Power Burn, Bullish Storage Report Revive NatGas Forwards

After sitting relatively idle much of the week, natural gas forwards markets got a boost from a bullish storage report that helped send September forward prices up an average 7.6 cents between Aug. 12 and 18, according to NGI’s Forward Look.

The U.S. Energy Information Administration reported a 22 Bcf injection into storage inventories for the week ending Aug. 12, below most expectations in the mid-20 Bcf range and wider estimates in the upper 20 Bcf range.

“EIA data missed slightly bullish today, thanks in part to more weather-driven cooling demand across the East and continued storage draws in the South Central,” Bespoke Weather Services said.

Indeed, the EIA shows the South Central region withdrew 12 Bcf from storage for the week ending Aug. 12.

Cash backwardation has aided these sizable draws across the South, and this trend is likely to continue to limit injection size moving forward as well, Bespoke said.

The Nymex September futures contract rose 5.5 cents following the EIA report to settle at $2.674, and ultimately gained 8.8 cents from Aug. 12 to 15.

Thursday’s settle was the highest daily close in the last eight trading sessions as storage inventory levels and underlying balance tightening are generating a “hyper focus” on near-term data points, analysts at Mobius Risk Group said.

“For some time now, our view has been that near-term volatility would dominate the shape of the curve, and we remain convinced that this dynamic holds for the foreseeable future,” Mobius said.

Daily production data, overnight/midday weather updates and weekly storage reports are the key focal points for market participants. Recent bullish storage reports have struggled to spur the upside demonstrated earlier this summer and, thus, there will be an even sharper focus on weather nuances and daily production data, Mobius said.

“Today’s inventory report and early expectations for next week’s report suggest we could see further upside, but the corresponding price impact to fall balances would likely cause this to be a short-lived phenomenon,” Mobius added.

Indeed, Friday morning brought about a sharp reversal in futures prices, as the Nymex September contract had fallen roughly 9 cents by midday.

“The bullish miss yesterday helped elevate prices briefly above resistance, but our inability to sustain above that important technical level looks to have led to some selling this morning,” Bespoke said. “Still, we see relatively limited downside risk in the short-term as scrapes remain relatively tight, EIA data missed a bit bullish yesterday and weather forecasts are still not as bearish as they were at the beginning of the week.”

Forecasters at NatGasWeather agreed that there is additional upside risk to prices as the recent spate of hot weather in key demand regions is expected to keep next week’s storage build rather lean.

NatGasWeather is projecting a build as low as the upper teens Bcf to as high as the upper 20s Bcf next week, which would drop surpluses versus the five-year average by another 40 Bcf or so and with further declines to come.

Looking ahead to weather patterns for the next couple of weeks, the forecaster expects a warm upper ridge to remain intact and dominate the west-central U.S. in early September with moderate to locally strong natural gas demand, but likely struggling to reach the important Great Lakes and Mid-Atlantic regions, where mostly pleasant temperatures are likely.

Short-Changed Storage Could Have Winter Impact

“So while bearish weather trends have shown up this past week in the shorter term, long-term impacts of recent warm/hot weather and meager builds seem like they could have bullish consequences longer term,” NatGasWeather said.

Taking a more in-depth look at natural gas futures/forwards markets, gains seen at the front of the curve extended for the balance of the year.

The Nymex October futures contract climbed 9 cents between Aug. 12 and 18 to reach $2.71, while the prompt winter rose 5 cents to $3.13.

On a national level, the September forward price was up 7.6 cents during that time, October was up 8 cents and the prompt winter was up 7 cents, according to Forward Look.

18 New Forward Pricing Points

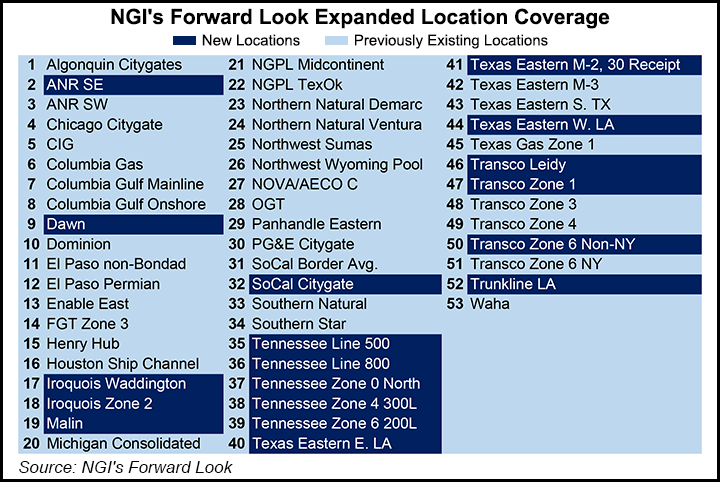

NGI recently enhanced its Forward Look offering by adding 18 new pricing points, strengthening its coverage of three key areas: Appalachia, the Northeast and California.

“Our new expanded listing brings the Forward Look to a total of 53 points, allowing us to serve the needs of customers doing business almost anywhere in the country,” said NGI’s Nate Harrison, markets analyst. “The buildout supplements coverage of the important Northeast and California demand regions while also adding points tied to Marcellus and Utica Shale production.”

At SoCal citygate, one of the new Forward Look price points, prices across the forward curve followed the general uptrend seen in the Nymex futures strip.

The SoCal citygate September forward price moved up 7.1 cents between Aug. 12 and 18 to reach $2.84, while October rose 7 cents to $2.83. The prompt winter was up 5 cents to $3.55, and the summer 2017 strip was up 2 cents to $3.08.

The strength in the southern California market comes as SoCal system-wide demand reached a summer-to-date high of 3,338 MMcf on Aug. 16 amid hot and dry weather in the state.

This maximum is still lower than that for each of the last four summers, which were all over 3,400 MMcf, according to Genscape, an energy data and analytics company.

“The pipeline’s demand activity was slightly anomalous based on its summer-to-date demand-per-degree relationship,” Genscape said. “Tuesday’s system-wide demand number of 3,338 MMcf was 440 MMcf higher than the expected system-wide demand of 2,897 MMcf predicted by SoCal’s demand-per-degree profile for summer 2016.”

Forest Fires Don’t Impact Socal Demand

The strong demand comes as out-of-control wildfires continue to threaten the San Bernardino area and have prompted mandatory evacuation orders affecting close to 100,000 people.

SoCal’s system-wide aggregate demand number has not yet seen a significant impact attributable to the infernos, Genscape said. The largest of these wildfires, the Blue Cut fire, has burned at least 30,000 acres near Interstate 15 north of San Bernardino. It began on Tuesday and was still 0% contained by Wednesday evening.

California Gov. Jerry Brown declared a state of emergency for San Bernardino County on Tuesday.

The only pipeline in the area affected by the fires so far is SoCal, which has a segment that follows Interstate 15 through the area of the fire, Louisville, KY-based Genscape said.

“While a shutdown of this line could affect intraday immediate flows, particularly to the city of San Bernardino, the pipeline’s extensively networked system should still allow it to bring imported gas to the L.A. area via lines far from the fire,” the company said.

None of SoCal’s four storage facilities are close to the Blue Cut fire area. Also, Kern River supplies about 100 MMcf/d to a power plant for the city of Victorville, located downwind of the fire, but nominations at this location have not changed significantly since the evacuations began, Genscape added.

Non-Access Northeast Bumps Futures

Across the country in the Northeast, forward prices at New England got a substantial bump after Massachusetts’ highest court ruled on Wednesday that electric generators could not pass along costs related to gas transmission and distribution to ratepayers (see Daily GPI, Aug. 18).

The ruling, likely aimed at Spectra’s Access Northeast Project, puts the roughly 900 MMcf/d expansion proposal on the Algonquin Gas Transmission pipeline into question as the cost-recovery pass-through mechanism is essentially the only way the project would make sense to move forward.

The project has a targeted November 2018 in-service date.

Traders responded promptly to the news as winter forward prices at AGT shot up by the double digits Thursday, Forward Look data shows.

AGT September forward prices climbed just 4.6 cents between Aug. 12 and 18 to reach $2.46, while October edged up just 3 cents to $2.52.

But AGT’s prompt winter strip jumped 51 cents during that time to $6.25, and the winter 2017-2018 strip rose 22 cents to $6.40.

The stronger gains in the prompt winter were likely driven by more liquidity at the front end of the curve.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9915 | ISSN © 2577-9877 |