NGI All News Access | Infrastructure | Markets

Weak Physical NatGas Outdone By Still Weaker Futures; August Sheds 7 Cents

Natural gas for Thursday delivery was mostly lower in Wednesday’s trading as double-digit average advances at Northeast points were unable to counter broad declines in Texas, Louisiana, the Midcontinent and Midwest.

The NGI National Spot Gas Average fell 4 cents to $2.52. Futures trading was all directed lower as traders hinted that the market may have been overly exuberant in its late June run up close to $3 and that along with a weaker petroleum sector made the decline inevitable. At the close August had fallen 7.0 cents to $2.658 and September was down 6.8 cents to $2.621. The expired August crude oil added 29 cents to $44.94/bbl. after trading as low as $43.69/bbl.

The decline has traders recalculating trading parameters, and “we are now in the $2.50 to $2.75 range once again,” a New York floor trader said. “We’ve seen crude and products decline, and we are still above the one and five-year storage averages.”

Traders were scratching their heads trying to figure out the day’s price move in light of forecasts for hot weather and expected thin storage builds. “The price weakness despite these supports highlights the extent to which June’s price rally may have left the market overvalued and vulnerable to just such a downward correction,” said Tim Evans of Citi futures perspective.

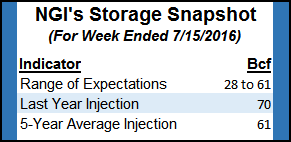

Evans forecasts a build of 37 Bcf in Thursday’s storage report and analysts at ICAP Energy are looking for a 41 Bcf increase. A Reuters poll of 20 traders and analysts revealed an average 39 Bcf with a range of 28 Bcf to 61 Bcf.

In midsession Nymex trading the Intercontinental Exchange EIA futures contract was 37 Bcf bid at 39 Bcf offered. The contract is traded in units of 1 Bcf and a change of 1 Bcf results in a gain or loss of $1,000.

Last year 70 Bcf was injected and the five-year pace stands at 61 Bcf.

Next-day prices in the Midwest declined in spite of the loss of deliveries out of the Marcellus (see Daily GPI, July 18). “Rockies Express began the planned Zone 3 compressor station tie-in work on Tuesday which has halted all flows between eastern Ohio and central Indiana,” said industry consultant Genscape. “REX normally flows 1.8 Bcf/d of Utica gas [west] along this segment to feed major interconnects with pipelines serving Midwest markets. Until the work is completed, interconnects with NGPL, ANR, Panhandle, Midwest GT, and Trunkline will be short nearly 2 Bcf/d, and a significant amount of gas will need to be shut-in.”

Gas on Alliance was quoted 7 cents lower at $2.66 and deliveries to the Chicago Citygate fell 5 cents to $2.72. Gas on Consumers fell 8 cents to $2.66 and deliveries to Michigan Consolidated changed hands a dime lower at $2.62.

Downstream REX points on the Zone 3 Expansion also eased. Gas delivered to ANR at Shelby County, IN, skidded 9 cents to $2.64, and packages at the Trunkline interconnect in Douglas County, IL, were down 5 cents to $2.69. Gas at the NGPL connection in Moultrie County, IL, shed 7 cents to $2.68. See the NGI Rex Zone 3 Tracker.

A Michigan marketer said that temperatures “had not gotten up to the oppressive levels quite yet. It’s close to 90 and will get higher than that over the weekend.”

The marketer said that temperatures since the first of the month haven’t been of the variety that would cause additional spot purchases. “We haven’t bought anything since bid week. We’ll have to check customer usage Monday and see if additional gas is needed. In the meantime we have been able to move gas around between customers.”

Gas buyers for power generation Wednesday had an active weather landscape to deal with.

“A large ridge of high pressure will build over the southern Plains,” said Kari Strenfel, a Wunderground.com meteorologist. “This high-pressure system will usher warm and moist air over the Plains and the Midwest, [and] a wave of low pressure will transition slowly across the northern Plains.

“This system will collide with the aforementioned air mass, producing rain and thunderstorms in the northern Plains and the Midwest. Prolonged heavy rain will bring threats of flash flooding to southern Wisconsin, eastern Iowa, Illinois and northwest Indiana. Most of the central and southern Plains will experience hot and dry weather.”

Tom Saal, vice president at FCStone Latin America LLC in Miami, in his work with Market Profile expected the market to test Wednesday’s value area at $2.753 to $2.723. He identified the week’s initial balance at $2.786 to $2.708. Market Profile methodology requires traders to follow the market either higher or lower should it break above or below the initial balance parameters. He identifies trading targets lower at $2.669 and $2.630 and at $2.825 and $2.864 higher.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |