Shale Daily | E&P | NGI All News Access | NGI The Weekly Gas Market Report

Gastar Turning Drillbit to Delineate STACK

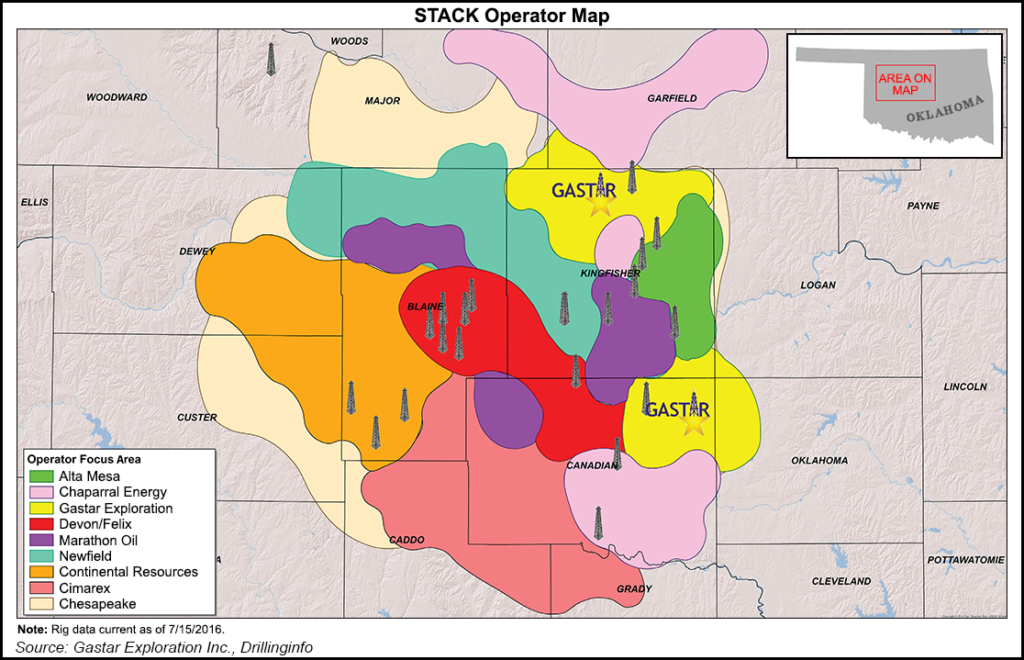

After exiting the Appalachian Basin earlier in the year, Gastar Exploration Inc. plans to spend the rest of 2016 delineating its multiple reservoirs within Oklahoma’s Sooner Trend of the Anadarko Basin, mostly in Canadian and Kingfisher counties, more commonly known as the STACK.

With an estimated 3,900 gross (1,500 net) drilling locations in its 109,000 STACK acres, Gastar is planning a nine-well drilling program to delineate the acreage and determine whether to sell or further develop its assets, management told analysts during a 2Q2016 conference call last week.

The Houston-based exploration and production (E&P) company plans to spud at least six of the nine wells in 2016, raising its full-year capital budget to $61.2 million from $40.5 million.

CEO J. Russell Porter said drilling and completion costs near Gastar’s leasehold are around $4-4.5 million per well, with multiple producing zones that yield a mix weighted to oil.

“At the prevailing commodity prices and current well costs, we project very attractive internal rates of return from the development of each of these prospective formations,” Porter said. “Offset operators are having success developing numerous producing formations in the STACK,” including the Meramec, Osage, Oswego, Woodford and Hunton.

For more on the STACK and other North American oil and gas plays, see NGI’s North American Shale & Resource Plays 2016 Factbook.

Gastar has begun drilling the McGee 29-1H test well in the Osage in southern Garfield County, which is expected to be completed by late September. From there, the E&P will likely move its one rig to Kingfisher County to drill a test well targeting either the Meramec or the Oswego. Gastar may take steps to fund additional drilling beyond the nine-well program to further demonstrate the value of its leasehold position and hold acreage by production, according to Porter.

“Over the next couple quarters, we’ll obtain additional well results from operated and non-operated drilling activity that allow us to evaluate our position and determine how to move forward with the development and/or potential [merger and acquisition] activity,” he said.

Excluding the output from the Appalachian Basin assets that were sold in April (see Shale Daily, Feb. 22), production averaged 6,200 boe/d in the second quarter, flat year/year and a slight increase over the 6,100 boe/d produced in 1Q2016.

Midcontinent production in the second quarter was 71% weighted to liquids, including 48% crude oil, versus 1Q2016 output, which included Appalachian volumes, that was 56% weighted to liquids.

Gastar’s Deep River 30-1H Meramec well in Kingfisher County (see Shale Daily, Jan. 12), which began flowback last October, continues to produce at a post-peak 230-day average gross rate of 513 boe/d, with 53% weighted to oil, Porter said. A second operated Meramec well, the Holiday Road 2-1H (see Shale Daily, March 30), which began flowback in April, produced a recent five-day gross average of 343 boe/d, 82% weighted to oil, he said.

“It bears noting that the Osage formation looks excellent at the Holiday Road location, and we’re currently participating in the drilling of a non-operated Osage well adjacent to the Holiday Road well,” Porter said.

Production in 2Q2016 totaled 583,000 boe, including 271,000 bbl of oil, 1 Bcf of natural gas and 142,000 bbl of natural gas liquids (NGL). Daily production averaged 3,000 b/d of oil, 11.2 MMcf/d of natural gas and 1,600 b/d of NGLs.

Year-ago production totaled 1.26 million boe, or 369,000 bbl of oil, 3.57 Bcf of gas and 297 bbl of NGLs, with the sale of Gastar’s Appalachian assets accounting for much of the difference. Year-ago daily production averaged 13,900 boe/d, including 4,100 b/d of oil, 39.3 MMcf/d of gas and 3,300 b/d of NGLs.

Average sales prices for the quarter, excluding hedges, were $41.82/bbl for oil, $1.84/Mcf for gas and $12.02 for NGLs, compared with prices of $47.68/bbl, $1.10/Mcf and $7.34/bbl in the year-ago quarter. Average sales price before the impact of hedging, was $25.60/boe for the quarter, compared with $12.07/boe in the first quarter and $18.79/boe in the year-ago period. CFO Michael Gerlich attributed the higher per-boe price to a production mix weighted more heavily to liquids following the Appalachian divestiture.

Lease operating expenses (LOE) totaled $4.6 million, down from $7.2 million in 2Q2015 and $6.1 million in the first quarter. LOE excluding the Appalachian Basin costs decreased 20% to $4.5 million, driven in part by a $1.6 million decrease in workover expenses.

Depreciation, depletion and amortization (DD&A) costs declined to $5.6 million in the quarter, compared with $16.1 million in the year-ago period and $13.7 million in the first quarter. DD&A costs were lower as a result of previous impairment charges and factors related to the Appalachian divestiture.

General and administrative (G&A) costs totaled $6.3 million in the second quarter, compared with $4.4 million in the year-ago quarter and $5.7 million in 1Q2016. Management attributed the higher G&A expenses to an allowance for a $2 million bad debt expense charge related to a third-party production purchaser’s bankruptcy.

Gastar reported a quarterly net loss of $18.1 million (minus 17 cents/share), compared with a net loss of $118 million (minus $1.52) in the year-ago period.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |