Regulatory | M&A | NGI All News Access | NGI The Weekly Gas Market Report

Duke-Piedmont Deal Nears Final Regulatory Approval

The proposed Duke Energy Corp.-Piedmont Natural Gas Inc. tie-up is nearing final regulatory approval in North Carolina after the companies and the state’s consumer advocate agency, the Public Staff, submitted a proposed order last week approving the transaction.

The next step will be for the North Carolina Utilities Commission to review and rule on the proposed order, which would clear the way for the two Charlotte, NC-based utilities to complete their merger.

“This is another key step forward for the merger,” said Duke spokesman Dave Scanzoni, who noted that approval in North Carolina represents the last major procedural hurdle for the Duke-Piedmont tie-up. The deal has already received approval from the Federal Trade Commission, Tennessee regulators and Piedmont’s shareholders, he said.

Duke is still looking to close the acquisition on or before the end of 2016, Scanzoni said.

Last October, Duke announced its plans to pay out $4.9 billion to acquire neighboring Piedmont, a move that would give Duke “a growing natural gas platform” (see Daily GPI, Oct. 26, 2015).

Under the deal, Piedmont would retain its name but become a wholly-owned subsidiary of Duke.

Duke CEO Lynn Good has pointed to the growing role of gas in the power stack as a benefit of acquiring Piedmont, though analysts have had their doubts about the synergy of the utilities’ respective operations (see Daily GPI, March 22).

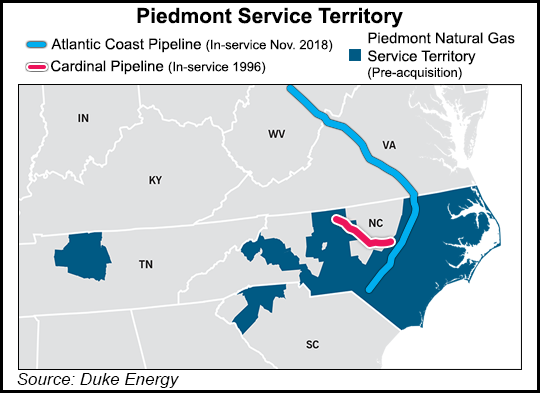

Duke and Piedmont are both joint venture partners in the Atlantic Coast Pipeline LLC, a proposed Appalachian Basin-to-Southeast takeaway project headed up by Dominion Resources Inc. (see Daily GPI, Nov. 3, 2015).

The Southeast has been a hotbed for incremental natural gas demand growth, driven by coal-to-gas switching among electric generators, a trend examined in detail in NGI’s special report “Southern Exposure: Gas-Fired Generators Rising in the Southeast; But Will Northeast Gas Show Up?”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |