NGI Data | Markets | NGI All News Access

Physical NatGas Can’t Match Storage-Report Futures Gains; September Adds A Nickel

Physical natural gas traders Thursday hunkered down before release of the Energy Information Administration (EIA) storage report, and both producing basins and market zone prices for Friday delivery varied within only a penny or two.

Some exceptions were noted in southern California and the Mid-Atlantic, which experienced double-digit setbacks, but the NGI National Spot Gas Average fell 2 cents to $2.48. Futures bulls awakened from their sleep of the last few sessions and managed to post a 5-cent gain on the heels of moderately constructive storage figures.

EIA reported a build of 22 Bcf, about 5 Bcf less than market expectations, and at the close September had added 5.5 cents to $2.674 and October had risen 5.3 cents to $2.712. September crude oil continued its romp higher, adding $1.43 to $48.22/bbl.

California and New York took the day’s biggest hits, more specifically Southern California, as power loads were expected to decline and next-day on-peak prices eased. Intercontinental Exchange reported that on-peak Friday power at NP-15 fell $2.97 to $39.58/MWh and at SP-15 peak power fell $5.73 to $39.33/MWh.

Next-day deliveries to the PG&E Citygate rose 3 cents to $3.18, but market points aligned with Southern California endured double-digit declines. Gas at the SoCal Citygate fell 29 cents to $2.79, and deliveries priced at the SoCal Border Avg. shed 19 cents to $2.71.

Gas on Kern Delivery came in 18 cents lower at 2.73, and parcels on El Paso S. Mainline/N. Baja changed hands 16 cents lower at $2.74.

CAISO forecast that Friday peak loads would reach 40,088 MW, down from Thursday’s peak of 40,322 MW.

Major trading hubs were flat to lower. Gas on Dominion South was quoted flat at $1.28, and deliveries to the Chicago Citygate were unchanged at $2.66. Gas at the Henry Hub was also unchanged at $2.71, and gas on El Paso Permian fell a penny to $2.48.

When the 22 Bcf storage figure rattled across trading screens, the result had bulls in the driver’s seat. September futures reached a high of $2.675 immediately after the figures were released, and by 10:45 a.m. September was trading at $2.654, up 3.5 cents from Wednesday’s settlement.

“It seems like the market moves, and then we go right back to where we were,” a New York floor trader told NGI.

“Crude oil was less than $40 not too long ago. And think about it, you are up almost $10 in crude. Natgas bulls should be grateful for crude oil, but we are still stuck in that range between $2.50 to $2.75.”

“The data for last week showed a somewhat smaller than expected 22 Bcf net injection into US natural gas storage,” said Tim Evans of Citi Futures Perspective. “While not a major surprise, this suggests some ongoing volatility from prior weeks that had featured both an unexpected 6 Bcf withdrawal and then a larger than expected 29 Bcf build. The market continues to show greater sensitivity to extreme summer heat than anticipated.

“The market does keep making progress in reducing the storage surplus, which remains constructive for the intermediate term but doesn’t necessarily preclude a further downside price correction in our view.”

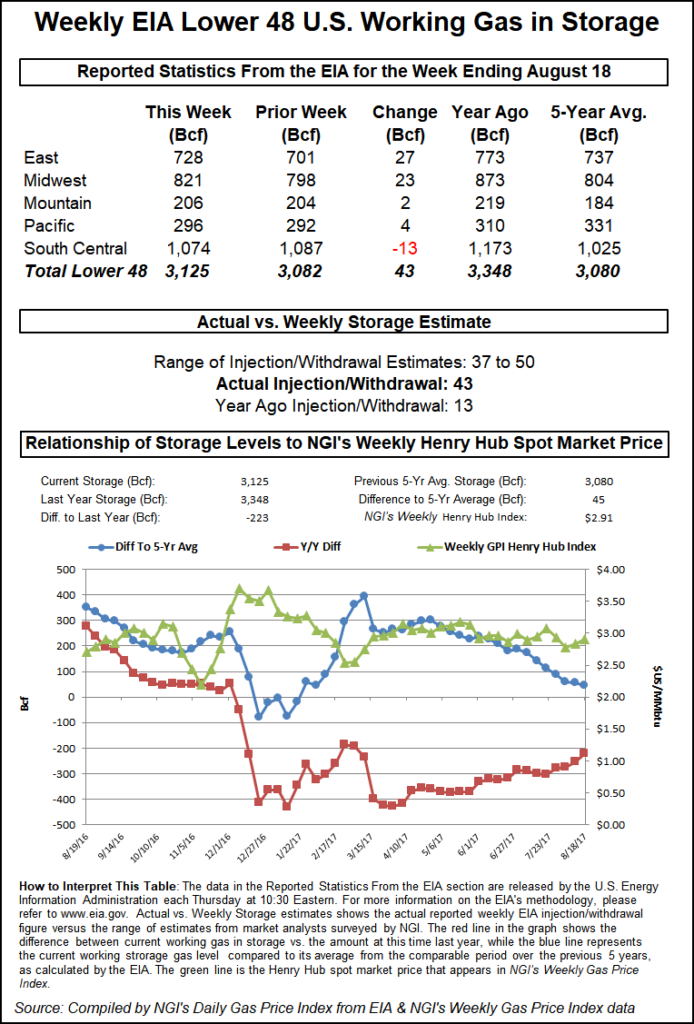

Inventories now stand at 3,339 Bcf and are 327 Bcf greater than last year and 405 Bcf more than the five-year average. In the East Region 17 Bcf was injected, and the Midwest Region saw inventories increase by 16 Bcf. Stocks in the Mountain Region rose 2 Bcf, and the Pacific Region was lower by 1 Bcf. The South Central Region shed 12 Bcf.

The report of a 22 Bcf storage build has some analysts looking for leaner ending inventories than 2015. “Injections have been below prior-year levels in all 20 weeks this refill season and total injections are down 44% (about 5.0 Bcf/d) year over year,” said Jefferies LLC in a Thursday report. “Of the approximately 5 Bcf/d of lower season-to-date fills, we think about 2 Bcf/d has come from lower supply with the balance due to higher exports, better gas fired power generation, and rising exports to Mexico (+1 Bcf/d).

“Our injection season factor model continues to point to storage only reaching prior-year end-season levels. Specifically, our model estimates season-end storage of 3.87 Tcf vs 2015’s 3.93 Tcf and the five-year average of 3.79 Tcf.”

The drumbeat of lower injections and a continually falling storage surplus continued with Thursday’s report of a modest 22 Bcf injection. Last week, 29 Bcf was reported injected, and this week’s report was not expected to be much different. Last year 56 Bcf was injected, and the five-year pace is also 56 Bcf.

Supplies currently stand at 3,339 Bcf. In order to reach last year’s burdensome record level of 3,954 Bcf an estimated 53 Bcf would have to be injected weekly for the remainder of the traditional storage season.

The range of estimates was wide. The Desk Tealeaves survey showed an average 27 Bcf with a range of 18 Bcf to 41 Bcf. Bentek Energy, using its flow model, calculates a 26 Bcf build.

John Sodergreen, editor of The Desk, said, “There were plenty of folks in both the 24 to 25 Bcf neighborhood and the 38 to 43 Bcf neighborhood, so the range wouldn’t have moved all that much. This week, the range is still quite wide; like last week, though, we think the numbers might nudge slightly higher than the consensus, or within 2 Bcf.

“[W]e rarely see two highballer reports in a row out of EIA. And our GWDD Model is low at 24 and the model has been on a tear lately.

“The south-central region is the big ‘if’ this week, again. Salts and non-salts continue to confound. Last week the region posted its fourth net withdrawal in a row and the sixth draw in seven weeks.”

In its 5 p.m. EDT Thursday report the National Hurricane Center (NHC) said that Tropical Storm Fiona was 1,145 miles west of the Cabo Verde Islands and was traveling northwest at 10 mph. Maximum sustained winds were 45 mph. NHC projected a storm path to Bermuda.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |