NatGas Cash Down, But Futures Add 6 Cents Amidst GOM Shut-Ins

Financial and physical natural gas moved in opposite directions in Wednesday’s trading for Thursday deliveries. Few points made it to the plus side of the trading ledger, and most locations were off by a nickel or more.

Moderating temperature trends along the Eastern Seaboard, along with soft power prices, forced Northeast prices into double-digit losses, and the NGI National Spot Gas Average fell 8 cents to $2.63.

Futures were able to recover most of Tuesday’s 7-cent setback, and at the close October had gained 6.0 cents to $2.887, and November had risen 5.4 cents to $3.003. October crude oil continued to struggle posting its third straight loss for the week with a drop of $1.65 to $44.70/bbl.

Eastern prices softened as temperatures were forecast to trend to the mild side. AccuWeather.com predicted that Wednesday’s high in Boston of 84 would slide to 79 Thursday and to 75 Friday, 2 degrees below normal. New York City’s Wednesday peak of 86 was expected to fall, along with rain, to 79 Thursday and Friday. The normal high in New York this time of year is 80.

Gas at the Algonquin Citygate tumbled 34 cents to $2.84, and deliveries to Iroquois, Waddington fell 13 cents to $2.96. Gas on Tenn Zone 6 200L shed 33 cents to $2.79.

Gas on Transco Zone 6 NY dropped a stout 35 cents to $1.39, and packages on Texas Eastern M-3, Delivery were off 12 cents to $1.27.

Weak power prices also left their imprint. Intercontinental Exchange reported on-peak power at the ISO New England’s Massachusetts Hub fell $8.88 to $31.50/MWh, and on-peak deliveries to the PJM West terminal skidded $5.90 to $29.82/MWh.

California next-day gas also fell victim to a weak power environment. Intercontinental Exchange reported next-day power at NP-15 retreated $3.71 to $35.71/MWh, and megawatts at SP-15 skidded $3.44 to $35.50/MWh.

Gas on PG&E shed 6 cents to $3.37, and gas at the SoCal Citygate was off 10 cents to $2.98. Packages priced at the SoCal Border Avg. changed hands 13 cents lower at $2.84, and Kern Delivery came in at $2.84, down 18 cents.

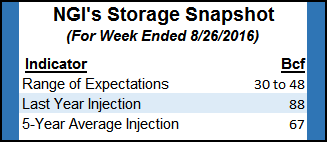

Thursday’s Energy Information Administration storage report should enable traders to fine-tune their season-ending inventory estimate, but storage builds continue to come in far less than historical averages. Last year a stout 88 Bcf was injected, and the five-year pace is 67 Bcf. Ritterbusch and Associates is looking for a 30 Bcf build and IAF Advisors calculated an injection of 45 Bcf. A Reuters survey of 18 traders and analysts revealed an average 41 Bcf with a range of 30 Bcf to 48 Bcf.

Wednesday’s advance has some traders skeptical the market can breach $3.00, but Tuesday’s decline had more to do with trader dynamics than fundamental factors. According to Tim Evans at Citi Futures Perspective, the 7-cent decline was prompted by “profit taking after prices failed to clear Friday’s high. A slightly cooler 11-15 day temperature forecast may have encouraged selling, although we note that 346 MMcf/d of natural gas production from the Gulf of Mexico (GOM) was shut in as a precaution due to Tropical Depression No. 9, nearly double Monday’s outage.”

The tropical storms affecting the GOM and East Coast may not seem like much, but gas production is getting shut in nonetheless. Industry consultant Genscape Inc. calculated that about 190 MMcf/d of Gulf of Mexico production has been shut in because of the approaching tropical weather systems.

Offshore operators evacuated platforms and rigs in the path of upgraded Tropical Depression (TD) 9, renamed Tropical Storm Hermine. The National Oceanic Atmospheric Administration said the storm system was becoming more organized as it issued tropical storm and hurricane watches for areas of the GOM. The system was moving northwestward and was forecast to hit the northwestern Florida coast by Thursday.

“Personnel have been evacuated from six production platforms, and a total of five DP rigs have moved off location out of the storm’s path as a precaution,” the Department of Interior’s Bureau of Safety and Environmental Enforcement (BSEE) said in a Wednesday morning report.

The National Hurricane Center (NHC) reported that TD 8 was heading along the North Carolina coast. The storm was 75 miles east-southeast of Cape Hatteras and continued to hold 35 mph winds, heading northeast at 5 mph. NHC said no coastal watches were in effect, but it could become a tropical storm later Wednesday.

Hermine now presents the clearer threat, situated 420 miles west-southwest of Tampa, FL, with 35 mph winds. It was moving to the north at 2 mph. Tropical storm warnings were in effect for portions of coastal Florida.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |