Bankruptcy Judge Approves Sabine Chapter 11 Exit Plan

A bankruptcy court judge in Manhattan has approved a second amended plan for Sabine Oil & Gas Corp., which calls for the company to emerge from Chapter 11 later this year.

On Wednesday in U.S. Bankruptcy Court for the Southern District of New York, Judge Shelley Chapman issued findings of fact and conclusions of law in the case [No. 15-11835]. According to court documents, the plan for Sabine to emerge from bankruptcy calls for the cancellation of all of the company’s equity interests and new common stock issued. All existing securities and agreements will also be cancelled.

Under the plan, the reorganized company and its debtors will enter into an exit revolver credit facility agreement, with initial commitments equal to $200 million. The agreement — which will be provided to each of the reserve-based lending facility (RBL) lenders on account of its pro rata share of the allowed RBL secured claims — will contain deemed borrowings equal to $100 million, have an initial borrowing base of approximately $150 million, and mature at the end of 2020. It will be secured by first-priority security interests in and liens on substantially all of assets of the reorganized company and its debtors.

The reorganized company will also enter into a new second lien credit facility, a term loan with a principal amount of $150 million maturing at the end of 2021. It will be secured by second-priority security interests in and liens on substantially all of assets of the reorganized company and its debtors.

A new five-member board will be appointed to lead the company. Wells Fargo Bank NA and Barclays Bank plc will each appoint one member, while RBL lenders will appoint two others, provided they are “reasonably acceptable” to Wells Fargo and Barclays. The fifth board member will be the CEO.

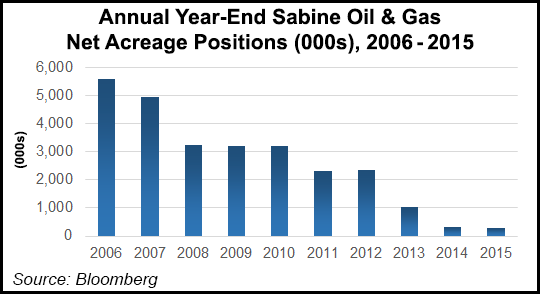

Sabine has fought a bitter battle in bankruptcy court with its creditors and midstream companies it signed agreements with in the past. Faced with crushing debt and the collapse in oil and gas prices, Houston-based Sabine voluntarily filed for Chapter 11 bankruptcy in July 2015 (see Shale Daily, July 15, 2015).

Last month, Chapman rejected a motion by Nordheim Eagle Ford Gathering LLC and HPIP Gonzales Holdings LLC to stay a court ruling that would have allowed Sabine to cancel agreements it signed with them in 2013 and 2014 (see Shale Daily, June 15). Chapman also rejected a summary judgment stay motion.

Chapman ruled last March that Sabine could terminate agreements with Nordheim, a subsidiary of Cheniere Energy Inc., and HPIP, but was unable to determine whether the covenants at issue run with the land under Texas law and ordered further proceedings on the matter (see Daily GPI, March 9; March 8). The court ultimately sided with Sabine in May, agreeing that the contracts do not run with the land.

Midstream companies are fearful that, should Sabine and other producers be allowed to terminate their contracts, a host of other E&P companies struggling in the low commodity price environment could attempt the same strategy (see Daily GPI,Feb. 23).

Executives and analysts are divided over whether the Sabine case could spell trouble for the midstream sector. While some agree the ruling could be troublesome, others don’t believe the ruling sets a precedent. Nevertheless, the latter group is advising midstream companies to fortify their contracts with producers.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |