NGI Weekly Gas Price Index | Markets | NGI All News Access

Weekly NatGas Prices Drop A Penny In Tranquil Trading; Futures Slide

On balance weekly natgas trading was a subdued affair, but you would be hard pressed to convince traders working the Rockies, California, or Southeast markets as the Rockies and California experienced double-digit gains and the Southeast endured average losses of nearly 30 cents.

The NGI Weekly Spot Gas Average fell all of a penny to $2.54. Leading all points higher was a 26-cent gain at Kingsgate to average $2.42 and the weakest weekly performer was FGT Citygate with a $1.90-cent drop to $3.60.

Regionally the Rockies added 15 cents to $2.54 and California advanced 17 cents to $2.74. The Southeast found itself at the bottom of the pile dropping 29 cents to $2.88.

The Northeast skidded 9 cents to $2.51 and Appalachia shed 6 cents to $1.56.

South Texas on average was 4 cents lower at $2.65, and South Louisiana and East Texas both fell a couple of pennies to $2.70 and $2.68, respectively.

The Midwest was a penny lower at $2.68 and the Midcontinent was up a penny at $2.58.

August futures shed 4.5 cents to $2.756.

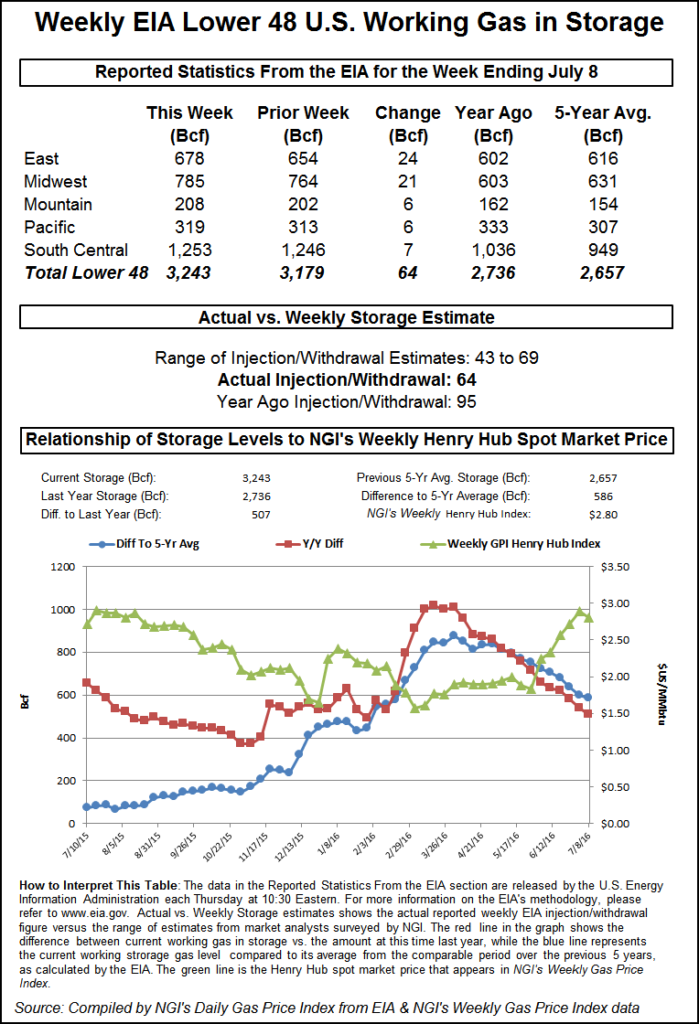

The Energy Information Administration (EIA) Thursday reported a storage build of 64 Bcf for the week ending July 8, about 5 Bcf above expectations and the market counter intuitively rose after the number was released. In derivatives market trading, however, the higher build was already in the market, and at the close August had fallen 1.0 cents to $2.727, and September was unchanged at $2.707.

When the EIA reported the higher than expected storage injection, August futures curiously traded to a high of $2.769 immediately after the figures were released and by 10:45 a.m. August was trading at $2.745 up 8-tenths of a cent from Wednesday’s settlement.

“Even though we were looking for a 59 Bcf build, it didn’t have all that much impact. It should have come off but it held,” said a New York floor trader.

“There is an EIA swap market traded on the ICE (Intercontinental Exchange) and before the number came out it was 65 bid at 67 so based on that market it was probably already factored in.”

“The 64 Bcf build was somewhat above the consensus expectation, most likely because the July 4th holiday had a somewhat larger impact on demand than anticipated,” said Tim Evans of Citi Futures Perspective. “The build was still less than the 95 Bcf jump a year ago and the 77 Bcf five-year average, and so still constructive in supporting prices over the intermediate term.”

Inventories now stand at 3,243 Bcf and are 507 Bcf greater than last year and 586 Bcf more than the five-year average. In the East Region 24 Bcf were injected and the Midwest Region saw inventories increase by 21 Bcf also. Stocks in the Mountain Region rose 6 Bcf, and the Pacific Region was higher by 6 Bcf. The South Central Region rose by 7 Bcf.t

In Friday trading natural gas buyers for weekend and Monday delivery elected to take a pass and were reluctant to commit to three-day deals.

Prices fell, with only a handful of points followed by NGI either unchanged or in positive territory. Losses were greatest in the Northeast, with average declines approaching 50 cents, but declines of a dime or more were the norm across nearly all market points.

The NGI National Spot Gas Average fell 15 cents to $2.42.. Futures managed to waffle to an uninspired close higher, although traders currently see risk in the front of the curve to the downside. At the close, August had added 2.9 cents to $2.756 and September was higher by 2.1 cents to $2.728.

Although eastern points led the day’s decline, price volatility has been in ample supply. Construction and maintenance have pushed Algonquin Gas Transmission (AGT) to the head of the class recently as work on compressor stations, expansions, and looping have caused shippers to navigate a host of restrictions to interruptible, out of path and in path pipeline transportation.

For gas day July 15, for example, AGT “has restricted 100% interruptible, 100% secondary out of path and 100% secondary in path nominations sourced from points west of its Stony Point Compressor Station for delivery east of Stony Point. No increases in nominations sourced west of Stony Point for delivery east of Stony Point, except for Primary Firm No-Notice nominations, will be accepted.”

The Stony Point compressor station is not the only point involved. “AGT has restricted 100% interruptible and approximately 67% secondary out of path nominations that exceed entitlements sourced from points west of its Oxford Compressor Station for delivery east of Oxford. No increases in nominations sourced west of Oxford for delivery east of Oxford, except for Primary Firm No-Notice nominations, will be accepted,” the company said on its website.

Gas at the Algonquin Citygate fell 28 cents to $2.78, and deliveries to Iroquois, Waddington skidded 23 cents to $2.66. Gas on Tennessee Zone 6 200 L fell 46 cents to $2.67.

Other Northeast points gave ground as well even though temperatures were expected to remain above normal. Weekend power loads were forecast to fall substantially and not recover until Monday. The New York Independent System Operator forecast peak New York loads of 28,212 MW Friday would plunge to 23,893 MW Saturday and reach 28,359 MW by Monday. PJM Interconnection predicted Friday’s peak load of 51,466 MW would slide to 48,205 MW Saturday, before climbing back to 52,930 MW Monday.

Gas bound for New York City on Transco Zone 6 tumbled 81 cents to $1.77, and gas on Transco non New York North serving southeasternmost Pennsylvania, Trenton and southern New Jersey gave up a healthy 79 cents to $1.80.

Major hubs took it on the chin as well. Gas at the Chicago Citygate fell a dime to $2.63 and gas at the Henry Hub retreated 10 cents as well to $2.67. Gas at the PG&E Citygate was quoted 12 cents lower at $2.87.

Traders see short term risk to the downside. “You have got to figure all the information is priced in. Everybody sees the hot weather, and the power burns but this market can’t get off the ground,” said Jeff Richter, principal with EnergyGPS, a Portland, OR-based energy, power, and risk management firm.

“Next week we might see production come off because of maintenance to major pipelines, and that could keep the market up, but at the end of this month you are coming off the highs from a temperature standpoint. What’s the upside from $2.75? Maybe 5 cents. What’s the downside? $2.50 is the next benchmark. That’s just the front of the curve. Everyone will keep the back end of the curve up because of winter.

“Short term, I am bearish. If this market hasn’t busted through because of the hot weather, I don’t think sustained hot weather matters. The risk is to the downside.”

Other traders don’t see expected heat as providing enough impact to maintain any kind of upward momentum to prices. “Although updates to the short-term temperature views that we monitor are still favoring above-normal trends that will likely be stretching to month’s end via weekend updates, deviations from normal still don’t appear sufficient to sustain occasional price advances,” said Jim Ritterbusch of Ritterbusch and Associates.

“The market received an additional piece of bearish guidance yesterday in the form of a much larger than expected 64 Bcf storage injection that forced only a minor reduction in the sizable supply overhang. While the dynamic of surplus contraction is apt to remain intact through the rest of the summer, rate of decline is beginning to appear slower than we had anticipated. Some of this dynamic appears related to the recent lift in production as well as some gas to coal displacement that has resulted from the recent advance in gas prices.”

Gas buyers having to make incremental purchases for power generation across the PJM footprint had only moderate wind generation to supplement purchases. “Changeable mid-summer weather is expected,” said forecaster WSI Corp. in a Friday morning report. “Partly sunny, hot and less humid conditions are expected across the I-95 corridor today with highs in the upper 80s to mid 90s. A more seasonable and drier air mass will filter into western PJM and this will overspread the majority of the power pool by Saturday, though there will remain a chance of a pop-up shower across the lower Mid-Atlantic. A developing southwest flow ahead of an approaching cold front will begin to cause warm and humid conditions to return during Sunday.

“A west-northwest breeze behind a cold front will promote modest wind generation today with output around 1-2 GW. Wind gen should become weak during Saturday, but the cold front will cause output to briefly increase in excess of 2 GW during Sunday into Monday.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |