NGI Data | Markets | NGI All News Access

California NatGas Cash Gains Offset Eastern Losses; August Out Like A Lamb

Looking at national average natural gas cash prices for next-day gas deliveries might make one think summer doldrums have set in, but nothing could be further from the truth. Sharp weather-driven surges in West Coast power prices, and a Flex Alert called by the electric grid operator, had California prices posting stout double digit gains. On the East Coast, major market centers showed double-digit losses, but the NGI National Spot Gas Average rose a lackluster 3 cents to $2.61.

The expired August futures limped across the finish line. August settled at $2.672, down 4.0 cents, and September ended at $2.660, down 1.7 cents. September crude oil continued to unravel losing $1.00 to $41.92/bbl.

Next-day power in California jumped as major markets were expected to see temperatures 10 degrees or more than normal. Forecaster Wunderground.com said the high Wednesday in Los Angeles of 91 degrees would “ease” to 85 Thursday before rebounding to 88 Friday. The seasonal norm for Los Angeles is 76. Sacramento’s 106 max Wednesday was expected to be 105 Thursday and 104 Friday. The normal high in Sacramento this time of year is 93.

Gas at Malin added 7 cents to $2.73, and deliveries to the PG&E Citygate added a nickel to $3.15. Packages at the SoCal Citygate jumped 25 cents to $3.42, and gas priced at the SoCal Border Avg. Average rose 33 cents to $3.26.

Inbound gas on El Paso S. Mainline/N. Baja vaulted 51 cents to $3.61 and gas at Kern Delivery rose 43 cents to $3.46.

“Gas nominations at Opal were down sharply, and that passed through to Kern Delivery,” said EnergyGPS principal Jeff Richter. “Also, gas on El Paso just got diverted back east to satisfy heat-related requirements in Las Vegas and other points. With Kern and El Paso so much higher than SoCal Border and SoCal Citygate, those points now have to rely on storage gas.”

The California Independent System Operator (CAISO) forecast Wednesday’s peak load of a hefty 45,786 MW would increase to an even heftier 46,888 MW Thursday.

CAISO issued a Flex Alert for Wednesday from 2-9 p.m. and urged residents to conserve electricity to avoid power disruptions (see related story).

CAISO also said it was declaring restricted maintenance on grid generation operations for the period from Wednesday from 6 a.m. to 10 p.m. and declared that the grid operator “anticipates generation resources may be inadequate for the period covered by this notice.”

Eastern market center prices went in the other direction. Gas bound for New York City on Transco Zone 6 fell 23 cents to $2.39, and packages at the Algonquin Citygate shed 22 cents to $2.95. Gas on Tennessee Zone 6 200 L was quoted 15 cents lower at $2.93.

Tim Evans of Citi Futures Perspective sees the market eventually moving lower as cooling demand subsides and storage injections increase.

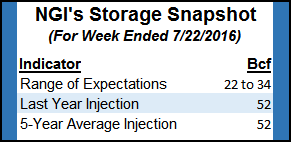

“While hot summer temperatures remain a current support for the market, we continue to see the seasonal cooling trend that will follow as a bearish factor, at least relative to the prevailing price level,” Evans said. Expectations for Thursday’s Energy Information Administration storage report “for the week ended July 22 are still being compiled by the major newswires, but estimates we’ve seen so far suggest a consensus running in the vicinity of 30 Bcf in net injections. This would be a modest decline from the 30 Bcf refill in the prior week and a supportive contrast with the 52 Bcf five-year average gain.”

Evans estimated a 24 Bcf build, and he suggested this sets the market up for a bullish surprise. His figures show that by Aug. 12, the year-on-five-year storage surplus could fall from its current 559 Bcf to 428 Bcf.

Other estimates of Thursday’s storage build are somewhat higher. Raymond James estimates an increase of 30 Bcf, and a Reuters survey of 18 traders and analysts showed an average 26 Bcf with a range of 22 Bcf to 33 Bcf. Last year 52 Bcf was injected, and the five-year average is also a 52 Bcf build.

Evans said he wouldn’t “rule out” a continuation of this trend, although he doesn’t have a specific forecast. “This declining surplus confirms that the market is becoming tighter on a seasonally adjusted basis, which most often translates into rising prices over the intermediate term.”

Once cooler temperatures set in, power sector demand is likely to decline.

“We think this weakening of current demand may allow the market to fall to the $2.40-2.50 range in the weeks ahead, which we view as a more appropriate discount to last year’s valuation given what was still a 471 Bcf year-on-year storage surplus as of July 15,” Evans said.

He is currently on the sidelines awaiting a new, limited-risk trade entry.

Weather-wise, look for brief respite from eastern heat followed by a return of warmth by next week.

“Fresh midday weather data continues streaming in, and again no major changes in the latest weather data, although there remain important differences between some of the major weather models on just how hot the first half of August will play out,” said Natgasweather.com in an update.

“To our view, regardless, it will be very warm to hot with stronger than normal nat gas demand. Until then, after a hot start to the week, cooler temperatures will spill across the Great Lakes and Mid-Atlantic over the next several days due to a weather systems with showers and thunderstorms tracking through. This cooler period will last through the coming weekend, easing natgas demand from recent very high levels to just slightly above normal even though it remains quite hot and humid with 90s and 100s over the western, central, and eastern U.S.

“However, as expected, early next week the hot upper ridge will bounce back with increasing strength, while also expanding back across much of the northern and eastern U.S. to bring another several day period of very strong nat gas demand around Tuesday through Friday of next week.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |