Shale Daily | E&P | NGI All News Access | NGI The Weekly Gas Market Report

Bill Barrett Adding More Extended-Reach Laterals in DJ as Costs Decline

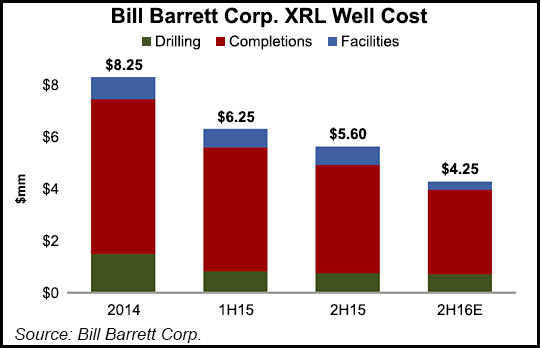

With costs falling and efficiencies growing, Rockies-focused Bill Barrett Corp. plans to pull the trigger on more extended well laterals in Colorado’s Denver-Julesburg Basin, with plans to spud up to 12 wells (gross) by the end of the year that would turn to sales in early 2017.

The 2016 capital expenditure (capex) program also was updated Monday, with spending set at the high end of guidance of $75-100 million because of the additional extended-reach lateral (XRL) activity.

“We continue to have strong confidence in the underlying economics of our XRL development program,” CEO R. Scot Woodall said. “We believe that lower demonstrated well costs and operating expenses, combined with a narrowing DJ Basin oil price differential, will generate a competitive rate-of-return in the current commodity price environment.

“While the increased activity will not impact our 2016 production, it builds increasing operational momentum as we move in to 2017. We remain positioned to be cash flow positive this year even at the upper end of our capital expenditure guidance range, allowing us to preserve the strength of our liquidity position.”

During a recent conference call to discuss second quarter results, Woodall said production was exceeding the guidance range by 14%, with 18% sequential growth and the sixth consecutive quarter in which guidance topped expectations.

Capex was “significantly below our guidance range as a result of well costs being executed below forecast levels and the timing of capital spending related to infrastructure and other nondrilling related capital,” Woodall told analysts. “This allows us to reduce our capital expenditure outlook for the second time this year,” a 30% reduction in initial guidance.

Between April and June, two drilling spacing units (DSU) were placed on flowback in the central-southern portion of the DJ, and 23 of the 24 wells were XRLs.

“Execution and well optimization continued to be a top priority for the company,” Woodall said. “To date, we have implemented targeted development of the Niobrara horizon throughout our acreage position. The primary focus of development has been on the Niobrara B across a broad section of the acreage position, while development of the Niobrara C has primarily been focused on the central portion of the acreage.” Initial wells also were drilled in the A and C bench on the northern acreage.

“Over the last two years, we have drilled and completed 75 XRL wells. We have utilized a variety of well construction designs, including sliding sleeves, plug-and-perf [perforation], varying number of completion intervals, varying number of proppant, sand volumes and flowback techniques. Our base design has evolved to a 55-stage plug-and-perf, 1,000 pounds of proppant per foot lateral design. This has resulted in a base type curve that continues to be evaluated — validated with now having over 20 months of production history on that collection of wells. At our current cost structure, these wells generate attractive rates of return at current strip pricing.”

To maximize the economic value of each DSU, the operations team also is testing several different spacing configurations, Woodall said.

“While these wells are still in various stages of initial production, we can at least observe a few trends. It appears that the tighter spaced wells have a lower initial peak production rates but shallower production declines. Additional production data will be needed to determine the optimum development plan and completion technique…”

Bill Barrett’s 2Q2016 production volumes totaled 1.6 million boe-plus, exceeding guidance of 1.4 million boe, with oil volumes up 15% sequentially. The output benefited from starting up the 16-well DSU, said Senior Vice President Bill Crawford, who oversees treasury and finance.

“For the third quarter, an eight-well DSU initiated production in early June and will contribute to production as it ramps up. We are forecasting third quarter volumes will approximate 1.5 to 1.6 million boe.”

Guidance reflects output lost from the Uinta Basin asset sale, which was completed in July (see Shale Daily, Sept. 29, 2015). The Uinta production was forecast to be about 100,000 boe in the second half of 2016. However, even with the sale, “we are raising the floor of our guidance range to 5.9 to 6.2 million boe for 2016,” Crawford said.

Companywide oil price differentials before hedging averaged $5.66/bbl less than West Texas Intermediate (WTI) during 2Q2016.

“DJ Basin differentials continue to tighten as infrastructure expands. For the second quarter, the DJ Basin oil price differential averaged $4.82/bbl less than WTI, which was a 14% sequential improvement over the first quarter,” said the finance chief. “Going forward, we expect our operated DJ oil differentials to average in a range of $3 to $5/bbl of WTI…We do not have any volumetric delivery commitments and are realizing tighter pricing with the excess takeaway capacity in the basin.”

Cost cutting initiatives also are paying dividends. Lease operating expenses (LOE) overall averaged $5.28/boe in the quarter, down from $6.46 1Q2016. DJ Basin LOE averaged $3.74/boe, versus $4.80 in 1Q2016.

“We are lowering our 2016 LOE guidance to $31-34 million to reflect the cost reductions achieved so far and the sale of the higher-cost LOE properties from the Uinta Basin,” Crawford said. General and administrative (G&A) expenses also are falling, down to $7 million in 2Q2016, which is $1 million less than in the first quarter. Based on the decline, the company has reduced its 2016 G&A guidance to $30-33 million.

Capex in 2Q2016 totaled $16 million, “significantly below our guidance range of $30 million to $35 million,” Crawford said. “This was primarily a result of lower XRL well costs, the timing of infrastructure-related spending, and other nondrilling related capital.”

Even at the high end of the capex guidance range, “we expect to be cash flow positive for the year,” he said. “We have full flexibility to the timing of our future activity as we have no drilling or marketing commitments to fulfill and minimal expiring acreage.”

Bill Barrett ended the second quarter with an undrawn $335 million credit facility and $87 million on hand. The closing of the Uinta Basin sale added an additional $30 million of cash proceeds.

“We continue to seek opportunities to improve our capital structure,” Crawford said. “Our operating cash flow is protected by an underlying hedge portfolio where approximately 65-70% of our remaining 2016 oil production is swapped at a price of $72.57 WTI. We also have approximately 3,900 b/d of oil swapped in 2017, weighted towards the first half of the year at $62.10 to provide support for next year’s cash flow.”

The company recorded a net loss of $48.4 million (minus 93 cents/share) in 2Q2016, versus a year-ago net loss of $44.6 million (minus 92 cents). Revenue declined to $47.3 million from $62.6 million.

For up-to-date 2Q2016 earnings and projections, check out NGI‘s Earnings Call and Coverage sheet.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |