NGI All News Access | Infrastructure | Markets

U.S. NatGas Exports to Canada, Mexico Climb as Canadian Imports Decline

U.S. exporters are edging closer to overtaking Canadians in cross-border traffic in natural gas, according to the latest trade scorecard of the United States Department of Energy.

U.S. pipeline deliveries to Canada and Mexico grew by 14% in first quarter 2016. At the same time Canadian shipments to the United States, while still the biggest item of North American gas trade, shrank by 2%, according to the department’s fossil energy office.

Total U.S. exports hit 512.7 Bcf, or an average 5.6 Bcf/d, in January through June, up by 64.9 Bcf from 447.8 Bcf or 5 Bcf/d during the first three months of 2015.

Canadian exports slipped to 754.1 Bcf, or 8.3 Bcf/d, in first quarter 2016, down by 17.7 Bcf from 771.8 Bcf or 8.6 Bcf/d during the same period a year earlier.

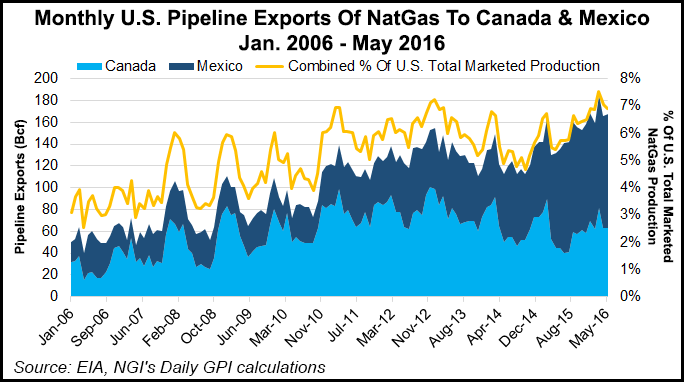

The first quarter 2016 performance continued a trade trend that has accompanied the growth of shale gas production for the past 10 years. U.S. exports grew from scratch as low-cost supplies proliferated in the United States, while Canadian cross-border sales dropped from peaks that topped 10 Bcf/d in the first decade of the 21st century.

The latest Washington gas trade scorecard confirms that Mexico has emerged as the continent’s growth customer for cross-border sales. U.S. pipeline exports to Mexico grew by 44.3% to 299.8 Bcf, or 3.3 Bcf/d, in first quarter 2016 compared to 207.5 or 2.3 Bcf/d in the same period a year earlier.

Canadian markets for exports, primarily in Ontario and Quebec, shrank as reduced domestic pipeline tolls helped Alberta and British Columbia suppliers compete with U.S. shale production. U.S. pipeline deliveries to Canada declined by 11.3% to 213.2 Bcf or 2.3 Bcf/d in first quarter 2016 from 240.3 Bcf or 2.7 Bcf/d in the same period of 2015.

The cross-border trade record also documents the effect of shale gas abundance. There was no heating season price peak this year as supply easily kept up with demand, which was moderated by an overall mild winter.

Prices fell in every branch of the North American gas trade during first quarter 2016.

Canadian exports only fetched an average US$2.00/MMBtu, down 48.9% from US$3.92/MMBtu in first quarter 2015.

U.S. exports to Canada averaged US$2.27/MMBtu in first quarter 2016, down 40.8% from US$3.83/MMBtu in the same period a year earlier. U.S. sales to Mexico went for US$2.17/MMBtu, down by 31.5% from from US$3.17/MMBtu in 2015.

But Washington’s trade accounts also recorded a breakthrough by the industry crusade to break out of the glutted North American market and into the overseas traffic in liquefied natural gas (LNG).

“The January to March quarter saw the first-ever exports of domestically produced, Lower 48 LNG,” said the fossil energy office’s gas regulation and international engagement bureau.

“American LNG Marketing LLC exported the very first volumes, with a small shipment in a cryogenic ISO container to Barbados, from Miami, FL, on Feb. 5th. On Feb. 24th, Sabine Pass Liquefaction LLC exported the first cargo from a large-scale liquefaction facility, with a shipment of nearly 2 Bcf of natural gas, in the form of LNG, to Brazil, aboard the Asia Vision.”

First quarter prices for 11.5 Bcf of U.S. domestically produced LNG exports averaged US$3.71/MMBtu. There were no comparable sales in the comparable period of 2015. But a steep drop in prices fetched by re-exported U.S. imports of LNG indicated that the global gas market is headed in the same direction as North America, although not so far into the value basement. Re-export LNG prices fell by 66.8% to US$3.47/MMBtu in first quarter 2016 from US$14.37/MMBtu in the same period of 2015.

The 2016 performance continued a prolonged drop in North American gas prices, the trade records show. The dive has driven the average price of U.S. imports from all sources on contracts less than two years long, or the great majority of the trade, down to US$1.94/MMBtu in the first quarter of 2016 from an annual average of US$5.05/MMBtu in 2014 and US$2.73/MMBtu in 2015.

Canada’s 25-entry lineup of LNG export terminal projects as escape routes from the continental gas glut remains stalled, held back by high costs and regulatory ordeals arising from environmental and aboriginal resistance.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |