Shale Daily | E&P | Markets | NGI All News Access

EIA: Shales to Power Domestic, Global NatGas Production Growth

Natural gas production from shales will account for 30% of global output by 2040 as shale resources are developed in more countries, particularly Mexico and Algeria, according to the U.S. Energy Information Administration (EIA).

In fact, anticipated new entrants Mexico and Algeria, along with current shale producers — the United States, Canada, China and Argentina — will account for 70% of global shale production by 2040, EIA said.

This is according to EIA’s International Energy Outlook 2016 and Annual Energy Outlook 2016 (AEO2016) (see Daily GPI,May 17), which forecast that worldwide natural gas production overall will increase from 342 Bcf/d in 2015 to 554 Bcf/d by 2040. Shale accounts for the largest portion of the growth, rising from 42 Bcf/d in 2015 to 168 Bcf/d by 2040.

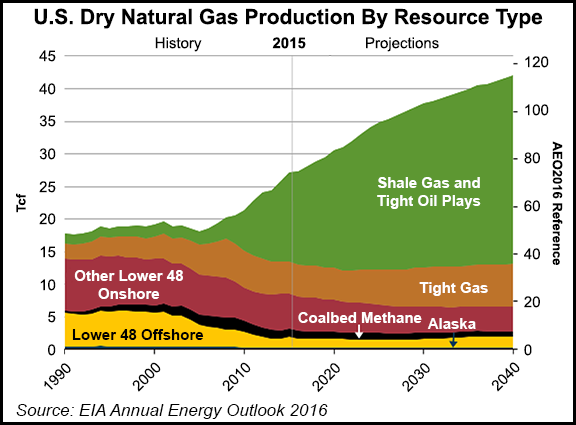

In the United States, shales accounted for more than half of U.S. gas production last year. Shale production is projected to more than double from 37 Bcf/d in 2015 to 79 Bcf/d by 2040, which is 70% of total U.S. natural gas production in the AEO2016 reference case by 2040, EIA said. Shale production in 2040 is projected to be 50% higher under the “high oil and gas resources and technology” case, reaching 112 Bcf/d. However, in the “low oil and gas resources and technology” case, production is projected to be 50% lower than the reference case, reaching only 41 Bcf/d.

Mexico is expected to gradually develop its shale resource basins after the recent opening of the upstream sector to foreign investors. Right now, Mexico is expanding its pipeline capacity to import low-priced U.S. natural gas (see Shale Daily, July 5; April 20). The country is expected to begin producing shale gas commercially after 2030, with shale volumes contributing more than 75% of total gas production by 2040 (see Shale Daily, April 18).

Canada has been producing shale gas since 2008, reaching 4.1 Bcf/d last year. Shale gas production in Canada is projected to continue increasing and to account for almost 30% of the country’s gas production by 2040 (see Shale Daily, Jan. 4).

Outside of North America, China has been among the first countries to develop shale resources. In the past five years, China has drilled more than 600 shale gas wells and produced 0.5 Bcf/d of shale gas as of last year. Shale gas is projected to account for more than 40% of the country’s total gas production by 2040, which would make China the second-largest shale gas producer in the world after the United States.

Argentina’s commercial shale gas production was just 0.07 Bcf/d at the end of 2015, but foreign investment is increasing. Pipeline infrastructure in Argentina is adequate to support current levels of shale gas production, but it will need to be expanded as production grows, EIA said. Current shortages of specialized drilling rigs and hydraulic fracturing equipment are expected to be resolved, and shale production is projected to account for almost 75% of Argentina’s total natural gas production by 2040.

Algeria’s production of oil and natural gas has declined over the past decade, which prompted the government to begin revising investment laws that stipulate preferential treatment for national oil companies in favor of collaboration with international companies to develop shale resources. Algeria has begun a pilot shale gas well project and developed a 20-year investment plan to produce shale gas commercially by 2020, according to EIA. Algerian shale production is projected to account for one-third of the country’s gas production by 2040 (see Shale Daily, Oct. 17, 2014).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |