Shale Daily | E&P | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

Concho’s $1.6B Deal in Permian Boosts Midland Position

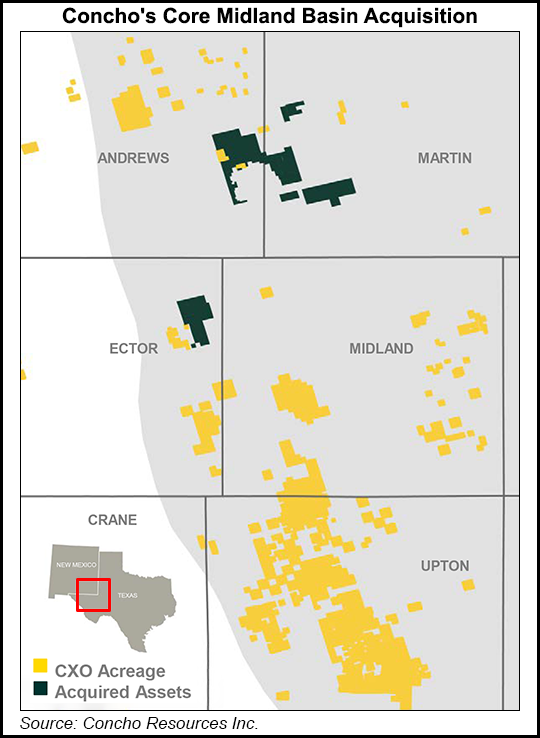

Permian Basin pure-play Concho Resources Inc. agreed Monday to pay $1.625 billion in cash and stock to Reliance Energy for 40,000 net acres in the Midland sub-basin.

The transaction would expand the independent’s West Texas leasehold to more than 150,000 net acres and increase output to an estimated 30,000 boe/d.

The definitive agreement with privately held Reliance is consistent with a strategy to be opportunistic and disciplined, the Midland, TX-based operator said. Concho early this year made a trio of deals to consolidate its position in Permian’s Delaware sub-basin, which boosted output in 2Q2016 (see Shale Daily, Aug. 3; Jan. 19).

“This transaction demonstrates Concho’s commitment to the Midland Basin as a core operating area and highlights our continued efforts to consolidate complementary leasehold,” CEO Tim Leach said. “In line with the objectives of our southern Delaware Basin acquisition in the first quarter of 2016, these assets not only build scale, but more importantly high-grade our inventory with additional long-lateral locations that compete with the best projects in the Permian Basin.

“As we continue to enhance our ability to efficiently allocate capital across our four key assets in the Permian Basin, we are uniquely positioned to deliver attractive returns today and build shareholder value over the long term.”

The transaction happened the same day that Parsley Energy Inc. agreed to pay $400 million for a bolt-on leasehold in the Midland sub-basin (see related story).

Concho would gain an average 99% working interest in the leasehold being acquired, including 10,000 boe/d of output that is 67% weighted to oil. The deal also would enhance the drilling inventory, with more than 530 long-lateral drilling locations that target the Middle/Lower Spraberry and Wolfcamp B formations.

Current production is from 326 vertical wells and 44 horizontals, with one horizontal completed this year. At current New York Mercantile Exchange strip pricing, the present value of the production base was estimated at $500 million, with the remaining $1.1 billion of the purchase price attributed to the 40,000 undeveloped acres.

Estimated proved reserves for the acquisition are 43 million boe, with proved developed reserves representing 69%. Internal estimates of proved reserves are as of June 30, using pricing assumptions based on the trailing 12-month average first-day-of-the-month prices of $39.63/bbl oil and $2.24/MMBtu natural gas.

The acquired acreage is in Andrews, Martin and Ector counties, “with minimal leasehold obligations,” Concho said. Because of the contiguous nature of the acquired assets, two-thirds of the locations are primed for two-mile laterals, with the remaining locations 1.5-mile laterals.

“The engineered locations are based on eight locations per zone in the Middle Spraberry, Lower Spraberry or Wolfcamp B, with two to three of these zones targeted per drilling spacing unit,” Concho management said. There also is “substantial development upside from applying optimal drilling and completion methods, testing closer well spacing and delineating other zones.”

Under terms of the agreement, Concho would pay Reliance $1.1 billion in cash and provide 3.96 million shares of its common stock, currently valued at $500 million. The cash portion of the acquisition is to be funded through proceeds from a potential equity market transaction, with closing set for October.

The acreage fetched a handsome price, according to analysts. Tudor, Pickering, Holt & Co. estimated Concho paid around $28,000/acre, or $35,000/acre excluding net acres with only deeper rights. Assuming $40,000/boe flowing, Wells Fargo Securities LLC estimated the company paid around $31,000/acre for the bolt-on leasehold.

Concho now expects full-year 2016 production to increase 1-3%, with the Midland assets contributing in 4Q2016. Capital spending guidance for 2016 was maintained at $1.1-1.3 billion, excluding acquisitions. Based on the current commodity price outlook, Concho expects to execute a capital program in 2017 “within cash flow and deliver approximately 20% annual production growth, with oil volume growth exceeding 20%.”

Concho also announced that Chief Accounting Officer Brenda R. Schroer, who joined the company in 2013, is taking on the role of treasurer.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |