Summer Power Burn Soars; EIA Raises 2016 NatGas Price Forecast to $2.41/MMBtu

Driven by competitive economics relative to coal and by warmer-than-normal temperatures, the amount of electricity generated using natural gas reached a record high during July, surpassing a record set in July 2015, according to the Energy Information Administration (EIA).

EIA expects natural gas to fuel 34% of electricity generation this year, compared with 33% in 2015, and coal is expected to be used for 30% of power generation, down from 33% last year.

“Despite the recent rise in natural gas prices, hot weather across the country is leading power plants to pull more natural gas from storage this summer, with the amount of electricity generated by natural gas to meet cooling demand reaching a record high in July,” said EIA Administrator Adam Sieminski. “Natural gas inventories were drawn down in the last week in July for the first time in 10 years during the June-August period, when gas stocks normally increase.”

Record-high natural gas power burn was the driving factor behind last week’s unusual 6 Bcf summer storage withdrawal, EIA said Monday (see Daily GPI, Aug. 8).

Thus far, 2016 power burn has outpaced 2015, which was already a banner year for natural gas consumption for electric generation (see Daily GPI, April 5).

Through the first five months of 2016, U.S. natural gas power burn was up 7.4% from the same period in 2015, according to NGI’s analysis of the latest EIA electric power data. Meanwhile, the Henry Hub bidweek price for the first five months of 2016 averaged $2.034/MMBtu, down 27.8% from $2.818/MMBtu in the year-ago period, according to NGI data.

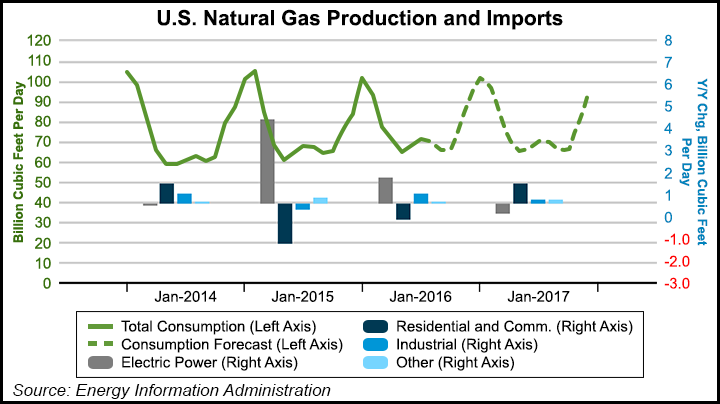

EIA’s forecast of U.S. total natural gas consumption averages 76.3 Bcf/d in 2016 and 77.2 Bcf/d in 2017, compared with 75.3 Bcf/d in 2015, according to the agency’s latest Short-Term Energy Outlook (STEO), which attributes the increases primarily to increases in electric power sector use. “Forecast electric power sector use of natural gas increases by 4.8% in 2016, then declines by 1.7% in 2017 as rising natural gas prices contribute to increasing coal use for electricity generation,” EIA said. Industrial sector consumption of natural gas is forecast to increase by 2.5% this year and by 1.1% next year, as new fertilizer and chemical projects come online.

Power generation’s increasing gas use is helping to bolster prices. For a second consecutive month, EIA nudged its 2016 price forecast higher, this time to $2.41/MMBtu. Last month, EIA said it expected 2016 Henry Hub spot prices to average $2.36/MMBtu in 2016 (see Shale Daily, July 12). EIA’s June forecast for 2016 was $2.22/MMBtu (see Shale Daily, June 7).

The 2017 price forecast remained unchanged at $2.95/MMBtu.

Henry Hub prices averaged $2.82/MMBtu last month, an increase of 24 cents from June, according to the STEO. Natural gas futures prices for November 2016 delivery (for the five-day period ending Aug.4) averaged $3.01/MMBtu.

Current options and futures prices imply that market participants place the lower and upper bounds for the 95% confidence interval for November 2016 contracts at $2.12/MMBtu and $4.28/MMBtu, respectively. At this time last year, the natural gas futures contract for November 2015 averaged $2.91/MMBtu and the corresponding lower and upper limits of the 95% confidence interval were $2.08/MMBtu and $4.06/MMBtu, EIA said.

Last week’s unanticipated withdrawal of 6 Bcf from storage put inventories at 3,288 Bcf, nearly as high as ever for this point in the injection season, 389 Bcf greater than last year and 464 Bcf more than the five-year average (see Daily GPI, Aug. 4). EIA forecasts natural gas inventories to be 4,042 Bcf at the end of October, which would be a record high level for that time of year.

Marketed production in May, the month of the most recent survey data, averaged 78.1 Bcf/d, down 2.0 Bcf/d from the record-high daily average production in February. EIA said it expects production to increase in late 2016 and through 2017 in response to forecast price increases and increases in liquefied natural gas (LNG) exports. The agency forecast natural gas production to increase by 0.6% this year and by 2.9% next year.

Natural gas exports by pipeline to Mexico have been on the rise this year, and EIA expects that growth to continue because of growing demand from Mexico’s electric power sector and flat natural gas production in Mexico. Gross pipeline exports are expected to increase by 0.7 Bcf/d this year and by 0.1 Bcf/d next year to an average of 5.7 Bcf/d

EIA projects LNG gross exports will increase to an average of 0.5 Bcf/d in 2016, with the startup of Cheniere Energy’s Sabine Pass LNG liquefaction plant in Louisiana, which sent out its first cargo in February (see Daily GPI, Feb. 24). EIA projects gross LNG exports will average 1.3 Bcf/d in 2017 as Sabine Pass ramps up its capacity.

The United States exported 104.63 Bcf (3.38 Bcf/d) to Mexico through pipelines in May, the most of any month on record and a 21% increase compared with 86.81 Bcf (2.80 Bcf/d) exported in May 2015, according to EIA (see Daily GPI, Aug. 2).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2158-8023 |