Shale Daily | E&P | NGI All News Access | NGI The Weekly Gas Market Report

Chesapeake’s Barnett Exit to Slash $2B-Plus in NatGas Pipeline Commitments, Costs

Chesapeake Energy Corp., once the biggest natural gas operator in North Texas, agreed late Wednesday to convey its Barnett Shale stakes to First Reserve Corp.-backed Saddle Barnett Resources LLC, a deal that allows it to, among other things, terminate a costly natural gas gathering agreement with Williams Partners LP and boost operating income through 2019.

The agreement between Chesapeake and the private equity-backed unit of Saddle Operating LLC, which included no disclosed financial exchange, had been rumored to be in the works for awhile.

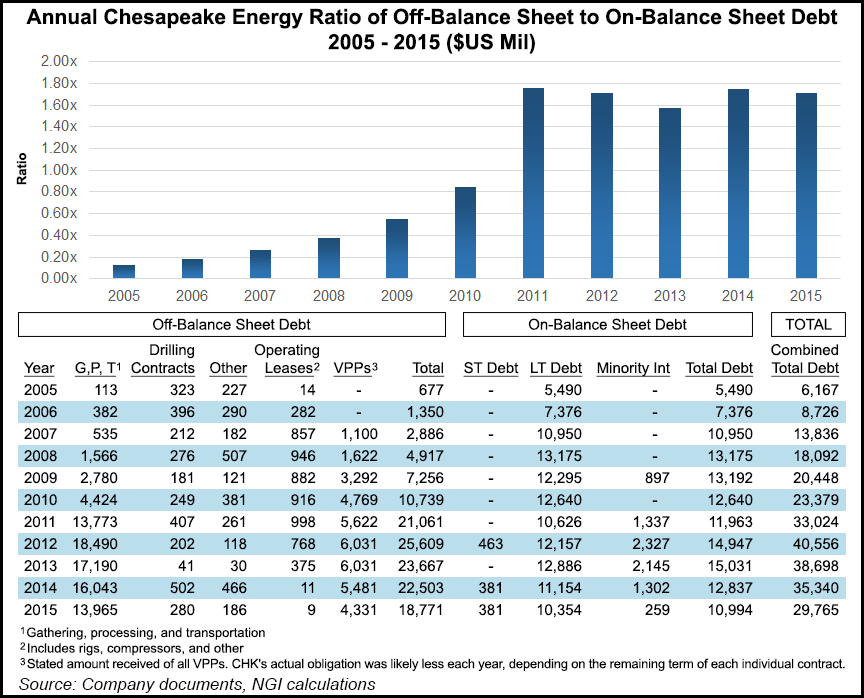

The transaction is expected to eliminate about $1.9 billion of future Barnett midstream and downstream commitments, as well as reduce about $715 million in its gathering, processing and transportation (GP&T) costs to the end of 2017.

The multiple announcements “mark a major step in our continued progress to transform Chesapeake,” CEO Doug Lawler said. “Given the significant negative cash flow profile of the Barnett assets, the net cash paid out in these transactions has a payback of less than 18 months, and it will be partially funded by the $146 million sale and assignment of our long-term gas supply contract.”

To fund the midstream transactions, Chesapeake accelerated the value of a gas supply contract with a $4.00/MMBtu floor pricing mechanism by selling it to an undisclosed third party for $146 million.

The North Texas properties to be conveyed to Saddle, most of which Chesapeake began accumulating in 2004, include 215,000 net developed and undeveloped acres and 2,800 operated wells, which in 2Q2016 produced an average of 65,000 boe/d, 96% weighted to natural gas. The expected net production impact to Chesapeake was estimated at 62,000 boe/d. Proved oil and natural gas reserves in the Barnett as of year-end 2015 were 81 million boe.

The Saddle transaction is expected to be completed by the end of September.

As part of the transaction, Chesapeake and Williams Partners agreed to terminate their current Barnett gathering agreement, projected minimum volume commitment (MVC) shortfall payments and fees, for which Chesapeake agreed to pay $334 million in cash (see Daily GPI, Feb. 18). Saddle is expected to pay an additional sum to Williams when a new gas gathering agreement is executed, which is expected in the third quarter when it completes its purchase from Chesapeake.

Chesapeake’s remaining GP&T agreements for 2016 in the Barnett would be reduced by about $250 million, including $170 million for a projected MVC shortfall payment. The sale also would provide Chesapeake with 2017 projected GP&T expenses within a range of $7.15 to $7.65/boe, around 45 cents/boe lower than current 2016 midpoint guidance.

After removing the Barnett assets and associated MVC payments, the sale is expected to increase by $550 million the present value (PV) of Chesapeake’s oil and gas revenues in the future, minus anticipated expenses, discounted using a yearly discount rate of 10%, otherwise known as PV-10.

In addition, Chesapeake renegotiated a gas gathering agreement in its Midcontinent operating area and agreed to pay Williams $66 million. As a result, Chesapeake’s Midcontinent gas gathering costs should decline by 36%.

“We believe that our approximately 1.5 million net acreage position in the Midcontinent area represents a tremendous resource,” Lawler said. “The new gas gathering agreement makes our operations more competitive and enhances the operating income from this asset.”

During a conference call earlier this month to discuss 2Q2016 results, Lawler put more emphasis on Chesapeake’s Midcontinent results and the Haynesville Shale gas wells (see Shale Daily,Aug. 5). He also said management was “actively working with Williams and all of our midstream and downstream service providers on win-win solutions in the current pricing environment” and expected to “announce additional, meaningful improvements in the near future.”

In an email that Lawler sent to employees on Wednesday, which was obtained by NGI’s Shale Daily, Lawler said the Barnett transaction was not a reflection on the employees who supported the play. Chesapeake has about 170 people working on Barnett-related activities, and they may transition to Saddle, he said.

“While the Barnett has great potential, it simply could not compete for capital in a portfolio with the depth and breadth of Chesapeake’s at current commodity prices,” Lawler wrote.

Chesapeake began acquiring land in North Texas in 2002, but it zeroed in Barnett-specific gas-rich land beginning in 2004 and built a substantial portfolio from there (see Daily GPI, June 6, 2006; Dec. 1, 2004). For perspective, Chesapeake in May 2007 was focusing most of its attention on the Barnett, where it was at the time running 28 rigs (see Daily GPI, May 7, 2007). One year later, however, former CEO Aubrey McClendon predicted that the company’s Haynesville Shale wells would top those in the Barnett (see Daily GPI, July 7, 2008). One year later, McClendon already was claiming the Haynesville would be overshadowed by the Appalachian Basin (see Daily GPI, June 1, 2009). Since 2008, the Barnett never has been a primary focus for the Oklahoma City-based producer.

Williams CEO Alan Armstrong said the revised agreements with Chesapeake “create a win-win commitment that results in both short- and long-term benefits for Williams Partners. Chesapeake is a great customer and an efficient operator; we look forward to a continued strong relationship as its leadership team directs the company’s focus on its most productive areas.”

With the sales and contract changes, Chesapeake issued preliminary 2017 guidance “for the items most directly impacted by these transactions, including wide initial ranges for production and capital spending, in order to highlight our flexibility around commodity prices,” the CEO said.

For full-year 2016, Chesapeake’s total production was adjusted to a loss of minus 2% to a gain of as much as 3% from 2015 output of 559,000 boe/d. Gas production was revised to 1,000-1,040 Bcf. Operating costs for gas production are forecast now to average $1.40-1.50/Mcf.

In 2017, production now is expected to decline by as much as 7% to a low of 2%, with gas production declining to 800-900 Bcf/d. The company prior to the Barnett sale had forecast total output would decline by around 5% in 2017.

Reaction to the transaction by financial analysts that follow Chesapeake was positive. Tudor, Pickering, Holt & Co. said that given the cost to rework the existing GP&G contracts, the “implied asset value is $1.1 billion” or a flowing metric of $3.00/Mcf, which analysts said was “fair value” for the proved, developed producing assets with market rate midstream contracts.

According to analysts with Wells Fargo LLC, the sale of gas assets should reduce Chesapeake’s aggregate volumes to 73% from 75%.

The disclosures, said Jefferies LLC analyst Jonathan Wolff, “indicate near-term cash flow accretion and provides a further beam of light for Chesapeake’s long-term survival.”

“The transformation of Chesapeake into a top-tier E&P company continues, and these transactions, along with our previously announced balance sheet and liquidity improvements, provide significant forward progress,” Lawler said. “We believe there are more positive moves to come.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |