Utica Shale | E&P | Infrastructure | NGI All News Access | NGI The Weekly Gas Market Report

NatGas Gathering A Crucial Priority as More E&Ps Focus on Dry Utica

The buildout of gathering infrastructure in the Utica Shale’s dry natural gas window of Southeast Ohio has remained robust over the last year as the midstream has worked to stay ahead of, and in some cases fallen behind, operators that have flooded a three-county region.

Natural gas production in the Appalachian Basin has remained resilient to the commodities downturn, continuing to grow at a time when volumes across the rest of the country have bottomed out. Unlike their counterparts, the Northeast shale plays are once again poised for year/year growth.

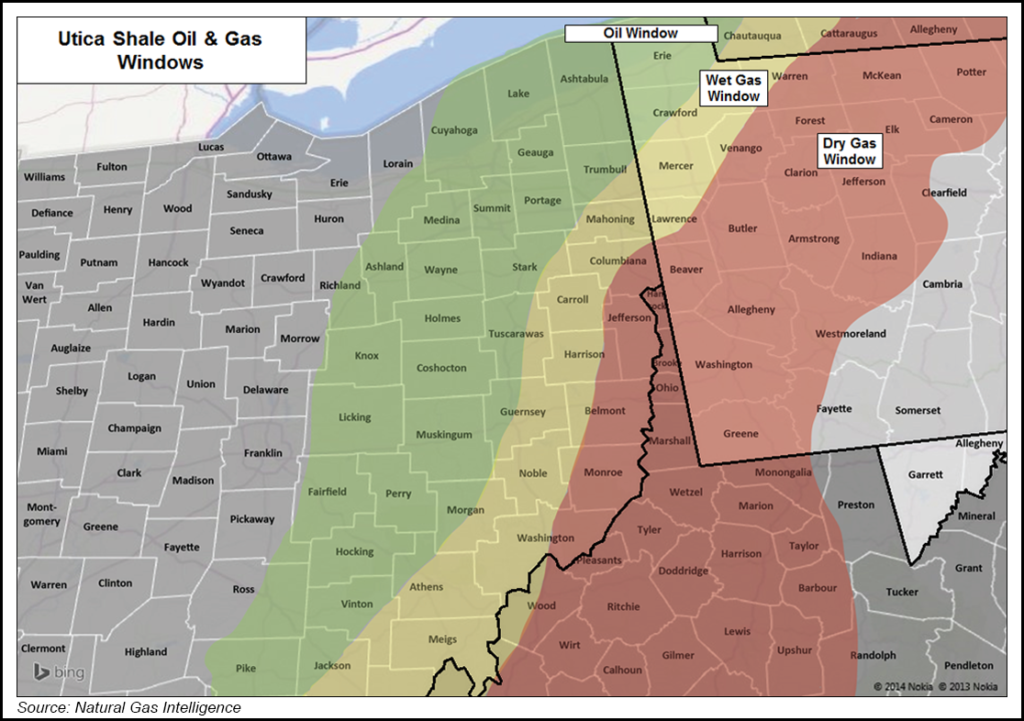

While a wholesale shift to dry gas production hasn’t occurred across the basin, many of its leading operators have been more focused on it, particularly in Monroe, Belmont and Jefferson counties, OH. Lower breakevens, better local markets for some and a shallower Utica target compared to other locations in the basin have increasingly attracted more companies to Ohio’s dry Utica (see Shale Daily, April 7).

Development in the play is also relatively new, compared to the Marcellus Shale. And while the cancellation and delays of long-haul transportation projects continue in some ways to temper the Northeast’s production outlook, gas has also been trapped on a lack of gathering capacity. A buildout is still under way in Southeast Ohio that will help add to the region’s incremental gas supply.

Growing Pains

“We saw similar growing pains up in the Northeast part of Pennsylvania, whenever that play kind of got going,” said Will Green, an analyst at the investment bank Stephens Inc., who covers some Appalachian producers. “Oil and gas infrastructure can be painfully slow, especially when you’re sitting on really good rock, where a number of well capitalized producers are trying to grow production.

“The fact that the geology’s there and a lot of guys have access to it — they have readily available capital to drill it — and it’s economic in a low-price environment, means that everyone’s kind of pushing at the same time, pushing production growth at the same time into a finite space,” he added of Southeast Ohio.

As of Friday, there were 13 rigs running in the state. Eleven of those were in Belmont, Monroe and Jefferson counties. Just two rigs were running in wetter parts of the play in Carroll and Noble counties.Exploration and production companies across the basin have also announced plans to add rigs or more manpower to complete wells (see Shale Daily, Aug. 19).

On its second quarter earnings call, Gulfport Energy Corp., which has been focused on its east and central dry gas windows in Monroe, Belmont and Jefferson counties, said high gathering line pressures there had curtailed some production (see Shale Daily, Aug. 4). The company said it would be running four rigs in the play by September, and it’s preparing for a six-eight rig program there next year,

“You’ve got to remember the development of the dry gas [Utica] area is fairly new development, and we are really the first to develop it in a big way,” CEO Michael Moore said during the company’s earnings call. “The situation you have here is this, you have lots of new production coming on in a very tight geographical area and these are very high pressure wells, a very prolific region. You’ve got pipelines that have maximum operating pressures and we’re seeing pressures of 1,100 to 1,300 psi, which are pretty incredible pressures.”

The company is currently working on adding pad-level compression and plans to phase in full-field compression later this year so the issue doesn’t affect 2017 production.

“Infrastructure buildout takes a long time to get into place,” Green, who covers Gulfport, said. “It’s a fairly common occurrence in places with not a lot of infrastructure. It makes sense to me. It’s a delay; it’s disappointing, but it makes sense. There’s growing pains within any newer basin.”

Antero Resources Corp., which is heavily focused on rich gas production in the Marcellus Shale, has also said its dry Utica properties remain heavily tied to takeaway capacity. Earlier in the year, CEO Paul Rady told analysts that the company’s ability to access premium markets for the dry Utica is tied to the Rover Pipeline, which is scheduled to be in service by mid-2017, limiting what Antero can do in the area for the time being.

Keeping Up

Staying ahead of the wells being drilled and completed in the dry Utica has also become crucial, as more operators have focused on the window. In July, Consol Energy Inc. announced plans to restart drilling with the addition of two rigs (see Shale Daily, July 26). It plans to drill eight Utica wells in Monroe County and another two Marcellus wells in Washington County, PA, by the end of the year.

Consol’s Vice President of Gas Operations Craig Neal said the company hasn’t had any major issues with gathering infrastructure impeding the flow of its Utica wells, but the company’s program there is young. The Utica now accounts for about 25% of its overall production.

“These dry Utica [wells], for perhaps as much as a year, are able to feed without any compression whatsoever,” Neal told NGI’s Shale Daily. “We manage the pressure; we slowly bring that pressure down.”

But as time goes on, he added, the wells can have steep decline curves that require more compression. As more wells are drilled in the area, more gathering lines need to be built to get gas into transmission systems, Neal said.

Staying ahead in the Utica has been a key part of Rice Energy Inc.’s growth strategy. Its decision to operate its own midstream systems in Ohio and Pennsylvania has helped it to avoid any “meaningful midstream constraints or delays,” Director of Investor Relations Julie Danvers said. Earlier this year, Rice and Gulfport entered into a limited liability company agreement to form a midstream joint venture (JV) in Belmont and Monroe counties, establishing Strike Force Midstream LLC to support the companies’ growing dry gas production (see Shale Daily, Feb. 12).

“We recently assigned a 13,000 acreage dedication from Consol Energy to Strike Force and expect both Gulfport and Consol to continue developing their acreage dedicated to Strike Force across Belmont and Monroe Counties in the dry gas core of the Utica Shale in Ohio,” Danvers said. Strike Force now serves 88,000 acres in both counties.

Rice completed construction of its Ohio gathering system about a year ago, which is designed to move more than 2 million Dth/d of dry gas from its wells and Gulfport’s. Rice Midstream Holdings, which has a 75% interest in Strike Force, plans to spend $155 million this year in the play. The company is currently constructing a new gathering system with a capacity of 1.8 million Dth/d to support Gulfport and Consol production in Belmont and Monroe Counties. Gulfport’s high gathering line pressures are in an area outside of its JV with Rice.

More Projects

Other gathering projects have been announced in the last year to support growing dry Utica production in Southeast Ohio. In August 2015, MPLX LP subsidiary MarkWest Energy Partners LP said it would construct a large-scale Utica dry gas gathering system (see Shale Daily, Aug. 13, 2015). The 2 Bcf/d system consists of more than 250 miles of pipelines and primarily supports Ascent Resources LLC’s assets in Belmont and Jefferson counties. It also serves other producers.

At about the same time last year, Williams said it would expand its gas gathering services in the region (see Shale Daily, Sept. 8, 2015). The company said an extended fixed-fee contract with Chesapeake Energy Corp. would allow it to enhance its third-party volumes and “build scale” in the Utica’s dry gas areas by providing an opportunity to invest more than $600 million over the next five years. In that time, the company said it plans to install more than 200 miles of pipeline and related facilities with up to 800 MMcf/d of capacity to serve Utica dry gas development.

“To me, it provides an indication that both producers and midstream companies are working towards expanding gathering capacity in the region in conjunction with production,” said BTU Analytics LLC analyst Marissa Anderson of those announcements.

MPLX recently said it expects both its Utica and Marcellus gathering volumes to increase by 20% year/year, adding that its processed volumes should also increase by 15% over the same time.

“In the Utica, what’s really going on there is sort of the macro environment slowing the rate of growth for producer customers; they’re really motivated by the ultimate netbacks up there,” CFO Nancy Buese said last month during a call to discuss the company’s second quarter operations. “And we’re still seeing very strong upstream economics for them, but the pace of drilling is really, for them, focused on the downstream pipeline projects like Nexus, like Rover and some of those things.

“Some of the downstream projects need to come online to release some of the [drilled, uncompleted wells] that are going on in that area,”‘ she added. “Given all of that, we are still anticipating better volumes toward the end of the year based on where prices are going and we’re still committed to that 15% increase in volumes year-over-year.”

The ongoing Utica midstream build-out, and any associated snags with long-haul and gathering projects, Consol’s Neal said, is a positive for the basin.

“Early in the play, we all had expectations for the dry Utica, and I think it’s exceeded our expectations. You size equipment prudently for your initial tests,” he said. “It’s a good thing that you have operators saying ‘hey, I have more gas than what I expected.’ In areas that are weaker, if you heard that, it wouldn’t make sense. It speaks to the quality of the rock in the area. It’s just something that takes time — building the pipelines. It’s solvable.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |