Shale Daily | Bakken Shale | E&P | NGI All News Access

Continental Pares More Leasehold in Bakken

Continental Resources Inc. agreed to take $222 million from an undisclosed buyer for about 80,000 net acres in North Dakota and Montana, the Oklahoma City-based independent said Thursday.

The sale, which includes 2,800 boe/d net, covers 68,000 acres of leasehold primarily in western Williams County, ND, and 12,000 acres in Roosevelt County, MT.

“This is our third sale of nonstrategic assets this year, with total expected proceeds of more than $600 million,” CEO Harold Hamm said. “We plan to apply proceeds to reduce debt and strengthen our balance sheet.”

In May the operator agreed to sell 132,000 net acres in the Washakie Basin of Wyoming for $110 million (see Shale Daily,May 6). Earlier this month it also took $281 million for 29,500 net acres in Oklahoma’s stacked reservoirs (see Shale Daily,Aug. 5).

“Our guidance for the year has not changed,” Hamm said. The combination of Continental’s “high quality drilling inventory, strong balance sheet and $560 million investment in drilled but uncompleted wells (DUC) provides the company with a robust platform for high-value future growth.”

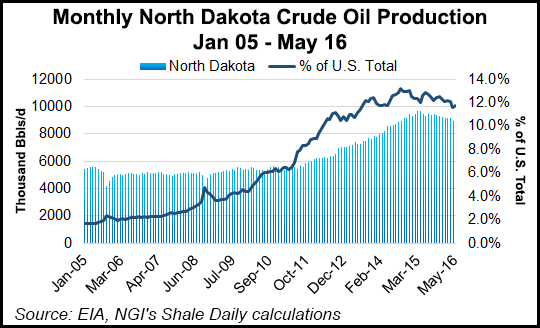

The $560 million investment includes all of the operated and nonoperated DUCs, 80% of which are in North Dakota’s Bakken Shale.

Continental currently has about 215 gross operated DUCs in inventory, with 165 in the Bakken. By year’s end, it expects the inventory to reach 240, including 190 in the Bakken.

The Bakken DUCs have an average estimated ultimate recovery of 850,000 boe/well, with average costs for each of $3.0-3.5 million, the company said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |