NGI The Weekly Gas Market Report | E&P | NGI All News Access

Peak Rig Count? Nine Hundred the New 2,000, Says Halliburton

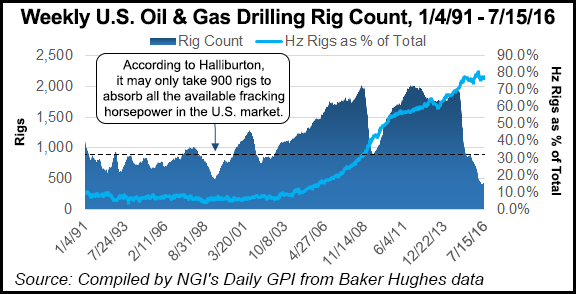

When it comes to the peak U.S. rig count, 900 is the new 2,000, Halliburton Co. President Jeff Miller told investors during the company’s 2Q2016 earnings call Wednesday.

“I believe that it’ll only take 900 rigs to consume all of the horsepower available in the market. Why? Well, we know the North American market best, and we are in every single part of that market, and what’s clear to us is that the increases in rig efficiency, lateral length and sand per well create a compounding effect that consumes increasingly more horsepower per rig,” Miller said.

He said the Houston, TX-based oilfield services giant has also witnessed “the effect of the downturn on North American service capacity every day and in every basin. We’ve seen the attrition of equipment, people and companies.”

Halliburton management estimates that as much as 4 million hp — maybe more — “has been permanently removed from the market” due to scrapping or cannibalization. That’s about 20% of the horsepower reported during the industry’s peak, Miller said. “And more is permanently impaired each day. Industry headcount reductions continue, and many of these people are leaving the industry…[while] bankruptcies and consolidations also work to accelerate equipment attrition.”

At the start of the downturn, 2,000 rigs could be balanced by around 600 frack crews, Miller said.

“So, a little more than three rigs kept every frack crew busy.” Today “rigs have gotten almost 30% faster, meaning more wells per rig per year, so that new ratio is closer to two or two and a half rigs for every crew,” he said. Meanwhile, the intensity of a typical frack job has increased by “almost 20% more, meaning that the same horsepower that made up 600 crews now only makes up 500.”

The end result, after accounting for attrition, means the North American upstream currently would max out at 900 rigs.

“So I think the important point is that the market can tighten maybe faster than you think,” Miller said.

Halliburton planned for a future recovery by keeping its crews active and protecting its market position while “absorbing the pain of pricing reaching unsustainable levels,” he said. The company “preserved idle equipment outside of our field locations so it doesn’t get cannibalized. It’s clear to me that it will be cheaper to reactivate our cold-stacked equipment than to put capital into cannibalized horsepower.”

He added that “equipment that has not been maintained and has been cannibalized could be very difficult to get economically back in the marketplace.”

Moving forward, Halliburton is making progress on a target of reducing structural costs by $1 billion by the end of 2016, Miller said. The next step will be to increase capacity utilization rates for its pressure pumping equipment, and the final step in a recovery will be the return of pricing.

“Price negotiations have been a bar room brawl, and in certain situations, as we’ve seen the signs of recovery, we’ve elected to walk away from money-losing jobs in recent months,” Miller said. “We’ve been reviewing every contract and program down to individual wells on a pad-by-pad basis, including opportunities for pass-through and cost-related pricing and surcharges. It’s a tough market, but we believe pricing will recover as activity increases.”

He expressed confidence that once the necessary ingredients for recovery are in place that “North American margins will return to double digits.”

When asked about whether the North American market’s current active horsepower can get to an 80% utilization rate, CEO David Lesar said it’s important to look more closely than the overall average.

“There are pumping companies out there that have zero utilization today because they can’t find a customer, or they’re in the wrong basin, or their equipment is not qualified to pump the formation where they are,” Lesar said. “…I think a lot of people like to lump everybody together and talk about averages, but I really think it’s important to segregate the market into the various basins, the various customers that are drilling, the types of formations that are being drilled, the kinds of completions that are getting done, before you get a more granular view of what is really going on out there.

“…But I think it’s important to stay away from averages, because I think you can actually draw the wrong conclusions about the health of the industry.”

Management said Wednesday that the psychology of the North American market is shifting and looking ahead to a recovery. Though Halliburton’s second quarter results reflect a “challenging environment” for the company, the 2Q2016 numbers could ultimately “mark the trough” leading up to a recovery, Lesar said.

The recent uptick in the rig count, combined with more optimistic operator sentiment, points to “a measured step up” from the worst of the downturn “as opposed to a boom,” Lesar said.

For the second quarter, Halliburton posted total revenue of $3.8 billion, down from $5.9 billion in the year-ago quarter and $4.2 billion in 1Q2016.

The company reported a net loss for the quarter of $3.2 billion (minus $3.73/share), compared with a net income of $53 million (6 cents/share) in the year-ago period. For 1Q2016, Halliburton reported a net loss of $2.4 billion (minus $2.81/share).

Costs related to the termination of the proposed merger with Baker Hughes Inc. (see Daily GPI, May 2) totaled $3.5 billion, which was reflected in the 2Q2016 results.

Cash flow for the quarter was “particularly noisy because of the termination of the Baker Hughes deal and continued restructuring work we are doing,” CFO Mark McCollum said. “When the smoke clears from the unusual items, however, cash flow from operations were slightly positive, and we closed the quarter with $3.1 billion in cash and equivalents.”

Stay up to date on 2Q16 earnings and projections for the remainder of the year with NGI‘s Earnings Call and Coverage sheet.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |