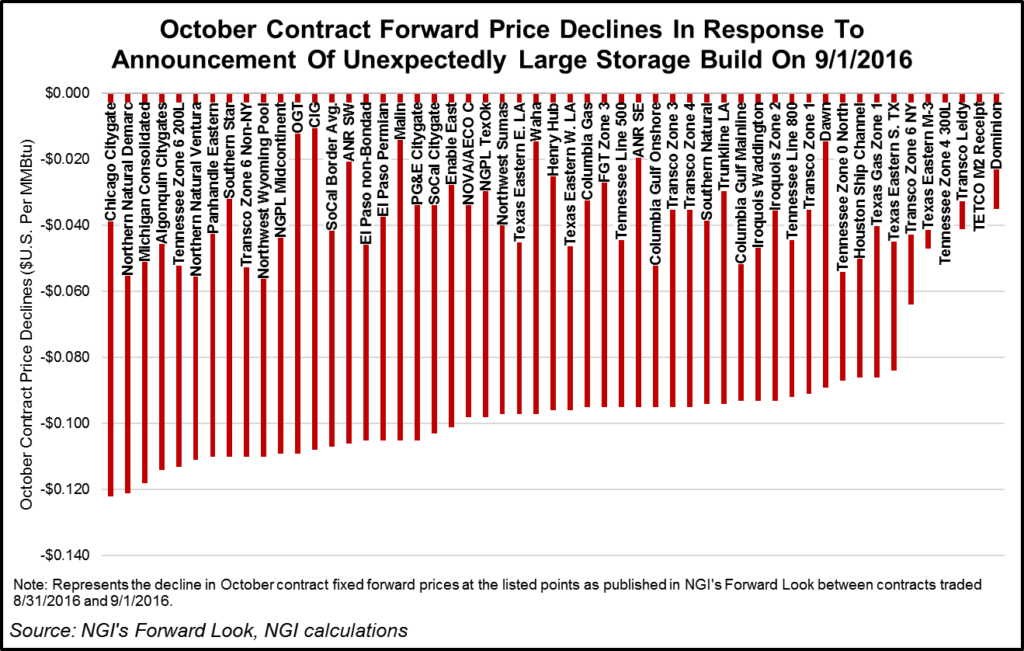

September got off to a decidedly bearish start as a much larger-than-expected natural gas storage injection and the upcoming holiday weekend combined to pull natural gas forwards markets down by an average of more than 10 cents between Aug. 26 and Sept. 1, according to NGI’s Forward Look.

The week leading up to Thursday’s storage report was rather volatile as bidweek, tropical storm activity and near-term forecasts for milder weather in key demand regions kept the front of the curve active.

Thursday’s action, a 9.5-cent decline in the Nymex October futures contract, was more telling after news of a much larger-than-expected storage report. The U.S. Energy Information Administration (EIA) reported a 51 Bcf build to natural gas storage inventories for the week ending Aug. 26, well above market estimates in the low to mid-40 Bcf range.

The injection reduced the surplus versus last year to 238 Bcf and the surplus versus the five-year average levels to 334 Bcf.

“Obviously, this is a very loose number week over week, with potentially important implications for the medium term since CDDs were not as strong, but with a fairly impressive jump in build size,” said NatGasWeather’s Andrea Paltrinieri. “I view this as implying higher risk for more robust injections in September/early October should supply-demand balances remain unchanged,” he said.

But data and analytics company Genscape said any time a stat is completely outside the range of published estimates, the possibility of an error needs to be considered. As per EIA, “Possible [EIA] survey errors in estimates published in the WNGSR may include sampling error, coverage error, nonresponse error, adjustment error, measurement error, and processing error.”

Compared to degree days and seasonality, a +51 Bcf injection is tight by 1 Bcf/d, Genscape said. “While this is still tighter than the five-year average, it is the loosest stat we have seen since May. We were at the upper end of the range of estimates this week, possibly due to the market missing a greater than 8 AGWh week/week rise in wind generation.” This pushed gas burn down by as much as 1.6 Bcf/d, according to the Louisville, KY-based company.

“Additionally, we have seen some supply growth from ethane rejection, as ethane frac spreads have been negative since the end of July,” Genscape said.

The Nymex October futures contract, which took over the prompt-month position on Tuesday, plunged 12.1 cents between Aug. 26 and Sept. 1 to $2.792. On a national level, October forward prices tumbled 12.3 cents on average during that time, while November forward prices dropped 14 cents, Forward Look data shows.

Meanwhile, demand centers in the Southeast saw cooler temperatures in recent days as Hermine made its way into the Gulf of Mexico. Hurricane Hermine, a category 1 storm, made landfall along the eastern coast of Florida early Friday, wiping out power to more than 170,000 customers and causing severe flooding in the state.

Power burn in Florida has averaged 4 Bcf/d so far in August, but Hermine could wipe out natural gas consumption by 0.5 Bcf/d or more, according to analysts with Mobius Risk Group.

Ahead of the storm, 10 platforms and 1 rig were evacuated, but based on data from offshore operator reports submitted to the Bureau of Safety and Environmental Enforcement (BSEE) through 11:30 a.m. CDT Friday, there were no remaining evacuated production platforms in the GOM. only three DP rigs were still reported as off-location Friday, compared to five on Wednesday, Genscape said.

Total natural gas shut-in Thursday had been estimated to be about 430 MMcf/d, around 9% of current production, compared to about 462 MMcf/d shut-in on Aug. 30. Total oil shut-in was estimated about 243 Mbopd, around 15% of current production, compared to about 353 mbopd Aug. 30.

Hermine was the first hurricane to hit the Sunshine State in 11 years, since Wilma in 2005. Although the storm was downgraded to a tropical storm shortly after landfall, it was expected to hit coastal areas of the mid-Atlantic with rough surf, heavy rain, gusty winds and cooler temps during Labor Day weekend, according to AccuWeather forecasters.

A swath of heavy rain and gusty winds was expected to advance northeastward over coastal sections of North Carolina, Virginia, Maryland, Pennsylvania and New York as well as much of Delaware and New Jersey over the weekend. A push of rain and wind into southern New England may follow late in the weekend or next week, AccuWeather said.

“Gusts between 60 and 75 mph are possible from the central New Jersey coast to the southern tip of Delmarva,” according to AccuWeather Senior Meteorologist Dave Dombek.

Hermine is likely to stall near the mid-Atlantic and southern New England coasts, causing adverse conditions for days regardless of its official classification of a tropical versus non-tropical storm. While the storm is likely to lose tropical characteristics in mid-Atlantic waters, it could maintain tropical storm strength and act like a slow-moving, powerful nor’easter, AccuWeather said.

As for temperatures, the storm was expected to cap daytime temperatures along the East Coast to the 70s and low 80s for the next few days.

Despite the cooldown expected in major demand regions in the next few days, NGI’s Patrick Rau, director of strategy and research, said it would likely take a sustained reduction in gas-fired power demand to impact natural gas storage by any meaningful amount. For example, Florida burned roughly 118 Bcf of gas during September 2015.

“If Hermine causes a 5% reduction in that figure for September 2016, that’s an impact of just 6 Bcf of gas,” Rau said. “There is currently 3,401 Bcf of working gas in storage in the Lower 48 U.S. Such a small reduction in Florida-related demand would be barely a blip on the radar.” And temperatures aren’t expected to remain cool for long. Forecasters with NatGasWeather say a rapid warm-up is expected shortly after the effects of Hermine subside.

“This very warm U.S. pattern is expected to hold through next weekend (Sept. 10-11) as strong high pressure dominates,” NatGasWeather said. “However, it remains likely cooler temperatures will arrive across the northern and eastern U.S. around Sept. 12as weather systems over southern Canada push more aggressively across the border.”

The cooler forecasts certainly hit the Northeast markets hard.

At New England’s Algonquin Gas Transmission citygates, October forward prices fell 17.9 cents between Aug. 26 and Sept. 1 to reach $2.62. This is well above the national average decline of 12 cents.

Steeper losses were seen further out the curve. AGT November plunged 34 cents from Aug. 26 to Sept. 1 to reach $3.10, while the prompt winter dropped 41 cents to $5.76, Forward Look data shows. By comparison, forward prices fell an average 14 cents for November and 13 cents for the prompt winter.

At Transco zone 6-non New York, a new point recently added to NGI’s Forward Look product, October fell 22.1 cents between Aug. 26 and Sept. 1 to reach $1.45. November slid 19 cents to $2.51, and the prompt winter dropped 27 cents to $4.64.

At Transco zone 6-NY, October was down 19 cents during that time to $1.48, November was down 17 cents to $2.68 and the prompt winter was down 30 cents to $5.95.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9915 | ISSN © 2577-9877 |