NGI The Weekly Gas Market Report | LNG | Markets | NGI All News Access

NatGas Demand Growth Big Question in Pacific Northwest, Says NWGA

While robust supplies and low prices are solidly assured for the next 10 years, demand for natural gas is a bit of a crapshoot in the Pacific Northwest, according to the 2016 Gas Outlook released Friday by the Northwest Gas Association (NWGA).

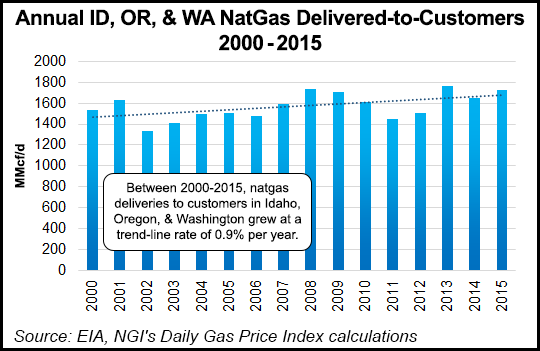

The NWGA’s annual outlook forecast a lengthy “golden age of natural gas,” but it also noted that gas demand growth in the region, which includes Idaho, Oregon, Washington and Canada’s British Columbia, has been “tepid” since the 2008 recession.

“In the Pacific Northwest, according to the U.S. Energy Information Administration, natural gas utility customers saw the cost of the commodity portion of their bills drop by almost 50% in 2015 over what they would have paid in 2008, yet demand growth in most sectors is tepid at best, despite a decent uptick in the region’s economy,” the NWGA researchers said.

Aside from new gas-fired power generation plants, the report said industrial sector gas growth is tied to the proposed Jordan Cove liquefied natural gas (LNG) export project on the Oregon coast and two massive new methanol production refineries in Oregon and Washington (see Daily GPI, April 20; April 11).

“Industrial demand growth in 2015 was nearly nonexistent” in the Pacific Northwest. “Unless and until these plans are finalized, we project almost no additional growth in regional industrial loads.”

A second area of uncertainty is the adequacy of the regional gas infrastructure, particularly if the LNG exports, methanol and gas-fired generation plant projects all come to fruition, said the researchers.

The report examined scenarios involving large new gas loads that could impact regional infrastructure capacity, such as coal-fired power replacement and industrial load growth.

“Additional capacity is likely to be required within the forecast horizon [through 2026] to serve growing demand for natural gas, particularly on a peak design day,” said the authors. “Additional generation demand and industrial loads materially above the expected case will amplify and accelerate the need for incremental capacity required to serve the region.”

The analysis noted that the timing, location and type of future capacity expansions or additions — whether pipelines or storage — along with use of existing infrastructure, “will depend on the changing nature of regional natural gas demand.”

Economically, the U.S. Pacific Northwest continues to outperform the United States as a whole, “thanks to continued strong growth in major metropolitan areas,” according to NWGA’s report.

And in the supply realm, the region continues to benefit from the proximity of two prolific gas supply basins in Western Canada and the U.S. Rockies, which combined accounted for 24.3 Bcf/d last year, or more than 30% of North America’s total gas supply. The projections are for that combined total to reach 30 Bcf/d by 2025.

In general, the regional outlook adheres to the national assessment that “new and abundant gas supplies have changed the nation’s energy picture” through the combination of advances in hydraulic fracturing (fracking) and various time-tested construction/manufacturing processes under the rubric of horizontal drilling. “The combination of these technologies has helped the United States become the world’s largest natural gas producer,” the authors noted.

They also noted that the rapid development of fracking production techniques has spurred more examination by regulators and academics of the potential environmental impacts from the nation’s robust extraction of new gas supplies.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |