So Long, Summer; NatGas Forwards Plunge 20-Plus Cents

After natural gas markets failed to bat an eye at last week’s historic storage withdrawal, it’s no surprise to see forwards markets plunge by double digits this week.

As Thomas Saal, Senior VP of Energy at INTL FCStone made the point on Monday, “It’s flow versus level. As long as the bathtub’s pretty full, it’s not going to create any fear in the market.”

This logic could apply beyond storage to production as well. “I’d guess most folks are trading on the “level” we’re at, which won’t change much in the short term and which fundamentally gives little reason to expect higher prices right now” said NGI’s Nate Harrison, markets analyst.

NGI’s Forward Look shows September prices tumbling an average of 19 cents between Aug. 5 and 10 as this week’s storage report proved decidedly bearish and traders looked to put the hottest days of summer in their rearview mirror.

The Nymex September contract dropped 22 cents during that time, with most of those losses occurring before the U.S. Energy Information Administration reported a larger-than-expected build to storage.

In fact, the Nymex closed just 1 cent lower following the report.

The 29 Bcf build was about 5 Bcf higher than most analysts’ expectations, but it was at the high end of wider-ranging estimates.

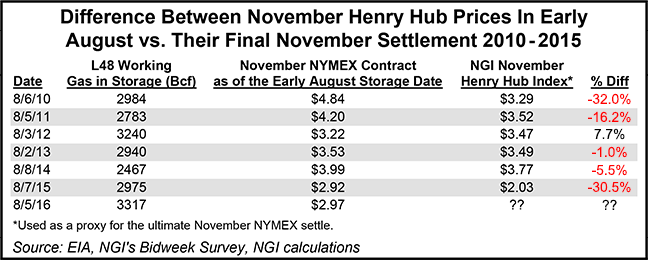

Recent history suggests that the November contract exhibiting weakness at this point in the summer may just be par for the course. “November has settled lower than where it traded during five of the last six years, and in each one of those years, natural gas in storage was higher than where it was on August 5,” said Patrick Rau, NGI’s director of strategy and research. “Interestingly, the only year the November Nymex contract settled higher than its early August price was in 2012, the only other time during this period when the early August working gas in storage level was greater than 3.0 Tcf.

“Of course, the main difference between those years and 2016 is that U.S. natural gas production was in a clear uptrend between 2010-2015, so there was always growing production to compete with injections,” he added. “Production has been declining since the beginning of 2016, however, so perhaps that will help rein in the August-to-November weakness this year.”

“Despite the initial bearish reaction to this week-over-week loosening, prices were down so much on the week that we feel this may not pressure them that much further,” analysts at Bespoke Weather Services said. “Still, inventories remain at record high levels, which caps any upside in prices moving through the coming weeks.”

Indeed, storage stocks are now 12.2% above year-ago levels and 15.3% above the five-year average, according to the Energy Information Administration (EIA).

Meanwhile, weakness in the crude pit could be transferring to natural gas as well, said Rau.

“Weakening crude prices suggest the rally in the oil and gas industry hasn’t quite started to happen just yet,” Rau said. “One shouldn’t necessarily be linked to the other, but if it’s a call on the entire industry, then they are being lumped together.”

It also doesn’t help that practically every publicly traded company has stated they plan to increase natural gas activity going into 2017, Rau said.

“That shouldn’t impact the near months as much, but the near months are where the majority of the volume and open interest lie, so that is what tends to get traded when bullish/bearish sentiment enters the market,” he said.

But after posting losses for six consecutive days, Bespoke said a technical bounce could be in the works for the September contract.

To be sure, the September contract rebounded in Friday morning trading, gaining about 5 cents by mid-day.

“Recent scrapes were somewhat looser, as EIA data yesterday also resulted in early analyst estimates for the data through the next two weeks being raised by 5-10 Bcf,” Bespoke said.

This should continue to cap upside for natural gas prices, thanks in part to continued high production at these levels, and we would need to see signs of either production drop-offs or demand increases at these price levels in order to feel prices could rally back signiï¬cantly to test prior highs, the weather forecaster said.

“That said, moving through the day today, we do see more upside than downside risk sitting near the bottom of our technical channel and with weather model guidance backing off a bit,” Bespoke said.

Indeed, next week is expected to bring some modest relief to the South as widespread showers and thunderstorms should prove quite effective in holding back late-summer heat by preventing the upper ridge from gaining strength, forecasters with NatGasWeather said.

In fact, the next couple days should play out as the last two hottest days of the year until next summer, the forecaster said.

For those in Texas, and especially the folks at power grid operator ERCOT, those words are music to their ears. As temperatures reached the low 100s, and high humidity propelled heat indexes to 115 degrees or more, ERCOT shattered peak demand records not once, not twice but three times over the past week.

Peak loads reached 70,169 MW on Aug. 8, 70,572 MW on Aug. 10 and 71,197 MW on Aug. 11. The previous record of 69,877 MW record occurred on Aug. 10, 2015.

Bearish weather risks continue to increase in the long range as well.

“The latest 12z GFS operational run kept cooler trends for late next week and beyond, highlighting [the fact that] any opportunity for widespread summer heat is quickly fading,” NatGasWeather said.

Diving into the forwards markets, the bearish trend was prevalent across the curve.

The Nymex Henry Hub October contract plummeted 20 cents between Aug. 5 and 10, while the prompt winter dropped about 15.5 cents.

Further out the Nymex strip, summer 2017 prices were down 10 cents during that time, while winter 2017-2018 prices were down 7 cents.

Similar decreases were seen in forward curves across the country as October prices fell an average 17 cents from Aug. 5 to 10, prompt winter prices shed an average 14 cents, summer 2017 forward curve prices slid an average 9 cents and winter 2017-2018 prices slipped an average 7 cents, according to Forward Look.

Northeast prices, however, were comparatively stronger as power burn in that region soared thanks to temperatures that reached the upper 80s and low 90s during the Aug. 5 to Aug. 10 time frame.

In fact, until Thursday (Aug. 11), Transco zone 6-New York forward prices were on track to put up one of the only gains for the week.

But after falling more than 5 cents alone on Thursday, Transco Zone-6 NY September prices ultimately slid 2.3 cents between Aug. 5 and 10 to reach $1.47, Forward Look data shows.

The gains come as energy data and intelligence provider Genscape shows Appalachian demand climbing to 10.72 Bcf/d Bcf/d on Aug. 12 and then to an average 11.06 Bcf/d over the weekend, up from the recent seven-day average of 10.19 Bcf/d.

Demand is expected to wane next week, averaging around 9.97 Bcf/d, Genscape said.

New York October forward prices also posted minimal losses, shedding just 1.4 cents from Aug. 5 to 10 to reach $1.57, according toForward Look.

The rest of the New York curve moved higher, however, as the prompt winter climbed 3.9 cents between Aug. 5 and 10 to reach $6.03, and summer 2017 rose 4 cents to $2.49. The winter 2017-2018 strip was up a much larger 9 cents to $6.36.

And while Tetco M3’s forward curve followed the general bearish trend seen across the country, the losses there were noticeably smaller.

M3 September forward prices fell 11.7 cents between Aug. 5 and 10 to reach $1.20, October slid 8.7 cents to $1.31 and the prompt winter slid 11 cents to $3.95, Forward Look data shows.

The relative strength at a majority of Northeastern forward price points compared to the rest of the country could be partly attributed to the ongoing capacity restrictions through Tetco’s Delmont compressor station near Westmoreland, PA, where an explosion ripped through the pipeline on April 20.

While current nomination trends are largely unaffected by this outage, the seemingly slow progress of repairs could mean constraints come colder weather, especially on peak demand days.

Tetco reported July 29 that while they have worked through much of the Corrective Action Order, they estimate only 10% of the total work has been completed.

There has been little indication on when the pipeline expects a return to full capacity, but pipeline owner Spectra CFO Pat Reddy said the company expects “we’ll be in a position to fully meet our customer obligations for the winter season.”

Meanwhile, maintenance continues on New England’s Algonquin Gas Transmission pipeline, restricting flows between the Stony Point and Oxford compressor stations.

And now, additional work is underway at the TGP Mendon interconnect, which has seen an increase in flows since Algonquin’s summerlong maintenance began.

TGP reported an emergent repair at station 237 near Clifton Springs, NY, on July 30 that continues to reduce capacity through the segment by 100 MMcf/d, down to 921 MMcf/d.

Work at the compressor station is expected to be complete by the end of the month.

Until then, the recent spate of hot weather has likely given some uplift to Algonquin prices as losses across the forward curve were less substantial than most other parts of the country.

AGT September forward prices were down 15.6 cents between Aug. 5 and 10 to reach $2.38, while October was down 13.5 cents to $2.475, according to Forward Look.

AGT’s prompt-winter strip fell 14.3 cents during that time to $5.66, while summer 2017 slid 7 cents to $2.53.

Genscape shows New England demand peaking at 2.71 Bcf/d on Aug. 12, up from the recent seven-day average of 2.16 Bcf/d.

Next week, demand is expected to average even lower at 2.14 Bcf/d, Genscape said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9915 | ISSN © 2577-9877 |