Shale Daily | E&P | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

PDC Enters Permian in $1.5B Dual Deal, Adding Third Core Area

Denver-based PDC Energy Inc. is joining the parade entering the Permian Basin, announcing Tuesday it would pay $1.5 billion to acquire two privately held operators that together would give it about 57,000 net acres in the Delaware sub-basin of West Texas.

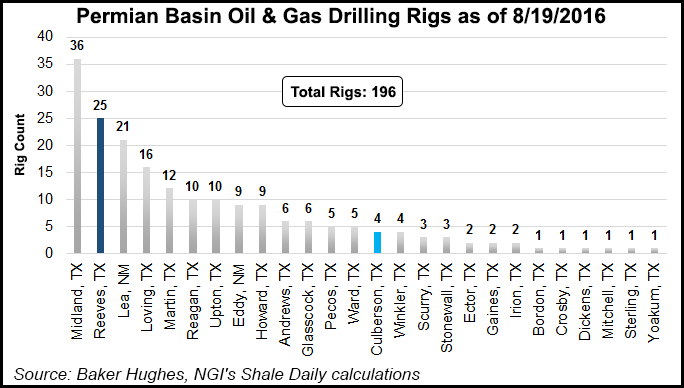

The companies being acquired, Arris Petroleum and 299 Resources, are managed by private equity-backed Kimmeridge Energy Management Co. Combined, the leaseholds in Reeves and Culberson counties have average working interest of 93%.

Current production is about 7,000 boe/d net from 21 horizontal wells, with two additional wells in the completion and flowback phase.

“This is truly a remarkable opportunity for PDC, its employees and its shareholders,” CEO Bart Brookman said. “Through a methodical approach, we were able to execute our stated acquisition strategy and add an extensive inventory of highly economic drilling locations that complement our already strong portfolio.”

The transaction, expected to close by the end of the year, includes an estimated 700-plus gross horizontal drilling locations targeting the Wolfcamp A, B and C zones. A preliminary estimated reserve potential based on four to 12 wells per section is 530 million boe net. Infrastructure included with the transaction are natural gas gathering systems, pipelines, rights-of-way and five saltwater disposal wells.

PDC today primarily operates in two regions, with most of its capital directed to the 100,000 net acres in the the Wattenberg field of Colorado (see Shale Daily, Aug. 10). It also has more than 60,000 acres in the Utica Shale, where dry natural gas drilling has not been a priority.

Brookman spoke on Tuesday morning at the Rocky Mountain Energy Summit sponsored by the Colorado Oil & Gas Association. He didn’t mention that a transaction in the Permian was underway, but he cited PDC’s strong balance sheet and low debt. He also pointed to the Permian as having some of the best rock in the country.

Producers don’t need higher crude prices if they have a solid portfolio, he told the Denver audience.

“I take it back to geology,” Brookman said. “It’s the quality of the rock. It’s been amazing to watch in the five or six regions of the country” where operators have ramped up operations, despite underwhelming commodity prices from 2014.

“I personally don’t think you need $50 oil. I see companies similar to ours surviving and actually thriving at $35 to $50. It comes back directly to the hot spots and emerging areas that are proving to be unique opportunities…The Utica is the next tier down, but you have the Midland and the Delaware” in the Permian, along with Oklahoma’s stacked reservoirs.

“These are areas that are still thriving and we all know who those companies are….You have to be fortunate enough to have good rock. Then you don’t need $50.”

Wells Fargo Securities LLC estimated PDC’s transaction is worth about $21,500/acre, assuming $40,000/flowing boe. Tudor, Pickering, Holt & Co. (TPH) estimated the deal was worth closer to $23,000/acre, with 41,000 in Reeves and 16,000 in Culberson, 42% weighted to oil.

“Assuming $5,000/acre for Culberson would imply…$30,000/acre for undeveloped Reeves acreage,” TPH said. However, analysts said assumptions could be adjusted based on the value of the acquired midstream infrastructure.

Coker Palmer Institutional (CPI) analysts estimated the deal was worked around $22,000/acre, but the acreage could be worth much more. “First PDC states they have 700 locations. We feel each well could have a net present value of $2-4 million/well (depending on internal rate of return assumptions). That would equate to $2.1 billion in value, or $37,000/acre, which in turn might add $13/share to PDC’s net asset value,” which was $54-87/share before the deal at $50-60/bbl oil.

CPI added that $22,000/acre is fairly inexpensive when compared to other transactions in the area in the $25,000-plus/acre range. “The gassy mix helps explain some of the discount,” CPI said Wednesday morning.

For the exploration and production (E&P) industry, the Permian has far and away been the hottest buyer’s market in the U.S onshore, with several big deals in the past month alone (see Shale Daily, Aug. 19; Aug. 16a; Aug. 16b; Aug. 8;July 13).

To enter the Permian, PDC is paying $915 million and providing 9.4 million shares of common stock valued at $590 million. The cash portion is to be funded through equity and debt; current liquidity through financing from J.P. Morgan is estimated at $1.4 billion.

“This acquisition is a significant step toward executing our vision of becoming a premier mid-cap E&P company,” said Executive Vice President Lance Lauck, who handles corporate development and strategy. “Adding this Delaware position to our core Wattenberg acreage gives us more than 1 billion net boe of liquid-rich reserve potential in two of the top-tier U.S. onshore basins.”

Through the rest of this year, PDC plans to spud nine horizontals in the Delaware, seven with 1.5- or two-mile laterals. Midstream infrastructure also is to be expanded for an expected total capital outlay of $55-65 million. Additionally, completion operations are being finished on two horizontal wells and plans to operate two drilling rigs by year-end 2016.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |