Shale Daily | E&P | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

Energen Building Up Permian DUCs For 1H2017

After posting strong results in 2Q2016, Energen Corp. is moving forward on a drilling plan in the Permian Basin that could see the pure-play operator achieve double-digit production growth in 2017.

After increasing production 7% sequentially in the second quarter, the Birmingham, AL-based exploration and production (E&P) company raised the midpoint of its 2016 guidance by 2%. The company, which recently shed its remaining San Juan Basin assets to focus on the Permian (see Shale Daily, June 21), attributed its strong quarterly production to the outperformance of its horizontal wells in the Midland sub-basin.

CEO James McManus said the company is looking to build an inventory of 54-58 drilled but uncompleted (DUC) wells by the end of the year.

“While our plans for 2017 are still evolving, we believe that completing our DUC inventory in the first half of 2017 combined with additional drilling and development supports year-over-year, double-digit production growth in 2017,” McManus said.

In 2Q2016, Energen completed its remaining inventory of 14 DUCs in the Midland and placed into production a total of 24 DUCs. Twenty-two were located in Martin County targeting the Lower Spraberry, Wolfcamp A and Wolfcamp B, while two were in Glasscock County targeting the Wolfcamp A and B.

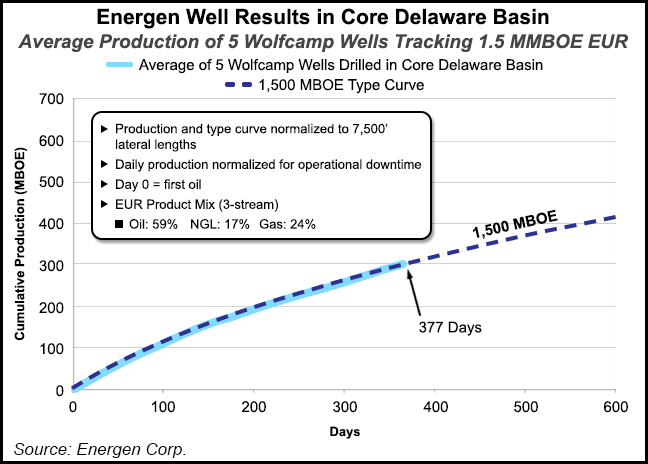

Energen is continuing to expand its core acreage in the Delaware sub-basin, bolting on 850 acres in July. The E&P said it is increasing its position in the play based on strong recent well results showing estimated ultimate recoveries of 1.1 million boe for a 4,500-foot lateral, 1.5 million boe for a 7,500-foot lateral and 2 million boe for a 10,000-foot lateral.

The company attributed the Delaware results to increased flow rates resulting from optimized surface facilities. Energen said it drilled a 9,000-foot lateral in the Wolfcamp A in 22.4 days from spud to total depth with an estimated drill and complete cost of $7.2 million.

The E&P anticipates $450 million in capital expenditures for full-year 2016 to develop its acreage, including $300 allocated to the Midland and $130 for the Delaware. The company expects to exit 2016 with an inventory of 38-40 gross (37-39 net) horizontal DUCs in the Midland and 17-19 gross (17-19 net) horizontal DUCs in the Delaware, as well as 1 gross (1 net) vertical DUC in the Delaware.

Total lease operating expenses for the quarter, including marketing and transportation, declined to $7.29/boe, compared with $9.09/boe for the year-ago quarter. Management cited lower costs for water disposal and electrical power, as well as reduced costs from fewer workovers.

Total quarterly production, excluding asset sales, averaged 56,000 boe/d, up from 52,300 boe/d in the first quarter and 55,400 boe/d in the year-ago period. Broken down by area, the company produced 37,100 boe/d out of the Midland, 9,800 boe/d out of the Delaware and 9,100 boe/d from other areas.

Realized prices averaged $39.52/bbl for oil, 32 cents/gallon for natural gas liquids and $1.68/Mcf for natural gas, compared with prices of $69.39/bll, 34 cents/gallon and $4.22/Mcf in the year-ago quarter.

Energen posted a net income for the quarter of $36.8 million (38 cents/share), compared with a net loss of $111.6 million (minus $1.52/share) in the year-ago quarter. Lower commodity prices were offset by a reduction in depreciation, depletion and amortization costs, lower net salaries and reduced general and administrative expenses, the company said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |